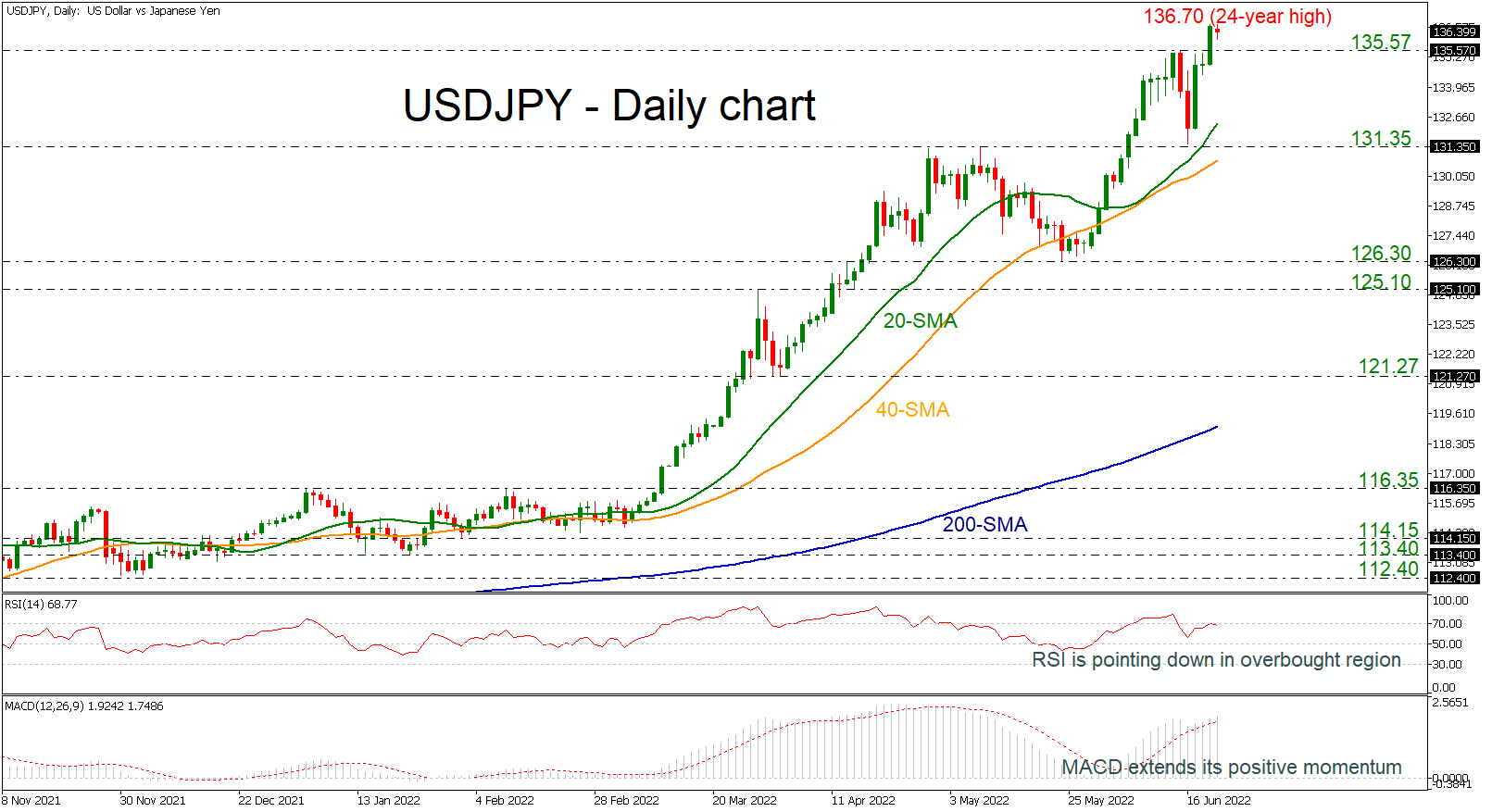

USDJPY is holding around the fresh 24-year high at 136.70, surpassing successfully the previous highs of 135.57 and endorsing the bullish view.

The MACD is moving further above its red signal line, and the RSI is pointing down after it reached the 70 level. However, the latter could also be an indication that the advance has been exaggerated, and as a result, bearish corrections in the upcoming sessions should not come as a surprise to investors.

In the event that the price moves in the opposite direction, the immediate support could come from the 135.57 barrier ahead of the 20-day simple moving average (SMA) around 132.35, which the bears were unable to break over the previous week. As the price moves lower, attention will shift to the support level at 131.35, though, a violation of the 40-day SMA located at 130.70 would boost speculation that the current bullish phase may transition into a neutral phase in the near future.

Traders will be avidly watching for a break above today's peak of 136.70 in the alternative scenario, which would result a rally towards the next psychological levels. If that turns out to be the case, the upswing can continue until the price reaches 140.00.

The recent bullish activity has made the wider picture more optimistic as well, and traders may expect additional improvement in the market as the shorter-term SMAs continue to increase their distance above the longer-term SMAs.

