USD/JPY soars to 20-year high as yen sell-off intensifies

The Japanese yen declined to a 20-year low against the US dollar as concerns about the Bank of Japan’s policies remained. Unlike other central banks, the BOJ has insisted that it will leave interest rates unchanged and continue with its asset purchases program. The bank has also hinted that it will even offer more stimulus if the ongoing trend of the Japanese economy continues. Recent data shows that the country’s economy is slowing down as energy costs rise and the ongoing supply chain challenges affect the country’s automobile sector.

The US dollar index continued its bullish trend as the bond sell-off continued. The yield of the 10-year government bonds rose to 2.88% while the 30-year rose to 2.97%. At the same time, US inflation-adjusted bond yields are on the verge of turning positive for the first time since the pandemic started. The 10-year real Treasury yields have risen 1 percentage point since early March and are currently at -0.04%, This is a sign that bond payouts are approaching the medium-term inflation expectations. This trend has happened as the Fed attempts to slow down inflation by hiking interest rates.

European stocks declined as investors continued to focus on the crisis in Ukraine. The Russian military restarted its operation in the Eastern side of Ukraine. The Ukrainian government asked its citizens to leave the Donbass region as the crisis escalated. Meanwhile, Stellantis, the multinational automotive firm, announced that it will halt operations in Russia as it suspended a manufacturing plant in Moscow. The firm attributed the decision to the ongoing sanctions and logistical challenges. In the United States, futures tied to the Dow Jones and Nasdaq 100 also declined as investors reacted to earnings from Johnson & Johnson, Hasbro, and Lockheed Martin. IBM and Netflix will publish after the market closes.

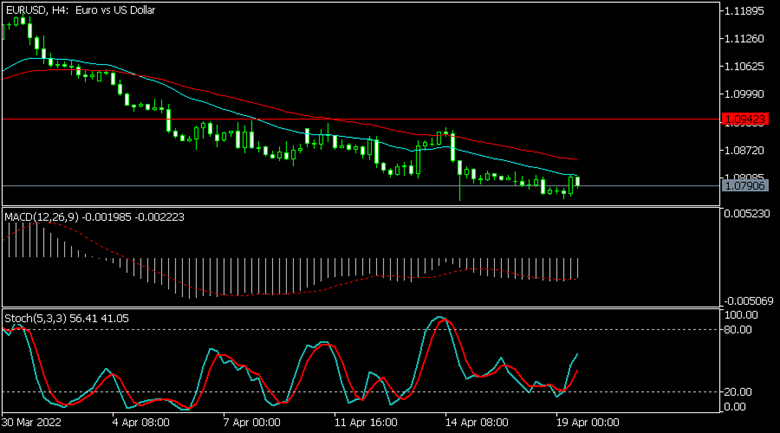

EUR/USD

The EURUSD pair declined slightly as investors reacted to the performance of the bond market. It is trading at 1.0790, which is slightly above last week’s low of 1.0757. On the four-hour chart, the pair moved below the 25-day and 50-day moving averages while the MACD moved below the neutral level. The Stochastic oscillator has also pointed upwards. Therefore, the pair will likely remain at these levels during the American session.

USD/CHF

The USDCHF pair continued surging as the strength of the US dollar continued. It rose to a high of 0.9486, which was substantially higher than this week’s low of 0.9150. It moved above the 25-day and 50-day moving averages and is above the upper side of the Bollinger Bands. The MACD and the Relative Strength Index (RSI) have also risen. The pair will likely continue rising during the American session.

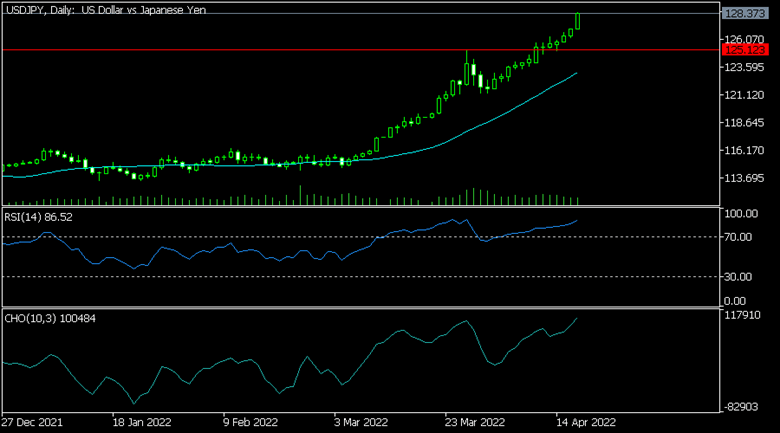

USD/JPY

The USDJPY pair surged to the highest level in over 20 years as the Japanese yen sell-off continued. The pair moved above the important resistance level at 125.12, which was the highest level on March 28. It has moved above the short and long-term moving average while oscillators like the Relative Strength Index (RSI) and Chaikin Oscillator rose. Therefore, the pair will likely keep rising, with the next target being at 129.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.