USD/TRY accumulation near 34.10 while waiting for upcoming key data

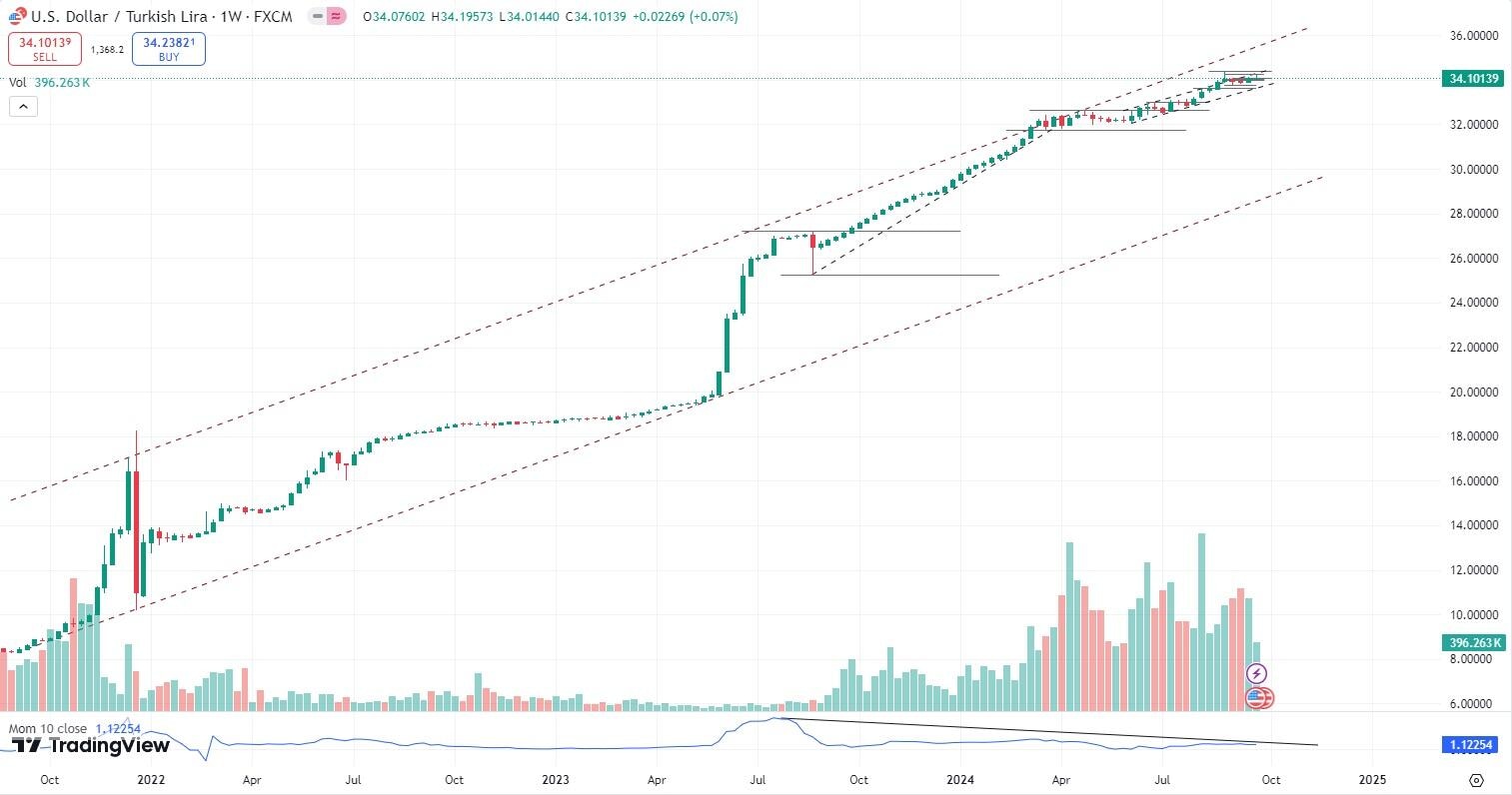

The USD/TRY pair closed at 34.098 on the FXCM platform last Friday (CBRT official bid-ask rate: 34.09 - 34.15) and is trading around 34.17 at the time of writing. After surging to a new all-time high of 34.388 on August 28, the exchange rate retraced to 33.78 at the beginning of September and has been trading sideways since then. The pair broke through the psychological resistance of 34 but failed to generate a sharp follow through. For the upward trend to resume, the pair needs to clear decisively the 34–34.10 resistance area, with the August 28 peak at around 34.39 serving as the next critical level. Other key levels to watch include a very short-term resistance at 34.24 (the August 29 high) and support in the 33.78–33.80 area, followed by 33.64 in case of further retracement.

The pair has been trading in a strong, long-term upward trend since late 2021, showing no signs of exhaustion and without significant retracement since August 2023, despite periods of deceleration. Currently, it is moving within a short-term uptrend that began in June.

It is worth noting that the Momentum indicator shows a deceleration on both the daily and weekly charts, with a clear divergence from price action. Yet on the weekly candlestick chart, the pair formed a continuation pattern known as the 'Matt Hold' during the five weeks following mid-August. This pattern typically signals a pause before the uptrend continues. These factors align with the idea of a broader mild uptrend characterized by alternating hikes and consolidation periods. If the uptrend continues and it brakes through the 38.4 level, Fibonacci extensions indicate potential target areas at 35.29, 35.56 (50% extension), and 36.73 (double the extension). Additionally, the psychological level of 35 could act as a resistance.

While a resumption of the upward trend in the coming weeks is the most likely scenario (the CBRT’s September market participants survey forecasts a year-end exchange rate of 37.16 for USD/TRY), I don’t expect sharp upward movements due to fundamental factors. The USD is currently experiencing general weakness as the Federal Reserve enters an easing monetary cycle and there is prevailing positive sentiment in the risky assets market. On the other hand, Turkey’s economic landscape suggests a continuation of tight monetary policy and the CBRT’s focus on controlled Lira depreciation.

Hyperinflation has been a persistent issue, along with challenges in domestic balance sheet management. Although Turkstat data shows a decline in annual inflation (51.97% in August and forecasted to decrease under 50% in september), households’ 12-month inflation expectations remain high at 71.56% in September (an indicator closely monitored by the CBRT in its policy-making). Consequently, rate cuts are unlikely before 2025. This stance supports carry trades on Lira bonds, benefiting the Lira’s exchange rate in the forex market.

Additionally, Turkish financial authorities remain committed to reducing the current account deficit, financing domestic debt, and rebuilding foreign reserves, a task made easier by a relatively stable Lira.

This week data release is quite rich, with Turkish CPI index and US Unemployment rate taking center stage. Readings that significantly differ from expectations could trigger volatility. Geopolitical developments in Ukraine and the Middle East also remain important factors to watch closely, as USD traditionally serves as a safe heaven.

Author

Giuseppe Bocci, CTA

Independent Analyst

Giuseppe Bocci is an independent trader primarily active in the U.S. stock market, international bonds, commodities, and forex. He has been trading full-time for about ten years, turning a passion into a profession.