Mexican President AMLO has been slow to pull the trigger on a large stimulus plan as many other countries have done. However, on Sunday he established a public works program to help the poor and to create jobs. In addition, he created a program to provide low interest rates loans to boost small businesses and housing.

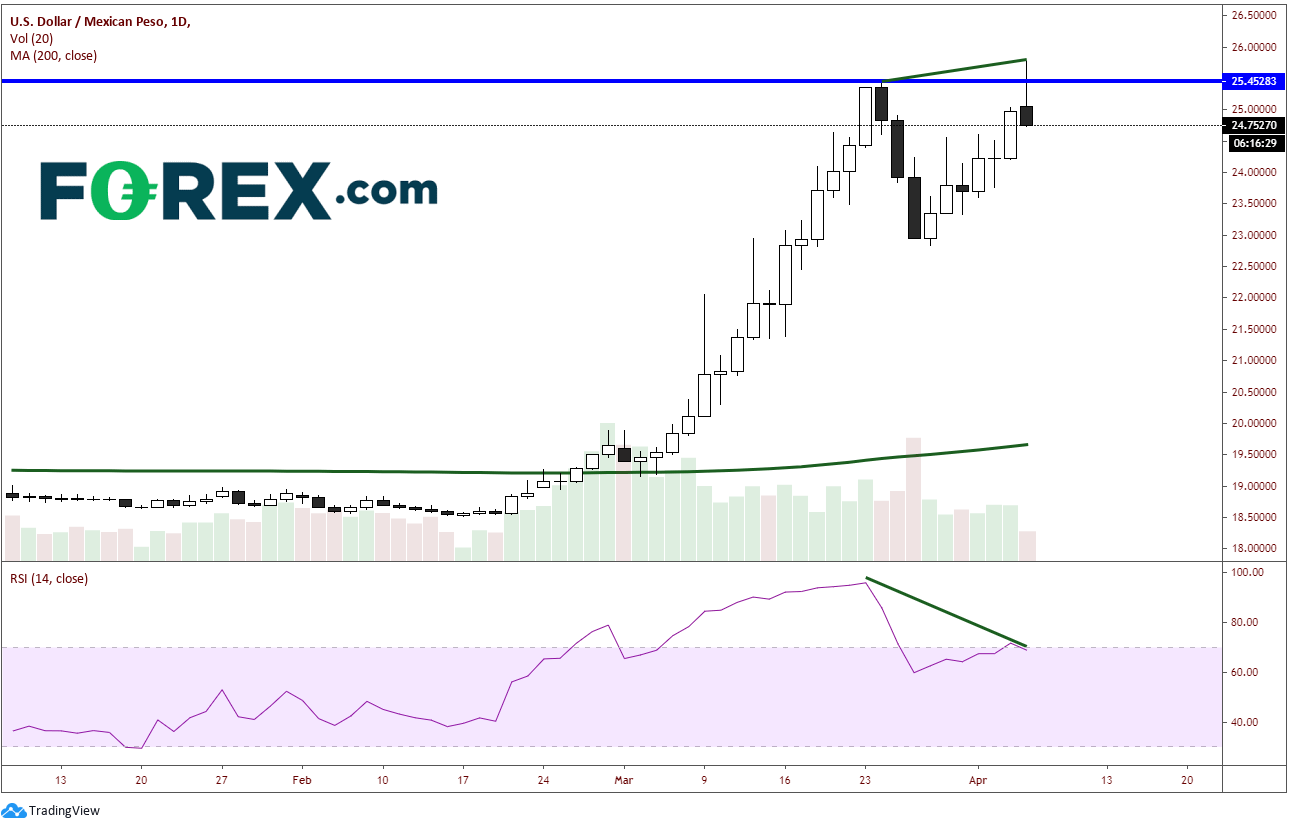

Emerging market currencies, in general, have been getting hit over the last few weeks. However, after putting in all-time highs on March 24th, USD/MXN appears as though it may be ready for a pullback. Although there is still half the day left in US trading, the pair appears to be putting it a shooting star candlestick formation, after spiking through the all-time highs to 25.78 in the Asian session. This is an indication of a possible reversal as bears overtake the bulls (on a possible short squeeze above the highs) and push price lower, closer to the open. In addition, the RSI is diverging from price as it is nowhere near a new high, as price had done.

