Weak ISM and tightening bets spark market reversal and tail risks

Yet another S&P 500 intraday reversal higher that fizzled out, in premarket already – but weak ISM would rescue the buyers for a while again. Triggering bets on the Fed to step back from the tightening campaign (of course a misguided notion), there are signs markets are positioning for such an outcome – gold has erased half of yesterday‘s setback already, and EURUSD is catching a bid the more the data release approaches.

So, get ready for a risk-on reprieve that won‘t change the adverse liquidity circumstances as since the debt ceiling was solved once again, the Treasury issued almost $600bn of fresh debt. Together with monetary tightening effects slowly making their way through the system, this increases tail risks to the downside over the coming weeks if not months.

Today‘s analytical intro is brief,as I‘m going to dive into many market charts. Thanks for the warm reception of the daily and intraday Youtube updates – you‘ve got plenty to look forward for!

Let‘s move right into the charts – today‘s full scale article contains 5 of them.

Gold, Silver and Miners

Precious metals would be today‘s beneficiaries and rise vs. their opening values, but the correction isn‘t over yet at least in terms of time.

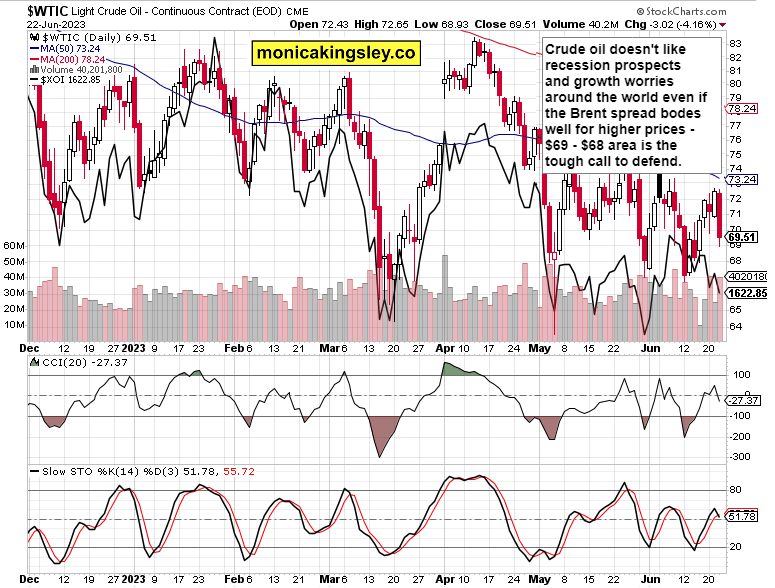

Crude Oil

Crude oil hasn‘t found strong footing yet, but will also benefit from the ISM figures and rise back above $68.

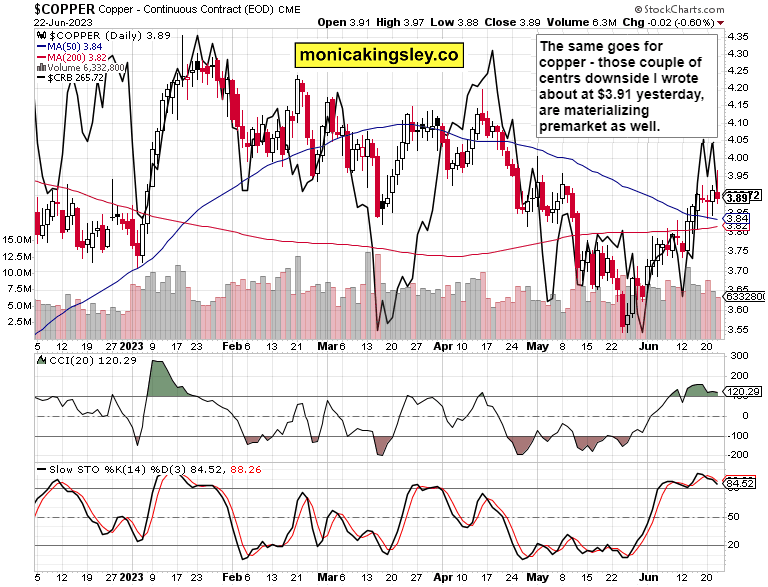

Copper

Copper also obliged lower in line with my yesterday‘s call, just as precious metals did. Growth worries are hitting home here as well, and today‘s steep decline will be partially retraced on the Fed tightening bets temporary reappraisal.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.