We are being gaslit by our quote boards

The hardest thing to do as a human is to trust what we know, not what we see. It’s hard not to have FOMO watching stocks soar higher while being under allocated. Yet, stocks are as expensive now as they have ever been. On many metrics, equities valuations are equivalent to the dotcom bubble highs. Perhaps this continues, but when we look around our quote boards, we know that there are significant headwinds to the rally that probably haven’t been accounted for. Also, some markets are outright signaling deflation and negative growth.

In a previous newsletter, we noted the sharp selling in Treasuries pushing interest rates to the higher end of their two-decade trading range. High interest rates will eventually be a drag on growth, despite how the stock market is behaving. Let’s take a look at a few other markets that might eventually work against the massive melt-up in equities.

Eventually, the US Dollar rally will matter

As part of the so-called “Trump trade,” the US dollar rally has accelerated in post-election trading. A higher dollar decreases demand for dollar denominated assets acting as a drag for corporate earnings. Commodities, such as copper, gold, and grains, appear to be properly accounting for this headwind, but the major US stock indices are completely ignoring it. Eventually, cooler heads will prevail, forcing the equity market to account for this in pricing.

Seasonality is generally positive for the dollar, and momentum seems to point toward 108.00 on the index. Thus, we would expect the dollar rally to continue for the time being. However, the market is either over its skis or outright wrong about the Trump Presidency's impact on currencies. During the last Trump administration, the dollar depreciated. Even more compelling is that the depreciation took place despite the pandemic, which inflated the dollar. Perhaps this is why stock traders are ignoring the dollar rally, but it is more likely they are simply ignoring it and its implications which are poised to get worse before they get better.

If doctor Copper is right, recession is a risk

Despite aggressive and widespread stimulus efforts, China as stopped growing. After the Chinese stimulated their economy in September, copper rallied to $4.80 but has given the entire rally back and seems destined for a move to $4.00. This is not a sign of a growing economy, nor is it a sign of inflation. The copper market is telling us that deflation might be a bigger concern.

The low $50s are calling Oil’s name

Since peaking in March of 2022, crude oil has consistently made lower highs while maintaining a floor from $70 to $65. The downtrend line now comes in near $75; if this level isn’t broken sooner rather than later, gravity will take hold. We believe this is the most likely scenario. It just doesn’t feel like a conducive environment to be a crude oil bull. The higher dollar works against oil demand, higher interest rates work against economic growth, seasonality is bearish through February, and there is a lot of renewed “drill, baby, drill” chatter that could keep rallies in a lower high mode.

Good times can be deceptive

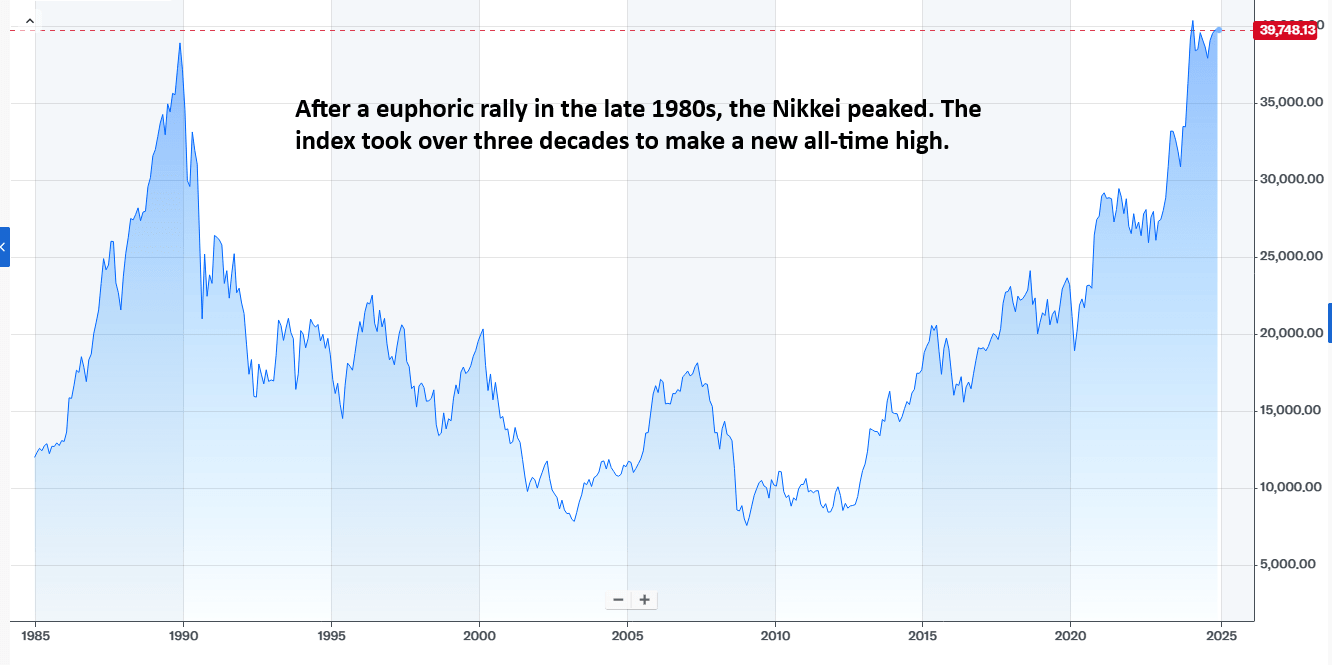

We mentioned the Japanese boom and bust cycle in the last newsletter, but we wanted to provide a visual. It took Japan decades of negative interest rates to allow its primary stock index to return to its 1990 elated high; this milestone was reached in 2024, almost 35 years later.

This is not to scare anyone, nor is it to suggest the masses should sell everything and hold a portfolio of cash. We are merely pointing out that exuberance can be deceptive. Markets are naturally forward-looking and sometimes the assumptions driving price action turn out to be overly optimistic.

Author

Carley Garner

DeCarley Trading

Carley Garner is an experienced commodity broker with DeCarley Trading, a division of Zaner, in Las Vegas, Nevada. She is also the author of multiple books including, “Higher Probability Commodity Trading” and “A Trader's First Book on Commodities”.