Source: Tradingview, FOREX.com

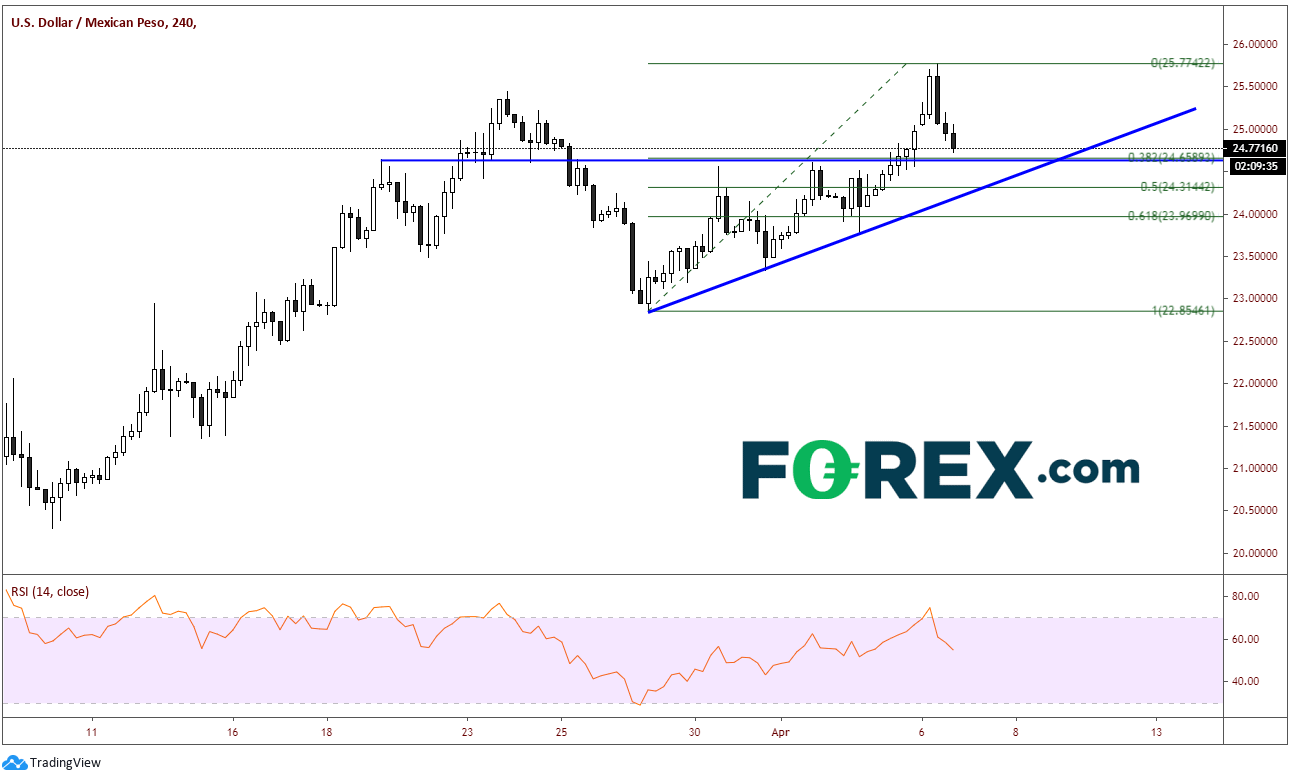

On a 240-minute USD/MXN has put in a bearish engulfing candlestick formation at the highs, which is also considered a reversal formation. The pair is close to support near the 38.2% Fibonacci retracement level from the low on March 26th to todays highs near 24.6590. There also horizontal support near this level. If price breaks lower from here, the next support would be the 50% retracement level and trendline support near 24.3152. Below here is the 61.8% retracement level from the same time frame at 23.9700 and final horizontal support at a full retracement of the recent move, at 22.85. Resistance is at today’s highs near 25.77.

Source: Tradingview, FOREX.com

Is this move in USD/MXN solely related to the fiscal moves by President ALMO? Probably not. The reversal nature appears to be common today across other emerging market pairs as well.

