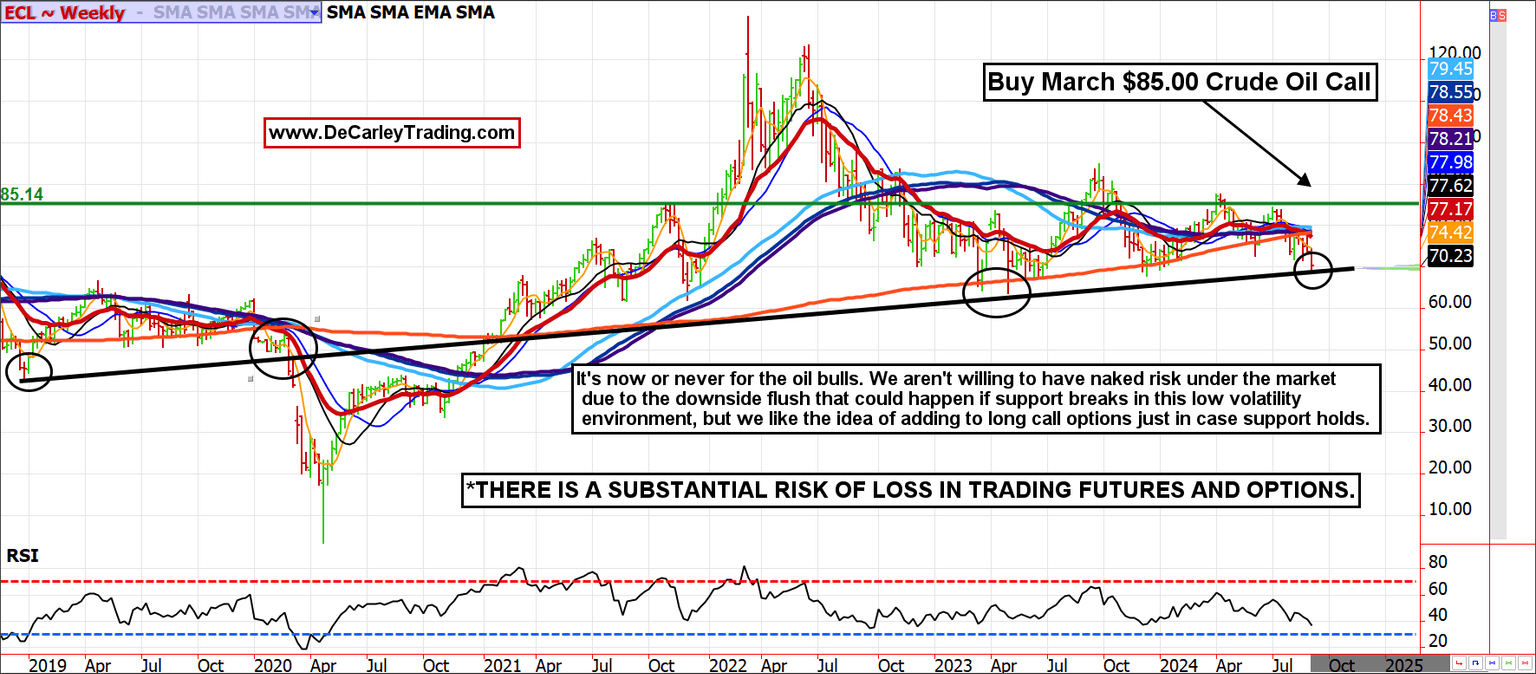

We don't trust Crude Oil, but we don't want to miss a rally either

We always say, "They don't call it crude for nothing". The oil market constantly battles politics, monopolies, the economy, and human emotions. Either we are seeing the beginning of a massive flush out of weak hands, or this is an exceptional buying opportunity. We would rather not be left holding the bag if it is the former, so we are leaning toward getting long (or longer if you are still holding December calls) with the purchase of March $85 calls for about $800. If support fails and oil reprices $10 or $20, the risk on this position is limited to the premium paid. But if oil holds and we see a decent rally, this down-and-out option will pick up value quickly.

Buy March Crude Oil $85 call

Cost = 82 cents or $820

Margin = $0

Risk = Limited to the cost of entry plus transaction costs

Maximum Profit = Theoretically unlimited

Expiration = February 14th

DTE = 162

Zaner360 symbols:

OCLH25 C85

*There is a substantial risk of loss in trading futures and options. There are no guarantees in speculation; most people lose money trading commodities. Past performance is not indicative of future results. Seasonality is already factored into current prices, any references to such does not infer certainty in future price action.

There is a substantial risk of loss in trading futures and options.

These recommendations are a solicitation for entering into derivatives transactions. All known news and events have already been factored into the price of the underlying derivatives discussed. From time to time persons affiliated with Zaner, or its associated companies, may have positions in recommended and other derivatives.

Author

Carley Garner

DeCarley Trading

Carley Garner is an experienced commodity broker with DeCarley Trading, a division of Zaner, in Las Vegas, Nevada. She is also the author of multiple books including, “Higher Probability Commodity Trading” and “A Trader's First Book on Commodities”.