USD/JPY Weekly Forecast: Fed decision, covid in the Olympics and yields to shake the pair

- USD/JPY has been trading in tandem with US yields, falling as fear grips markets.

- The Fed decision, US GDP and the rapid spread of the Delta variant are all eyed.

- Late July's daily chart is painting a mixed picture.

- The FX Poll is pointing to short-term strength but falls below 110 afterward.

A barometer of fear – USD/JPY has proved to gauge covid concerns, rising and falling with worries and US yields. Traders will eye Tokyo's covid-clouded Olympics, the Federal Reserve's decision, the first look at America's second-quarter growth – and the Delta variant as well.

This week in USD/JPY: Markets meet Delta

Reality check – Global stock markets have taken note of the Delta COVID-19 variant and its rapid spread beyond India. While many in the developed world are vaccinated, the jabs do not provide full protection, and the highly transmissible strain is hurting the unexposed all over the world.

Concerns about the economic impact triggered a stock sell-off on Monday and a rush into bonds. USD/JPY responded to fears with a drop, which was also correlated with the drop in Treasury yields – contrary to the dollar's moves against other currencies. The currency pair provided straightforward trades.

Coronavirus infections are rising in the US – mostly in undervaccinated areas, but now in all 50 states, dampening prospects of tighter policy from the Fed. Fear of rising inflation and consequent tapering of the bank's bond buys seemed to be temporarily shrugged off.

Cases are edging higher in Japan, including in Tokyo, where the delayed Olympic Games have begun. Reports about athletes and other officials testing positive have not deterred organizers. Still, surveys show locals are wary the Games could bring in more variants and turn into a super-spreader event. The capital remains under a state of emergency.

Source: FT

US housing figures were mixed, with a miss on Building Permits offsetting upbeat Housing Starts. Weekly jobless claims disappointed by topping 400,000.

Stimulus: A bipartisan infrastructure deal in Washington seemed close, but disagreements failed to pass an initial, procedural vote. Markets shrugged off the news.

In Japan, the National Consumer Price Index surprised with 0.2% in June, exceeding expectations for a drop of 0.1%. However, the Bank of Japan's 2% target remains elusive.

US events: Will the Fed promise support?

The Delta variant is set to continue spreading in America, potentially causing an increase in hospitalizations and deaths. While the safe-haven dollar has room to rise against most currencies, it would probably fail to battle the yen. Falling US yields are highly correlated with USD/JPY.