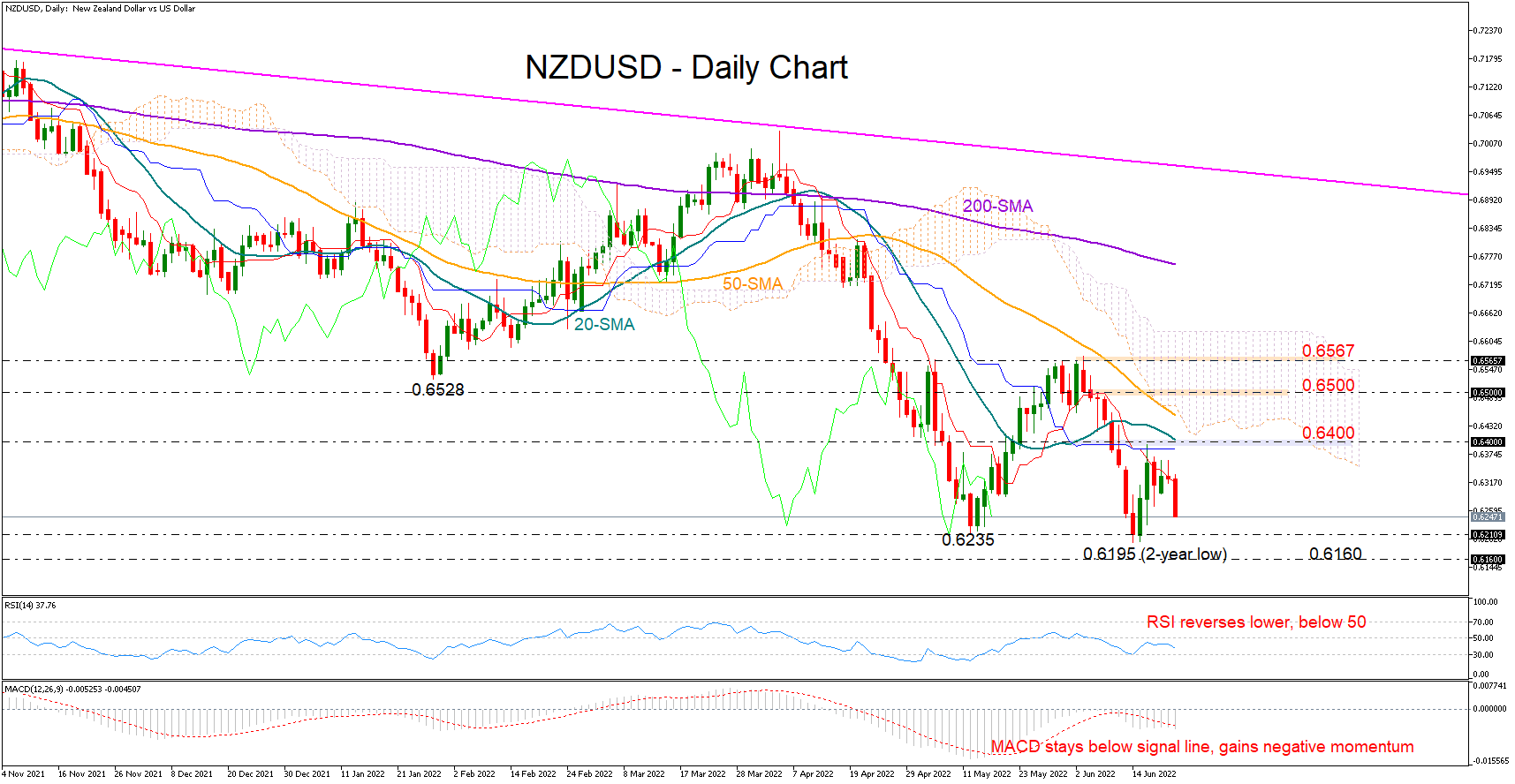

NZD/USD eyes June’s lows as bears regain control

NZDUSD resumed its slide on Wednesday, bringing the key 0.6335 – 0.6195 bottom area back under the spotlight after a four-day-long unsuccessful battle with the red Tenkan-sen line.

The RSI and the MACD remain negatively charged within the bearish zone, while the negative intersection between the red Tenkan-sen and blue Kijun-sen lines is another indication that the bears may hold onto control in the coming sessions.

Should the price close below 0.6235, the former resistance zone around 0.6160 may immediately attract some attention before selling pressures intensify towards the 0.6000 round-level. Below that, there is another important barrier around 0.5916.

Conversely, a decisive move above the red Tenkan-sen line currently at 0.6316 may continue towards the 20-day simple moving average (SMA) at 0.6400. If the 50-day SMA proves an easy obstacle too at 0.6452, the pair may visit the 0.6500 psychological mark, though only a durable rally above June’s topline of 0.6567 would make any rebound credible.

Summarizing, the odds are in favor of the bears in the NZDUSD market, and the next downside target is the May-June floor of 0.6235 – 0.6197.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD stays pressured near 1.0800 on Trump's 'Liberation Day'

EUR/USD keeps the red at around 1.0800 in European trading on Wednesday as investors rush for the safe-haven US Dollar, aniticpating US President Donald Trump’s long-threatened “reciprocal” tariffs package, due to be announced at 20:00 GMT.

GBP/USD trades with caution above 1.2900, awaits Trump’s tariffs reveal

GBP/USD is trading with caution above 1.2900 in the European session on Wednesday, Traders remain wary and refrain from placing fresh bets on the major, anticopating the US 'reciprocal tariffs' announcement on "Liberation Day' at 20:00 GMT.

Gold price stabilizes ahead of Trump's tariffs announcement on “Liberation Day”

Gold price stabilizes just above $3,130 at the time of writing on Wednesday following a mean reversal move the prior day after a fresh all-time high got eked out at $3,149 before closing in negative territory. The Gold rush rally stalled ahead of Trump officially announcing the reciprocal tariff implementation later this Wednesday at the White House

ADP Employment Change projected to show US job growth gaining in March

The US labor market is poised to steal the spotlight this week as concerns over a potential slowdown in economic momentum remain on the rise — an unease fueled by recent signs of slower growth and troubling underlying data, aggravated by the ongoing uncertainty surrounding US tariffs.

Is the US economy headed for a recession?

Leading economists say a recession is more likely than originally expected. With new tariffs set to be launched on April 2, investors and economists are growing more concerned about an economic slowdown or recession.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.