We map the world with latest EU inflation data

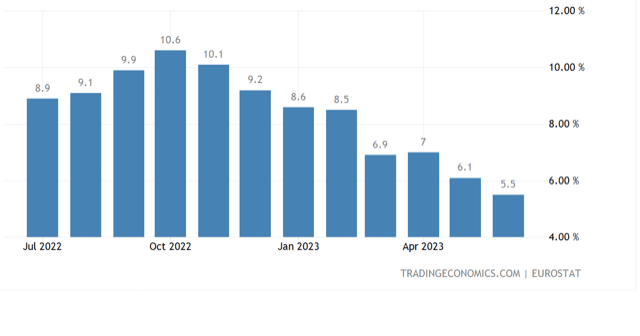

Euro-zone Inflation dropped markedly to 5.5% in June. Confirming the global trend.

However, it is still far too early to begin thinking the ECB’s job is done. Core Inflation actually re-accelerated to 5.5%.

EU Headline Inflation a welcome trend.

EU Core Inflation stubbornly troubling.

Headline Inflation 10 years.

Core Inflation 10 years.

The global trend lower in headline inflation is all about the fall back in the price of goods, particularly fuel and food. This is due to the passing of the price shocks resulting form supply chain disruption due to the pandemic, and the initial food and energy spikes due to the start of the Ukraine Russian war. These forces are reasonably under-stood.

We were also the first to explain how global pricing pressures were suddenly removed by the pandemic, and that this freedom of pricing saw businesses quickly raising prices substantially, to both build profit margins and to deal with the greater uncertainty that now pervaded the business outlook. We identified this process in real time. And now that the data is available to show these forces other people are seeing this is what was happening too.

The post-Covid boom gave way to the hangover effect of extreme stimulus measures. Having sucked potential normal economic activity back from the 1-5 year future horizon into that post-Covid period. This is the underlying cause of all western economy slowing at the moment, and yet still seems little understood by the major institutions.

This ‘always going to happen’ slowing is now starting to impact businesses directly and so price increases have slowed substantially. Even a price cutting competitive period is a slight possibility. The world needs deflation. Without it consumers in Europe and elsewhere will continue to struggle under an entrenched more expensive cost of living, combined with the heavy weight of permanently higher interest rates.

This last point is key to understanding the interest rate impact on assets like equities going forward. Not that stock markets seem to pay much attention to the economic fundamentals lately. As I have previously said, the stock market is either rising on hot air that will run out, or it is actually detaching from the overall economic conditions to focus on the upper middle classes and the rich economies?

It is also possible the stock market is now just about the excess stimulus measures of Covid finally finding its way to fund manager desks in the west. In other words, the distortions of the Covid-period, central bank and government responses are still playing out in a very big way.

Germany is the flag bearer for this at the moment. In recession with severe growing concerns in different sectors of the economy. Yet, the stock market keeps hitting record highs. In case you were wondering, this is not normal.

Of course, the bulls will argue the market is pricing future economic growth. But where is the turnaround catalyst? Most bulls will still trot out the same tired and forever wrong story of fantasy rate cuts soon to arrive. As we have stated from the start of these hiking cycles, rates were going up to extreme levels by recent standards and staying up permanently.

Often in funds management the ‘view’ on the market follows action. If fund managers are receiving large inflows, they will have to be buying and so they are bullish. What is happening here is that stimulus/money printing, is finding its way to their desks, after the tortuous journey of the past couple of years from the recipients to corporations, and finally to the fund managers.

So the market is seemingly detaching from the economic landscape.

Coming back to that ‘view’ dream of the bulls. Rate cuts just aren’t going to happen. How can they when core inflation is becoming entrenched in an extremely damaging manner. And the ECB, Fed and others see their only goal as to raise rates and to keep them high to fight this one animal.

When we look at the history of inflation in the West, we can see that both headline inflation and core remain at truly extreme and alarming levels. It is a welcome relief that headline inflation is trending correctly, but the core rates are remaining near their peaks and even re-accelerating.

This is a diabolical scenario. For it suggest even headline inflation could re-accelerate on any negative geo-political developments. More concerning to the ECB, and Fed alike, is that core inflation is exactly what will embed high inflation expectations in the broad community.

Exactly what the central bankers have been stating as their primary reason for one of the most aggressive tightening cycles in history. To avoid the risk of entrenched expectations. Well, quick call to the ECB and Fed, it is too late. Inflation expectations are now likely to remain steadfastly high. Hence the greater clamour for higher wages.

Western economies are in the midst, not at the end of, the ugliest inflation scenario that could ever be mapped out. To expect rate cuts in this building or even stable core inflation environment, is indeed a forlorn hope.

Equity markets have been disappointed constantly with the sentiment expectations on a whole host of dream run economic scenarios in the past couple of years. Yet, they have managed to just keep bouncing back regardless.

Perhaps, even as the ECB continues to hike, markets will just rally anyway?

They always say follow the money, and that is exactly what fund managers are doing.

Author

Clifford Bennett

Independent Analyst

With over 35 years of economic and market trading experience, Clifford Bennett (aka Big Call Bennett) is an internationally renowned predictor of the global financial markets, earning titles such as the “World’s most a