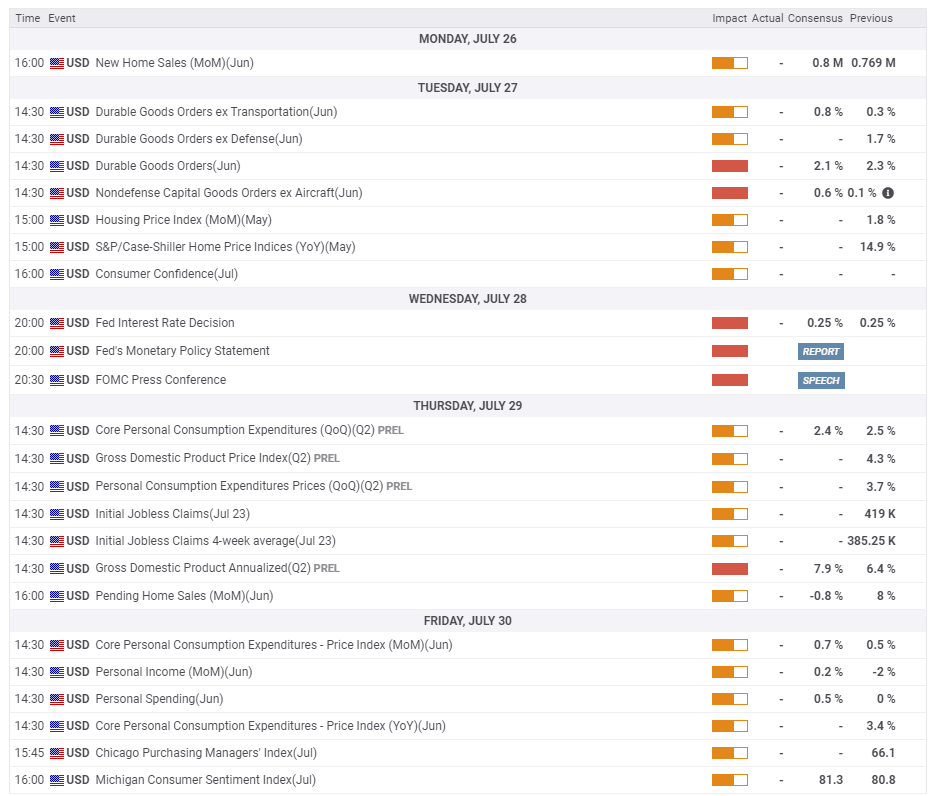

Apart from following covid statistics, there are plenty of scheduled events that could rock the dollar. Durable Goods Orders for June are forecast to show an increase in investment and serve as an input to Gross Domestic Product data released later in the week. The Nondefense Ex-Air figure is of special interest.

Will the Federal Reserve respond to the rise in coronavirus cases or notch up its taper talk? That is the main question for markets around the week's main event. Fed Chair Jerome Powell recently said that inflation is "uncomfortably high" – which would imply an upcoming reduction of the bank's bond-buying scheme.

However, the world's most powerful central banker seemed in no rush to print fewer dollars. Two weeks after his testimony on Capitol Hill, covid cases continued rising and also spooked markets. That and disappointing business and consumer surveys may sway the Fed to postpone any early withdrawal of support.

Investors have circled the bank's Jackson Hole Symposium in late August as an opportunity for signaling tighter policy, and they will want any bit of such a move. The Fed buys a total of $120 billion/month worth of bonds and indicated it would raise rates twice in 2023. No new forecasts are due at this time.

A dovish message would send stocks higher and the dollar down, while sounding upbeat like in June could weigh support for the greenback – albeit at a limited rate against the safe-haven yen. All in all, jittery markets imply a lose-lose situation for USD/JPY.

Markets will have little time to digest the Fed decision before the US releases its first GDP estimate for the second quarter. After growing at a robust clip of 6.4% annualized in the first three months of 2021, economists forecast an even faster rate of 7.9%.

Last but not least, the Fed's preferred inflation gauge – Core Personal Consumption Expenditure (Core PCE) – is set to shake markets on Friday. After hitting a high of 3.4% YoY in May, another uptick is on the cards.

Here are the upcoming top US events this week:

Japanese events: Olympics eyed (and not for medals)

The Japanese government has pushed through with the delayed 2020 Olympics despite rising cases – but the event remains at risk, especially if additional participants test positive. Even if there are only limited cancelations and the Games conclude with a flashy ceremony, the sight of empty stadiums could weigh on sentiment.

How will USD/JPY react? A blow to Japan's coffers is unlikely to hurt the yen but rather strengthen the safe-haven currency. If news of infections fades away, the yen could suffer.

The success or failure of the Games also has a political impact, as Prime Minister Yoshihide Suga faces internal reelection in his LDP party in September. Any concerns of political instability could weigh on sentiment.

The economic calendar features a bulk of releases late in the week, including the Unemployment Rate – an enviable 3% as of April – Retail Sales and Industrial Production.

It is essential to note that global risk sentiment more heavily influences the yen rather than Japanese indicators.

Here is the list of Japanese events from the FXStreet calendar:

USD/JPY Technical Analysis

Dollar/yen's bounce off the 109 level has proved technically significant – the currency pair recaptured the 50-day and 100-day Simple Moving Averages (SMAs). While momentum remains marginally to the downside and the pair set lower lows, USD/JPY bulls have an advantage.

Some resistance awaits at 110.70, which was a high point in mid-July, and it is followed by 111.10, a stepping stone on the way up in June. The peak of 111.60 is a critical cap.

Support awaits at 109.70, a swing low from June, followed by the 109 level mentioned earlier. Further down, 108.40 and 107.50 are the next levels to watch.

USD/JPY Sentiment

The key to the next moves are in the hands of the Fed. Powell may lean toward emphasizing recent disappointing data and the Delta variant at the expense of inflation, which could weigh on USD/JPY.

The FXStreet Forecast Poll is showing that experts foresee USD/JPY consolidating around current levels in the week, but then falling below 110 in ht medium-term and extending their decline later on. The average targets have been marginally downgraded in comparison to the previous week.

Related Reads

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.

-637626274264867466.png&w=1536&q=95)