USD/JPY: Will bulls charge or bears dominate ahead of Fed decision?

-

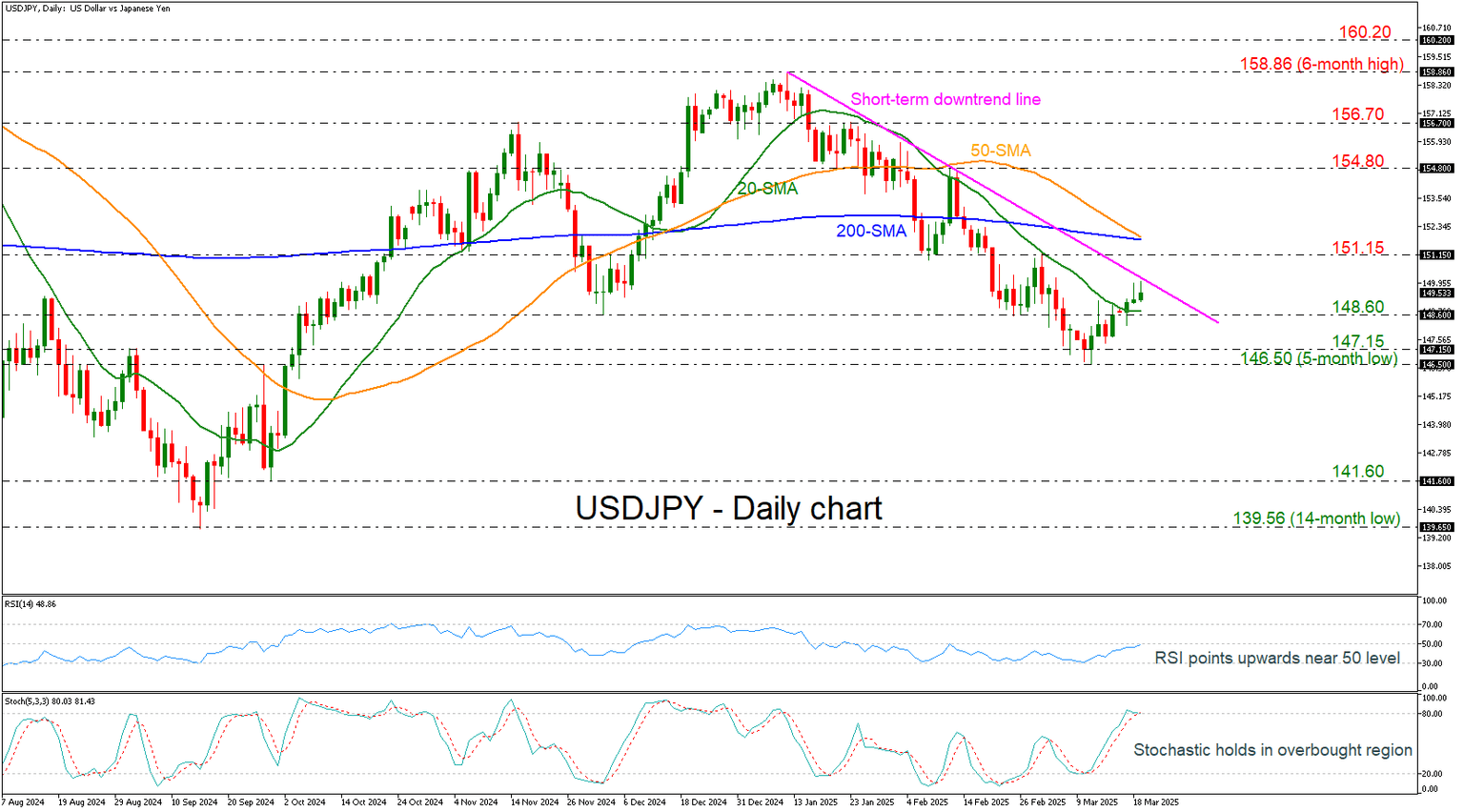

USD/JPY approaches downtrend line.

-

RSI points up but stochastic look overstretched.

USD/JPY is gaining some ground, a few hours before the Fed interest rate decision which is expected to leave the rates unchanged at 4.50%. The pair rebounded off the five-month low of 146.50 and is flirting with the short-term downtrend line slightly below the 150.00 critical level.

Technically, the RSI indicator is trying to cross above the neutral threshold of 50; however, the stochastic is flattening near the 80 level, indicating an overstretched market.

If the price overcomes the downtrend line, immediate resistance could come from the 151.15 barrier ahead of the potential bearish crossover within the 50- and the 200-day simple moving averages (SMAs) at 151.77. Surpassing these obstacles, the bulls could battle with the 154.80 barricade.

Alternatively, a pullback off the falling trend line could send investors toward the 20-day SMA at 148.60 before challenging the 146.50-147.15 support area. A slip lower could open the way for a test of the 141.60 level.

To conclude, USD/JPY has been demonstrating a descending tendency since January 10, and only a rally beyond the six-month peak of 158.86 could switch the outlook to positive again.

Author

Melina joined XM in December 2017 as an Investment Analyst in the Research department. She can clearly communicate market action, particularly technical and chart pattern setups.