We are in a recession in full-time jobs

We’ve been told the economy is strong for more than a year. The strong labor market with millions of new jobs serves as a primary data point to support this claim.

But the headline numbers don’t tell the whole story.

The labor market isn’t telling us the economy is strong. It’s signaling recession with full-time employment dropping.

Month after month, mainstream media trumpets the “creation” of hundreds of thousands of new jobs. White House spokespeople point to the data and brag. Federal Reserve officials say it proves we are heading for a “soft landing.”

And then a month later, the Bureau of Labor Statistics (BLS) quietly revised the number of new jobs lower. In June, the BLS erased 111,000 jobs from the books.

But even with the revisions one can still argue job growth remains impressive.

This is why you should always look beyond the headlines.

In reality, we have been in a full-time job recession for several months.

More jobs doesn't mean more people working

As Mises Institute Executive Editor Ryan McMaken pointed out, the total number of employed people has stagnated over the past year, even as the economy created hundreds of thousands of jobs every month.

How can this be?

The only way this can happen is if more and more people are working more than one job.

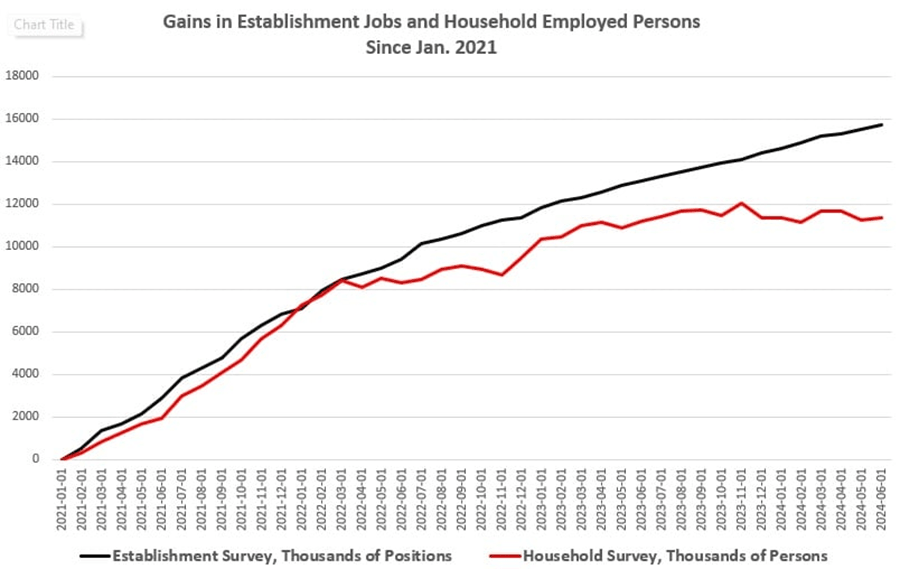

As we look at the numbers, it’s important to understand that the BLS releases two different reports. The establishment survey reports the total number of jobs created. It gets all the headlines. The household survey measures the employment status of individuals in households.

There are huge discrepancies between these two metrics.

Part of this is due to the fact that the BLS establishment survey creates jobs out of thin air. The agency uses a "birth-death model" that assumes the existence of new jobs every month based on assumptions and conjecture.

But even taking this into account, the discrepancies between the establishment and household surveys tell an interesting story.

According to the official establishment survey data (We’ll accept it as valid for the sake of argument), the economy added 2.6 million jobs between June 2023 and June 2024.

However, according to the household survey, the total number of employed persons only rose by 195,000.

In a healthy economy, you would expect to find the number of employed people rapidly rising with all these new jobs. If there is new work, you would expect new workers to fill those positions.

But based on the BLS household survey, the total number of employed people has flatlined over the last year.

Again, the only way an economy can add jobs without additional workers is if currently employed people take on additional jobs.

This appears to be what’s happening. People are losing full-time employment and taking on multiple part-time jobs, or they are still working full-time and taking on an extra job delivering pizzas in an effort to make ends meet.

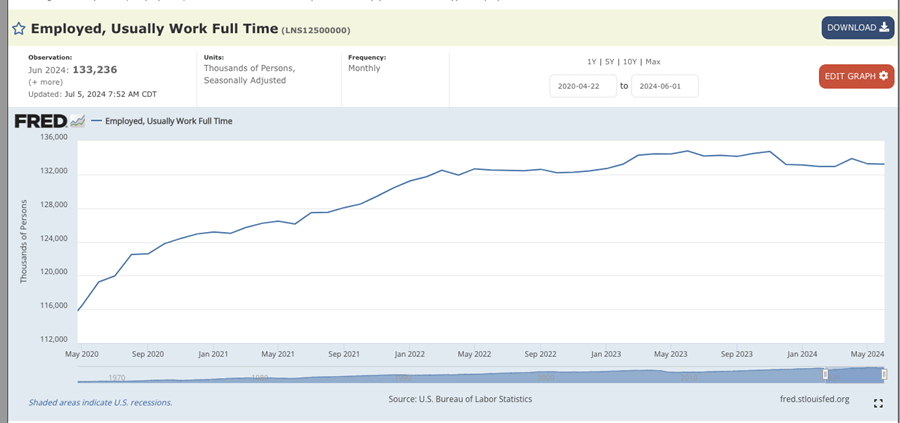

In fact, while the number of part-time jobs has grown, the number of full-time jobs has dropped. Based on household survey data, over the last three months, the number of full-time jobs fell into recession territory with the number of full-time employees dipping from 133.9 million to 133.2 million since April

Looking at the chart, the number of full-time employees has generally dropped since late 2023.

Meanwhile, the total number of full-time jobs was down year over year in February, March, April, May, and June.

This indicates some people are taking on a second full-time job as they try to cope with rising prices.

McMaken points out, “Over the past fifty years, three months in a row of negative growth in full-time jobs has always been a recession signal and has occurred when the United States has been in recession, or about to enter a recession.”

“This is to be expected in a weakening economy. Empirical studies have shown that economies tend to shift to part-time work in times of economic downturn as a means of allowing employers more flexibility in reducing costs. This has been observed internationally, and not just in the United States.”

Whenever you see headlines citing government data, you should always dig deeper. The mainstream media tends to report what the government wants you to hear. That often diverges from reality!

To receive free commentary and analysis on the gold and silver markets, click here to be added to the Money Metals news service.

Author

Mike Maharrey

Money Metals Exchange

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.