USD/JPY Weekly Forecast: Federal Reserve patience calms markets

- Fed taper promises higher US rates later or sooner.

- US payrolls indicate the economy is strong into the 4th quarter.

- USD/JPY ends the week near the low side of its three-week range.

- FXStreet Forecast Poll predicts a weak negative trend.

The Federal Reserve announcement that it was gradually ending its emergency bond program was the most highly anticipated market event of the year. In a tribute to the success of the Fed’s long campaign to inoculate markets against any precipitate responses, there were none.

Treasury yields rose briefly on Wednesday, the day of the Fed meeting, then fell. The 10-year yield opened the week at 1.561% and by Friday morning after the Nonfarm Payroll report was trading below 1.5%.

For the USD/JPY the retreat of US yields undermined what had been the best reason for buying the pair, the widening US Treasury-Japanese Government Bond (JGB) spread.

On September 22 before that day’s Federal Open Market Committee (FOMC) meeting the spread between the US 10-year Treasury yield and the 10-year JGB was 1.283%. One month later on October 21 the differential had widened to 1.587%. The high trade in the USD/JPY at 114.70 was on October 20 and the high close was on October 19 at 114.38.

Since then the US and Japanese yields have retreated with Treasury returns falling faster and the spread has narrowed to 1.423%.

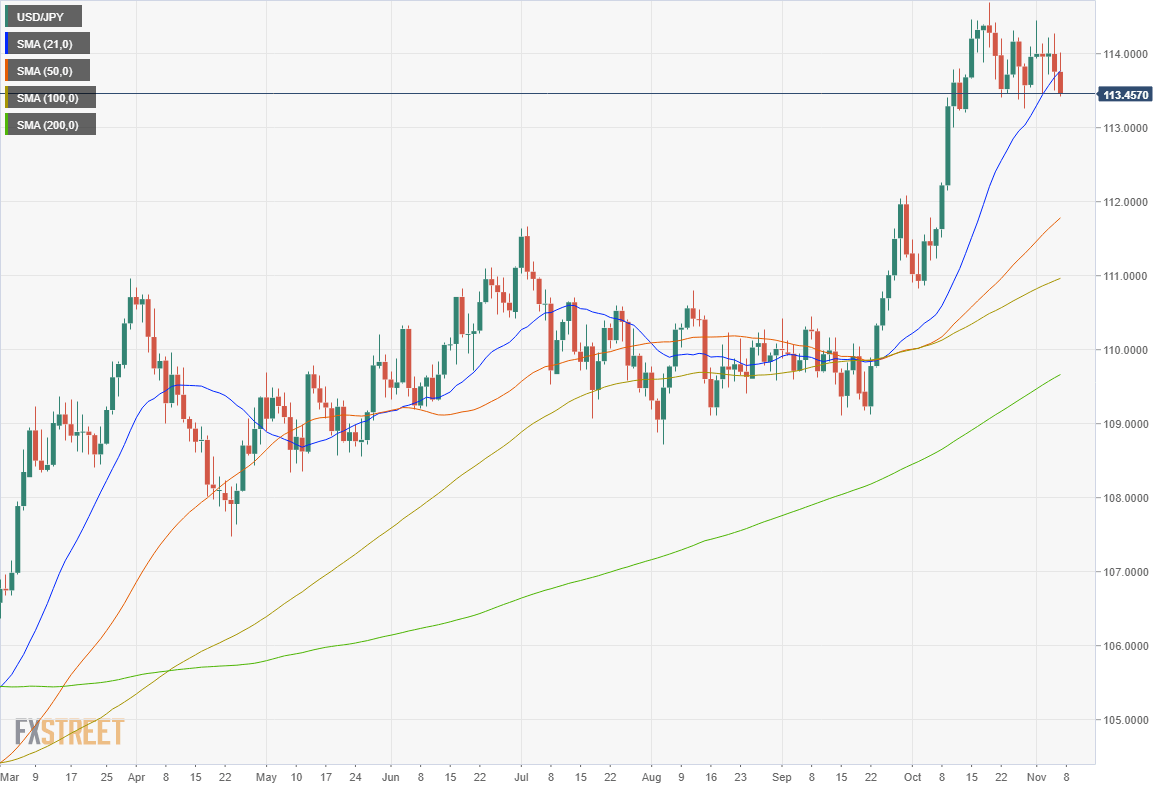

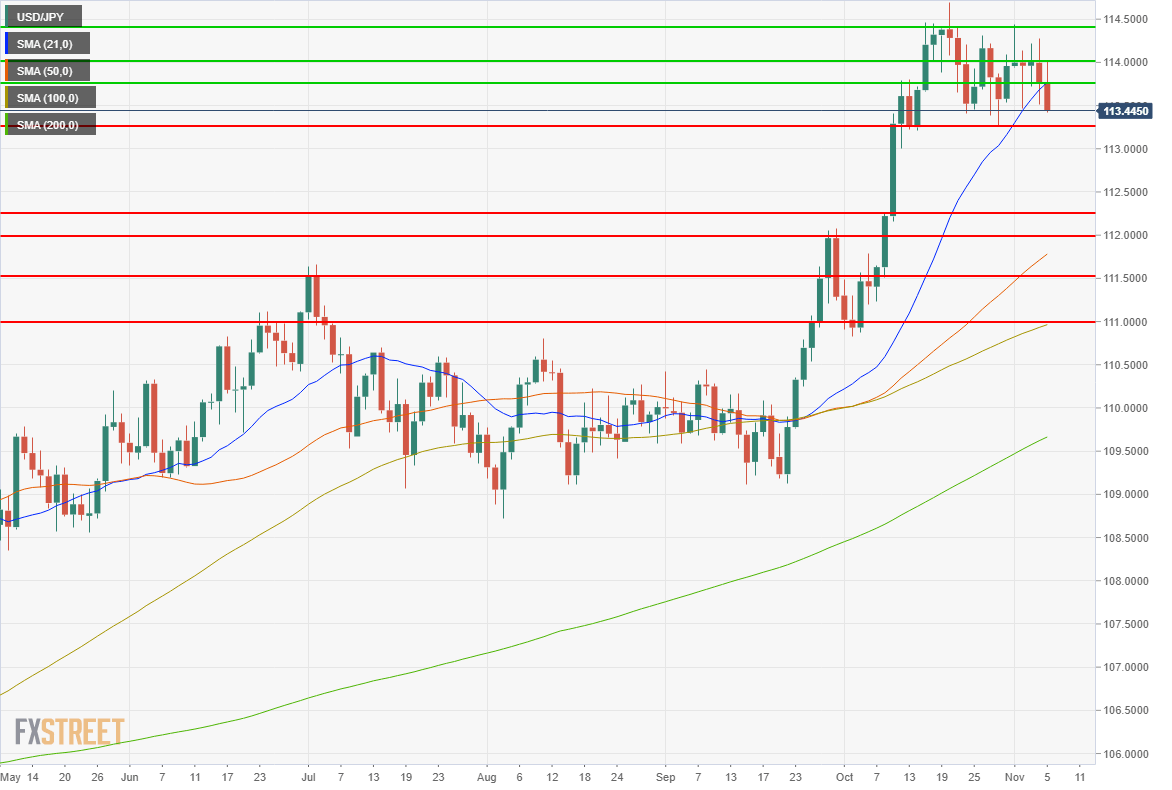

For the past three weeks the USD/JPY has traded in a thin 113.25 to 114.40 range. From the open on Monday at 113.96 the pair barely moved for three days, closing on Wednesday at 114.00. Thursday’s drop to 113.76 at the finish coincided with the reversal in US Treasury rates as did the continued fall in the USD/JPY and US yields on Friday.

Meaningful Japanese data this week was limited to Overall Household Spending for September which fell 1.9% on the year, less than the 3.9% expected and August’s 3% decline.

American information showed that despite the labor shortage, supply chain snafus* and pandemic dislocations the economy retains a strong base. Purchasing Managers’ Indexes for services and manufacturing from the Institute for Supply Management improved in October. The Employment Indexes remained above the 50 division between expansion and contraction though the services number fell and the manufacturing rose. New Orders were strong and Prices Paid indicated building inflation pressures.

