USD/JPY Weekly Forecast: Is the Fed serious about inflation?

- US inflation at four-decade high of 6.8% in November.

- Dollar-yen regains 113.00 on Monday then stalls.

- US Treasury yields rise but below recent highs.

- Fed meeting on December 15 is the focal point, higher rate guidance expected.

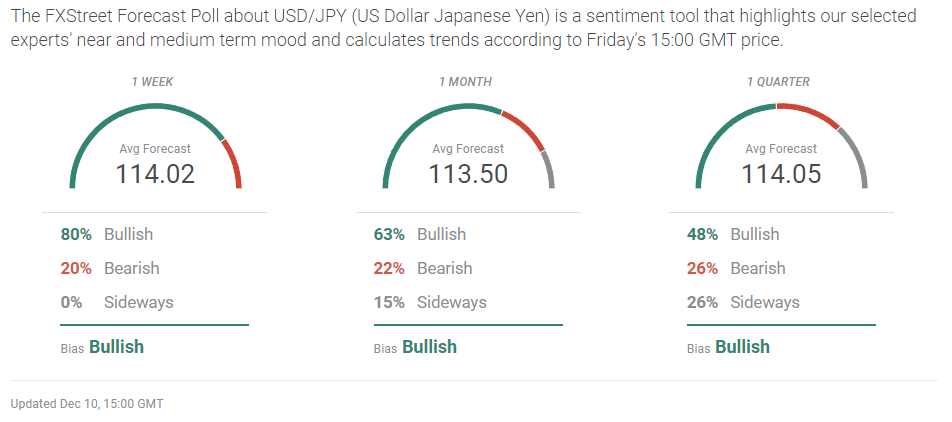

- FXStreet Forecast Poll predicts a minor and diminishing rise in the USD/JPY.

In writing a currency analysis column, the constant temptation is to anthropomorphize the subject, to treat the USD/JPY as if it were an actor. The Dollar-yen ran, fell, stumbled, blinked, all verbs of physical action. Today we take that one step further.

After the USD/JPY lost more than two figures in the completely foolish Omicron panic on November 26, it has barely moved. Perhaps Dollar-yen is embarrassed.

An alternative explanation is that US inflation figures and comments from Federal Reserve officials, including Chair Jerome Powell, that it is time to act on inflation, have put sharp focus on Wednesday’s Federal Open Market Committee (FOMC) meeting. The Fed is widely predicted to increase the amount of its monthly taper from $15 billion to $20 or $25 billion at the December 15 conclave. This would bring the end of the $120 billion program forward from June 2022 to April or March, depending on how the fractions are handled.

The Fed’s final economic and rate projections for the year are also due and expected to show the heightened inflation risk and two fed funds hikes next year. September’s estimates had one rate increase in 2022, the first of the pandemic. Fed funds futures from the Chicago Board Options Exchange (CBOE) show a 61.1% chance of three hikes by the December 14, 2022 FOMC.

In trading the week’s low was Monday’s open at 112.74 and the high close was on Wednesday at 113.67. After the initial 74 point move above 113.000 on Monday, the daily range for the rest of the week was 12 points.

Yields on US Treasury bills, notes and bonds rose. The 10-year note added 15 basis points to 1.508% at Friday’s open but it remains 16 points below its most recent high of the November 23 close of 1.667%.

Treasury yields have been down the road to higher rates several times this year and they have not broken the March 31 top of 1.764%. The Fed may be ready to encourage higher Treasury and commercial interest rates, but after numerous false starts credit traders want proof not rhetoric.

Japanese data was mixed. The decline in Overall Household Spending in October moderated to -0.6% from -1.9% but it was still the third drop in a row and the fourth in the last six months. Labor Cash Earnings for October rose 0.2%, less than a third of the 0.7% forecast and equal to September. The Eco Watchers Survey, which tracks regional economic trends, was better than projected in the Current gauge but worse on the Outlook side. Producer prices climbed more than expected in November, 0.6% on the month and 9% for the year. Only in perennially deflationary Japan is that good news.

