USD/CAD in bullish mode, resistance at 1.3650 [Video]

![USD/CAD in bullish mode, resistance at 1.3650 [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/USDCAD/canadian-money-11699219_XtraLarge.jpg)

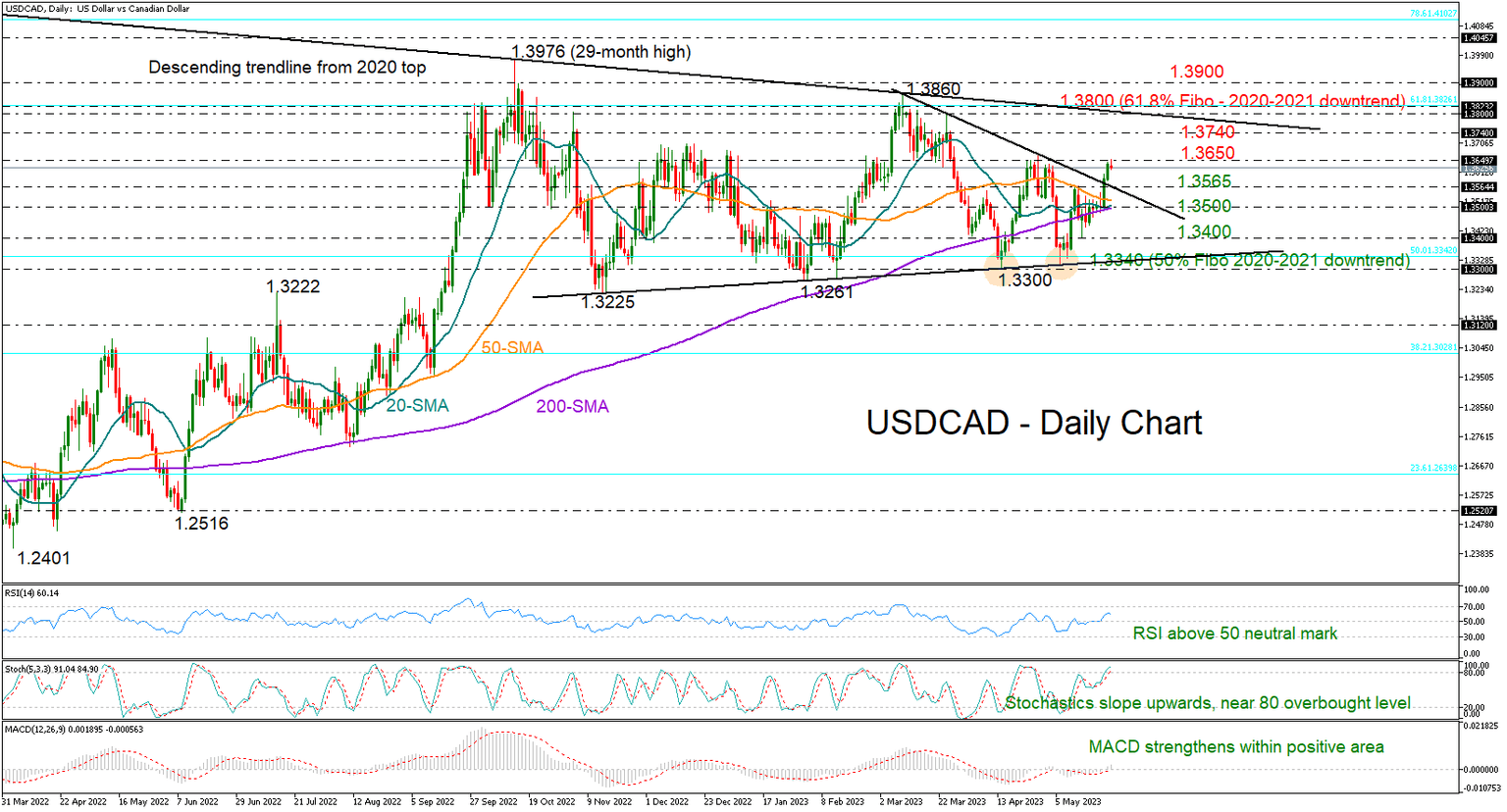

USDCAD bounced off its 200-day simple moving average (SMA) and went as high as 1.3653, surpassing a resistance line that had been in effect since March.

The technical picture is feeding optimism for a bullish continuation. The price has bottomed out twice around 1.3300 before drifting higher and beyond its simple moving averages (SMAs). Traders are currently waiting for a decisive close above the 1.3650 neckline to confirm the positive structure.

In momentum indicators, the RSI has crossed above its 50 neutral mark and the MACD has strengthened above its red signal and zero lines, both reflecting improving sentiment in the market.

Should the pair climb the 1.3650 wall, it may initially challenge the 1.3740 barrier and then push towards the crucial 1.3800-1.3830 zone, where the long-term descending line from the 2020 top is placed. The 61.8% Fibonacci retracement of the 2020-2021 downtrend is in the neighborhood as well. Therefore, a successful penetration higher could be the key for a rally towards the 1.3900 mark.

Alternatively, a downside reversal may take a breather near the broken resistance line at 1.3565. If the bears breach that base, the spotlight will fall immediately on the 200-day SMA at 1.3500. Moving lower, the price could retest the 1.3400 region ahead of the important 1.3340-1.3300 area. Notably, the 50% Fibonacci level and the almost flat support line from November are located here.

In brief, USDCAD has been trading within a broad range area for seven months now. While the short-term bias looks positive, the pair will need to claim the 1.3650 barricade in order to post new gains. In the big picture, a decisive rally above the 2022 peak of 1.3976 is required to change the market direction back to an uptrend.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.