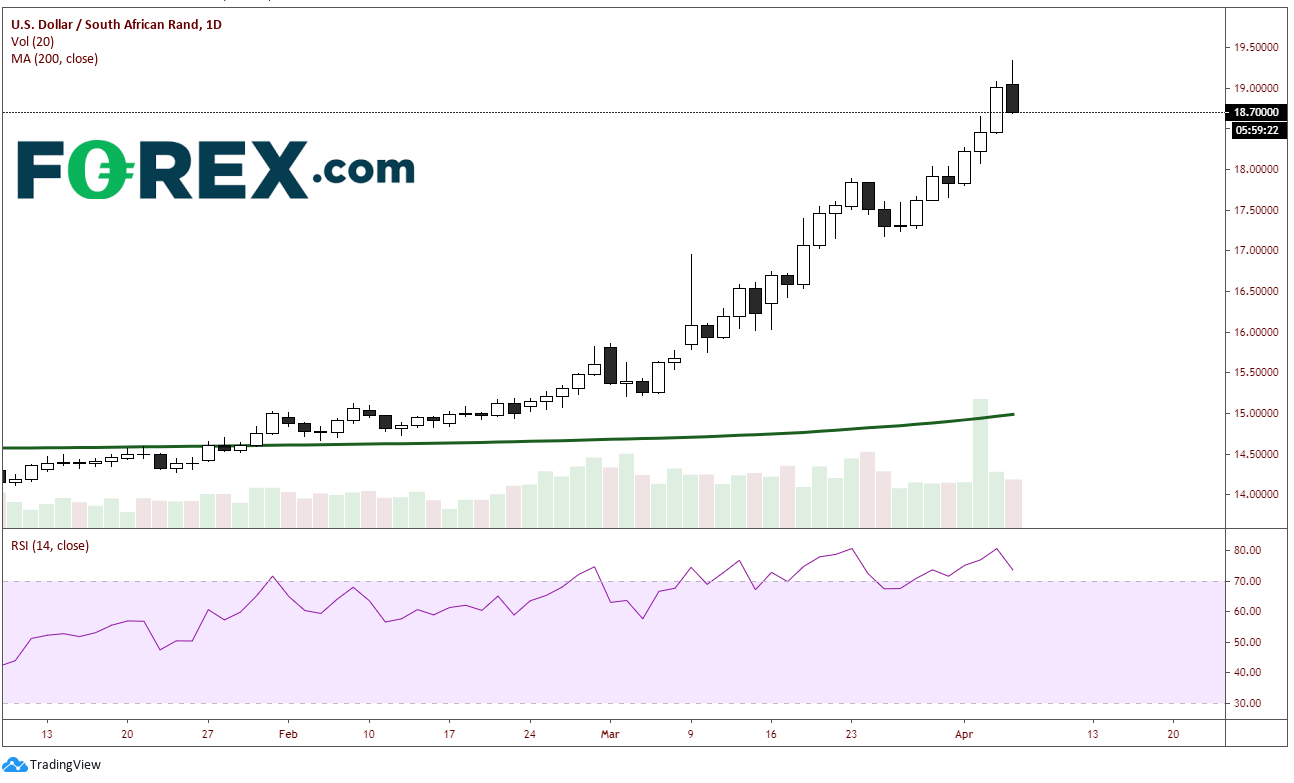

After the USD/ZAR put in all-time new highs today at 19.34, the pair is reversing and has pulled back into the body of Fridays candle and is currently down 1.6% today.