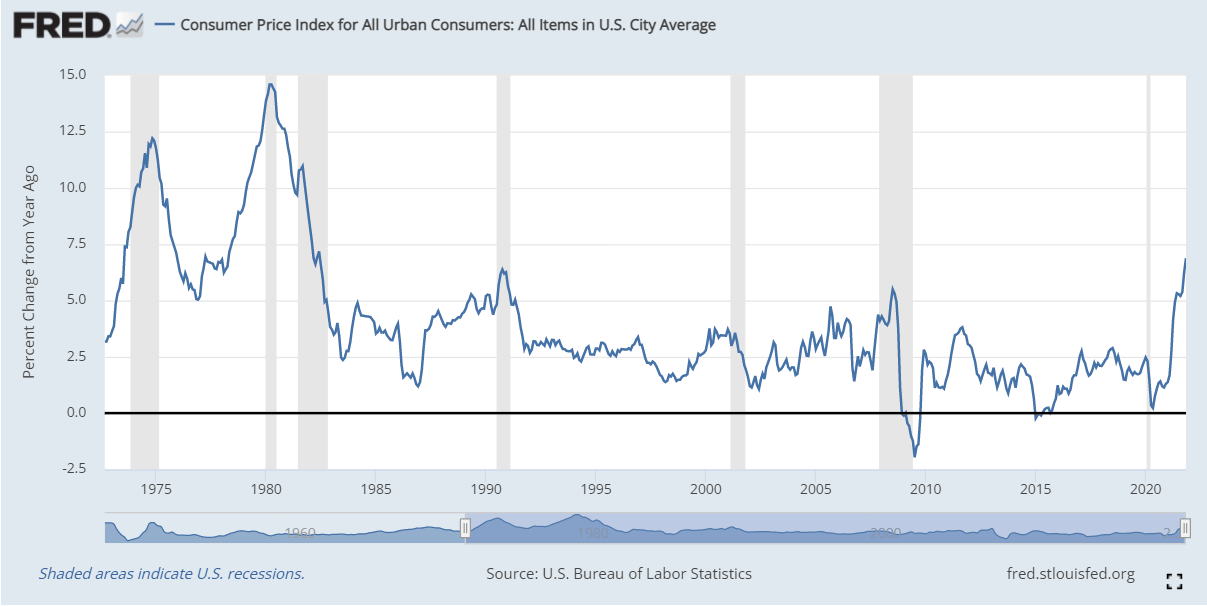

American information was also varied. The trade deficit improved in October and Initial Jobless Claims fell to 184,000 the lowest weekly total in 52 years. Consumer inflation was as predicted in November, 6.8% in headline, a 39-year high, and 4.9% in core, a three-decade top, after October’s 6.2% and 4.6%. The 5.6% jump in inflation since last November's 1.2% CPI is the fastest 12-month increase in 69 years.

The dollar dipped modestly on Friday after the CPI release with market relief the US inflation figures were not worse.

USD/JPY outlook

The USD/JPY is hostage to the US credit market and to the Federal Reserve. The Fed cannot counter US inflation in the near term unless it permits Treasury rates to rise. A fed funds rate hike is not necessary, the credit market will do the work, but traders have been conditioned by almost two years of pandemic panic, to buy Treasuries at every unknown twist of the virus. The Omicron panic two weeks ago is a prime example.

The US Federal Reserve and the Bank of Japan (BOJ), meeting on Wednesday and Thursday respectively, will restrain and order markets. Expect quiet trading until the 2:00 pm (ET) Fed rate and taper announcement. Consumer inflation and the Fed’s own expressed concerns make guidance for higher US rates close to a certainty.

The Bank of Japan is headed in the opposite direction. Prime Minister Fumio Kishida has promised fiscal and monetary programs to revive the Japanese economy. The BOJ may increase its credit market purchases and the government will put forth yet another supplemental spending budget. The yield on the 10-year Japanese Government Bond (JGB) was essentially unchanged in the week, opening at 0.056% and finishing at 0.051%.

With the Fed and BOJ pursuing different concerns and nearly opposite rate policies, the USD/JPY will rise. How fast and far depends on whether the Fed is serious about inflation. Markets will know on Wednesday.

Japan statistics December 6–December 10

US statistics December 6–December 10

FXStreet

Japan statistics December 13–December 17

USD/JPY technical outlook

The neutral aspects of the MACD (Moving Average Convergence Divergence) and the Relative Strength Index (RSI) are deceptive as is the declining momentum in True Range. All three are in contrast to the USD/JPY plunge two weeks ago. The MACD line is approaching the signal line from beneath and the diminishing gap is an alert to the buying opportunity, if not quite a classic instruction. Only a small rise in the USD/JPY will bring the MACD above the signal line. Unless the Fed abdicates all inflation responsibility on Wednesday that cross should happen next week.

The 21-day moving average (MA) at 113.90 marked the week's high on Wednesday but its greater role is part of the resistance line at 114.00. The 50-day MA at 113.61 fronts resistance at 113.70. In total the two averages and the two lines form a substantial band of resistance stretching from 113.60 to 114.00. Support at 112.75 has held in six different sessions since the USD/JPY moved through 113.000 on October 11. That line remains the immediate base.

Currency markets have been waiting for several weeks for the US Federal Reserve to deliver a stronger anti-inflation policy. In that time the technical resistance above the current trading range has become substantial. If the Fed does not produce on Wednesday, USD/JPY long positions will likely be cut and the pair revert to its six-month base between 111.50 and 112.00.

Resistance: 113.70, 114.00, 114.25, 114.85

Support: 113.20, 112.75, 112.20, 112.00, 111.50

FXStreet Forecast Poll

The FXStreet Forecast Poll illustrates the dependence of the USD/JPY on fundamental factors. Though the predictions are bid out to one quarter, the ranges never penetrate resistance at 114.00 and above.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.

-637747449381724107.png&w=1536&q=95)

-637747473274762583.png&w=1536&q=95)