USD struggles to find floor

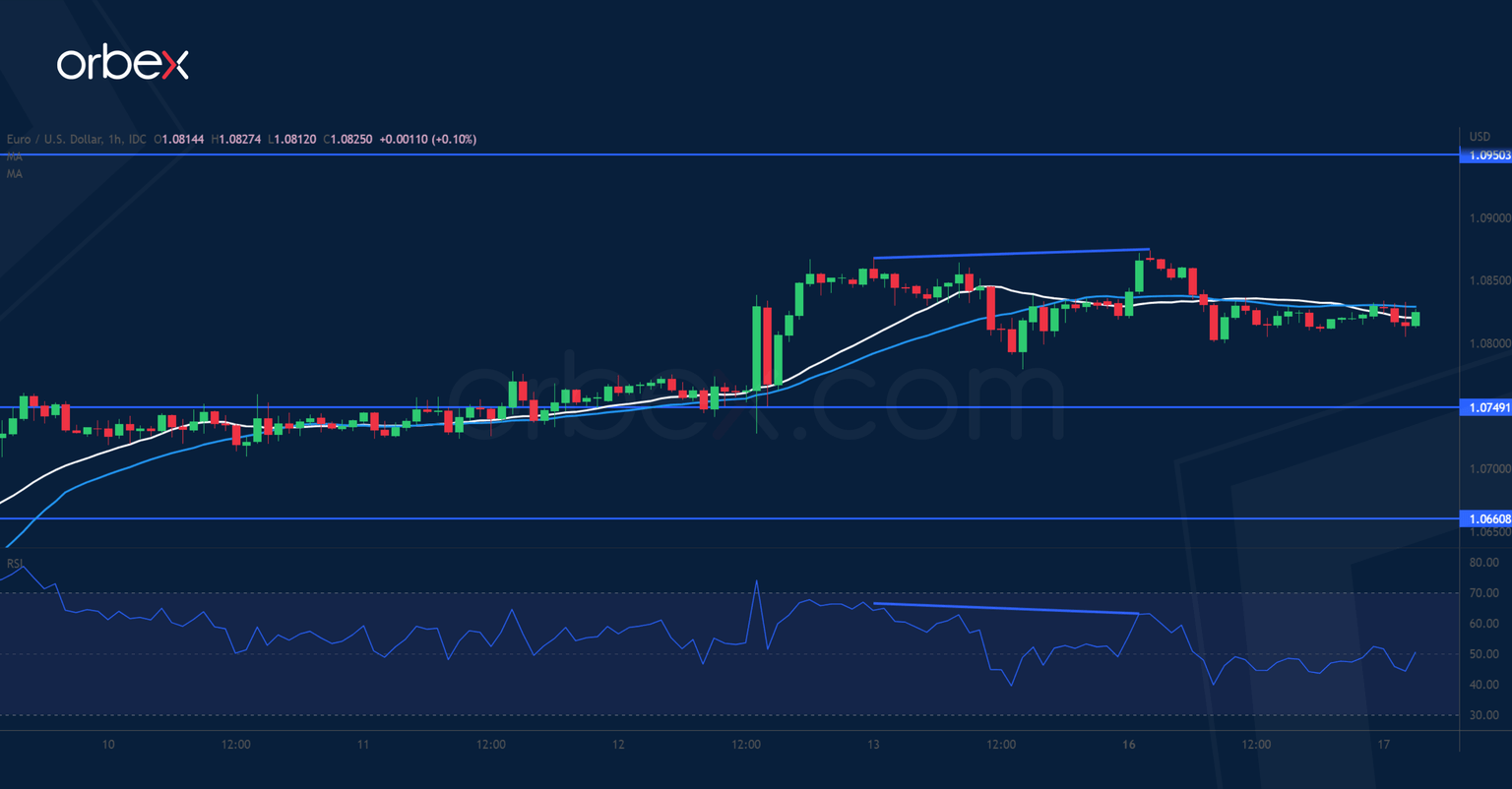

EUR/USD keeps high ground

The US dollar struggles on speculation that the Fed is nearing the end of its tightening. The pair is holding on to its gains after breaking above May’s high of 1.0780. A bearish RSI divergence suggests a deceleration in the momentum and may foreshadow a potential pause in the rally. But as sentiment improves, the bulls may see a pullback as an opportunity to stake in with 1.0750 as the first support. 1.0660 at the origin of the latest breakout and on the 30-day moving average is a major level. 1.0950 is the target in case of a bounce.

XAG/USD tests resistance

Silver steadies as traders continue to dump the US dollar. The price is testing the support-turned-resistance at 24.50 from last April’s sharp sell-off. The previous test caused a limited fallback, but a bounce off 23.20 indicated that the bulls are still in the game. A bullish breakout would trigger a runaway rally as sellers scramble to cover, opening the door to the psychological level of 26.00. In the meantime, after the RSI showed a double top in the overbought area, the metal may seek support above 23.55.

Nasdaq 100 grinds higher

The Nasdaq 100 rallies as improved US consumer sentiment showed a falling inflation outlook. The direction remains up as pullbacks have been met with enthusiasm so far. The index is pushing into the supply zone from the mid-December sell-off with 11580 as the first resistance. Its breach may gather more interests and send the price to 11900 right under last month’s spike (12200). A break above that area could turn the mood around in the medium-term. 11330 is the immediate support and 11100 a second line of defence.

Author

Jing Ren

Orbex

Jing-Ren has extensive experience in currency and commodities trading. He began his career in metal sales and trading at Societe Generale in London.