Source: Tradingview, FOREX.com

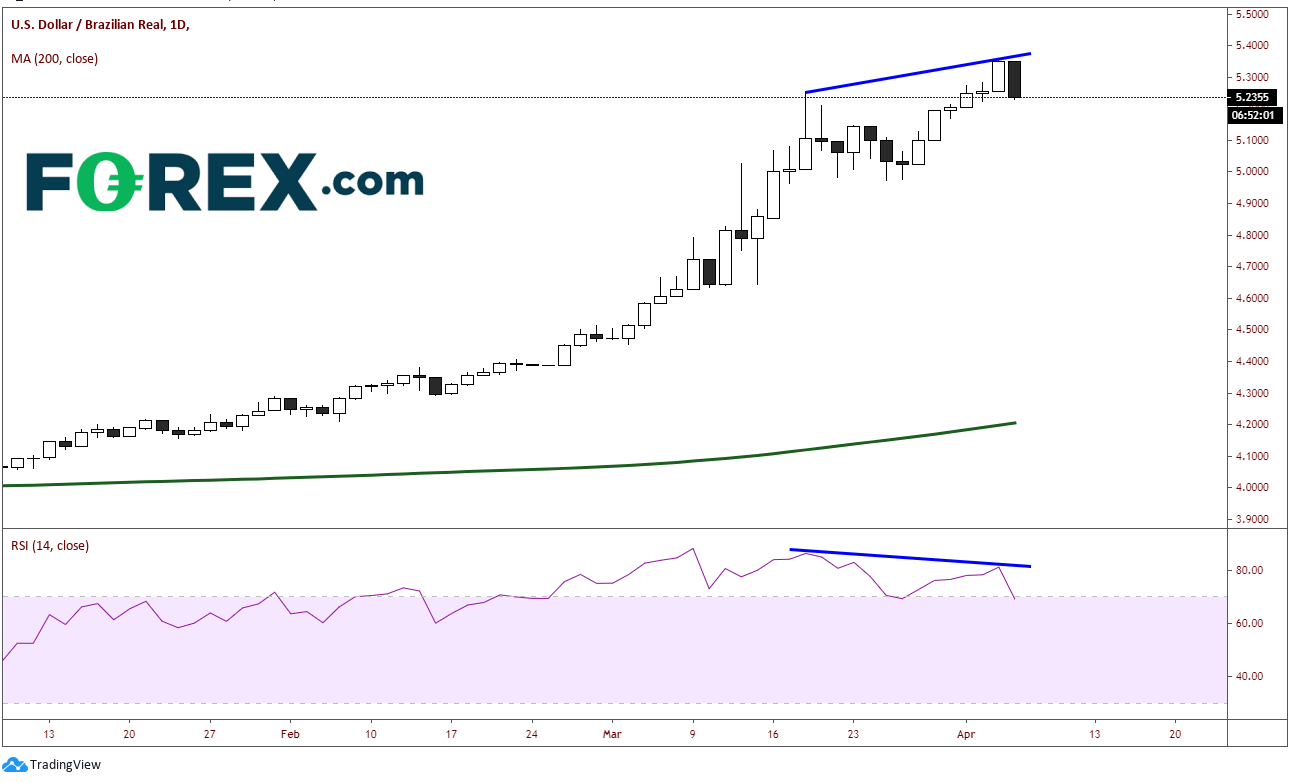

And USD/BRL is currently putting in a bearish engulfing candlestick formation today, down 2.15% near 5.2350 after putting in an all-time high at 5.3529 on Friday. The RSI is also diverging with price.

Source: Tradingview, FOREX.com

Although Mexico has finally put in measures over the weekend to help the Mexican economy, today’s move in USD/MXN may not be solely because of that. Other Emerging Market currencies are also taking a breather vs the US Dollar as pairs need to unwind a bit after a strong move higher.

Any reviews, news, research, analysis, prices or other information contained on this website is provided as general market commentary, does not constitute investment advice and may undergo changes from time to time. Trading the Financial and Currency Markets on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as to your favor. Before entering trading Financial and Currency Markets, you should carefully consider your investment objectives, level of experience and risk appetite. There is a possibility that you could sustain a loss of some or more of your initial investment and therefore you should not invest money which you cannot afford to lose. You should be aware of all the risks associated with Financial and Currency Markets trading, and in case you have any doubt, rather seek advice from an independent financial advisor. FOREXANALYTIX LLC, its owners, employees, agents or affiliates do not give investment advice, therefore FOREXANALYTIX LLC assumes no liability for any loss or damage, including without limitation to, any loss of profit, which may be suffered directly or indirectly from use of or reliance on such information. We strongly encourage consultation with a licensed representative or financial advisor regarding any particular investment or use of any investment strategy. As part of our service we provide “Patterns in Play” (abbreviated as “P.I.P.’s”). These PiPs are derived from certain clearly defined patterns that the team members identify from their analysis. Each PiP is indicated with its corresponding theoretical entry, target and invalidation levels. Please note that these are not trade recommendations; they are simply our team’s interpretation of these patterns and their theoretical levels. Any information or material contained on this website including, but not limited to, its design, layout, look, appearance and graphics is owned by or licensed to FOREXANALYTIX LLC. Reproduction is prohibited without FOREX ANALYTIX LLC prior license in writing.

Recommended Content

Editors’ Picks

EUR/USD clings to strong daily gains near 1.0400

EUR/USD remains on track to post strong gains despite retreating from the session high it set above 1.0430. The positive shift in risk mood, as reflected by the bullish action seen in Wall Street, forces the US Dollar to stay on the back foot and helps the pair hold its ground.

GBP/USD surges above 1.2500 as risk flows dominate

GBP/USD extends its recovery from the multi-month low it set in the previous week and trades above 1.2500. The improving market sentiment on easing concerns over Trump tariffs fuelling inflation makes it difficult for the US Dollar (USD) to find demand and allows the pair to stretch higher.

Gold firmer above $2,630

Gold benefits from the broad-based US Dollar weakness and recovers above $2,630 after falling to a daily low below $2,620 in the early American session on Monday. Meanwhile, the benchmark 10-year US Treasury bond yield holds above 4.6%, limiting XAU/USD upside.

Bitcoin Price Forecast: Reclaims the $99K mark

Bitcoin (BTC) trades in green at around $99,200 on Monday after recovering almost 5% in the previous week. A 10xResearch report suggests BTC could approach its all-time high (ATH) of $108,353 ahead of Trump’s inauguration.

Five fundamentals for the week: Nonfarm Payrolls to keep traders on edge in first full week of 2025 Premium

Did the US economy enjoy a strong finish to 2024? That is the question in the first full week of trading in 2025. The all-important NFP stand out, but a look at the Federal Reserve and the Chinese economy is also of interest.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.