USD/CHF outlook: Safe haven Swiss Franc hits the highest levels in a decade vs US Dollar

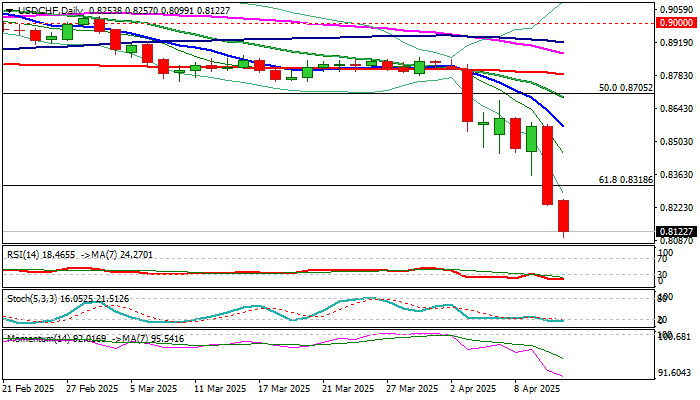

USDCHF fell to the lowest in ten years on Friday as safe-have Swiss franc shined on strong migration into safety, sparked by escalation of US-China trade war.

Friday’s drop of 1.7% until early US trading comes in extension of nearly 4% loss on Thursday (the biggest one-day drop in almost three years) and the pair is on track a weekly drop of around 4.5% (the biggest weekly fall since the second week of November 2022).

Fresh weakness broke below the floor of broader range on monthly chart that generates bearish signal of continuation of larger downtrend from parity zone (tops of Oct/Nov 2022) and exposes targets at 0.8000 (psychological) and 0.7840 (Fibo 76.4% of larger 0.7067/1.0343 uptrend).

Meanwhile, price adjustments on profit-taking could be anticipated, with likely limited upticks in very favorable environment for the Swiss franc, to provide better selling levels.

Swiss National Bank had no comments so far, but intervention to curb sharp gains of the national currency, cannot be ruled out.

Res: 0.8815; 0.8851; 0.8885; 0.8906

Sup: 0.8762; 0.8725; 0.8690; 0.8615

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.