Initial Jobless Claims dropped to 269,000 in the last week of October, not far from their level in the weeks before the pandemic hit last March. Nonfarm Payrolls rose 531,000 in October, with an additional 249,000 added to August and September for an excellent report.

* US military slang, World War II–situation normal all f....d up

USD/JPY outlook

The withdrawal of Fed support for the credit market will, over time, send US interest rates higher, though bond traders are in no rush to accomplish the fact.

At 113.41 on Friday the USD/JPY is at the low side of its recent range but more importantly it has exited the pennant at the bottom. The immediate implication is a test of 113.25.

Japanese Prime Minister Kishida’s government has promised action to revive the economy. Given the history of Tokyo’s involvement there is little reason to expect that the forthcoming spending program or the Bank of Japan’s (BOJ) monetary support will have any impact.

Japanese yen weakness from BOJ policy, is for the moment, matched by the lassitude of US interest rates.

Japanese data in the week ahead, September's Coincident Index or the Eco Watchers Survey for October, will not move the USD/JPY.

October inflation results for US consumers and producers, especially if they are higher than expected, may offer limited support for the USD/JPY.

The USD/JPY outlook is lower.

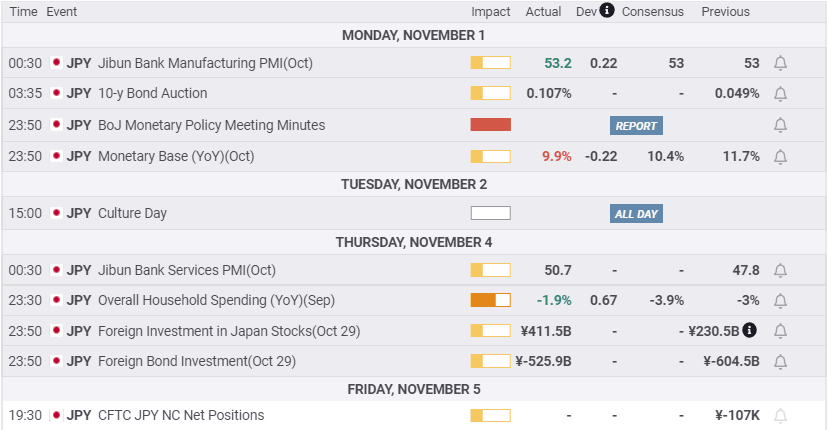

Japan statistics November 1–November 5

US statistics November 1–November 5

FXStreet

Japan statistics November 8–November 12

FXStreet

US statistics November 8–November 12

USD/JPY technical outlook

The mild negative prediction for the MACD (Moving Average Convergence Divergence) is due to the failure at 114.50 and 114.00 and the approach to the bottom of the recent range. This tendency will increase if the pair moves closer to the 113.25 support.

The Relative Strength Index (RSI) has drifted toward neutral but has to be considered a trailing indicator this week as the USD/JPY moves lower. True Range momentum has also diminished as the USD/JPY has remained range bound. These indicators do not take into account the likely acceleration in the USD/JPY if the 113.25 support is cracked.

The 21-day moving average (MA) at 113.77 managed to support the USD/JPY for one day marking the close on Thursday. Friday's initial rise was rejected at 114.00 and the retreat moved through the support without pause. The ease of the crossing makes it unlikely the level will offer much resistance should the USD/JPY return. The 50-day MA at 111.78 should provide substantial backing to the support line 112.00, as will the 100-day MA at 110.96 to the line at 111.00. The 200-day MA at 109.66 reflects the USD/JPY before the late September rise.

The first support line at 113.25 is enticing because there is nothing beneath for a figure. That near gap is defined by the trading on October 11. If the market nears that level on an active day the natural gravity of such a sparsely traded range will be hard to resist.

Resistance: 113.75, 114.00, 114.40

Support: 113.25, 112.25, 112.00, 111.55, 111.00

FXStreet Forecast Poll

The rejection at 114.00 in four straight trading sessions and the pennant exit have tilted the technical future lower.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.