USD/JPY surges as Trump storms to victory

The US dollar is on a tear against the major currencies after Donald Trump’s sweeping victory in the US presidential election. In the North American session, USD/JPY is trading at 154.62, up a massive 2.0% on the day.

Trump elected as US president

There are still plenty of votes to count in the US election but it looking increasingly likely that Republican Donald Trump has been re-elected as President. Trump and Democrat Kamala Harris were in a dead heat going into the election on Tuesday and there was concern that declaring a winner could take days or even weeks, which would have led to prolonged uncertainty.

In what was a huge surprise to both sides, Trump cruised to victory. The win is even sweeter for the Republicans as they likely have won control of both the House of Representatives and the Senate. With the Republicans in charge, Trump’s agenda will be easier to push through Congress. It should be noted that at the time of writing, the vote count is incomplete and Harris has not conceded defeat.

The US dollar has responded to the Trump win with sharp gains and the yen is in full retreat. Trump’s threats to slap stiff tariffs on China, Europe and Mexico would support the dollar, as tariffs would raise inflation and interest rates. If Trump’s policies lead to trade wars, market sentiment will fall, further boosting the dollar.

The Bank of Japan released the minutes of its September meeting today. At the meeting, the BoJ kept rates at 0.25% and Governor Ueda said that BoJ would not rush to raise rates during market volatility. Those comments were a response to a stock market slide after weak US employment reports raised fears that the US economy was deteriorating much more quickly than expected. Those fears were unfounded and the markets don’t expect a BoJ rate hike before early 2025, although if the weak yen takes a dive, it could accelerate plans to raise rates.

USD/JPY technical

-

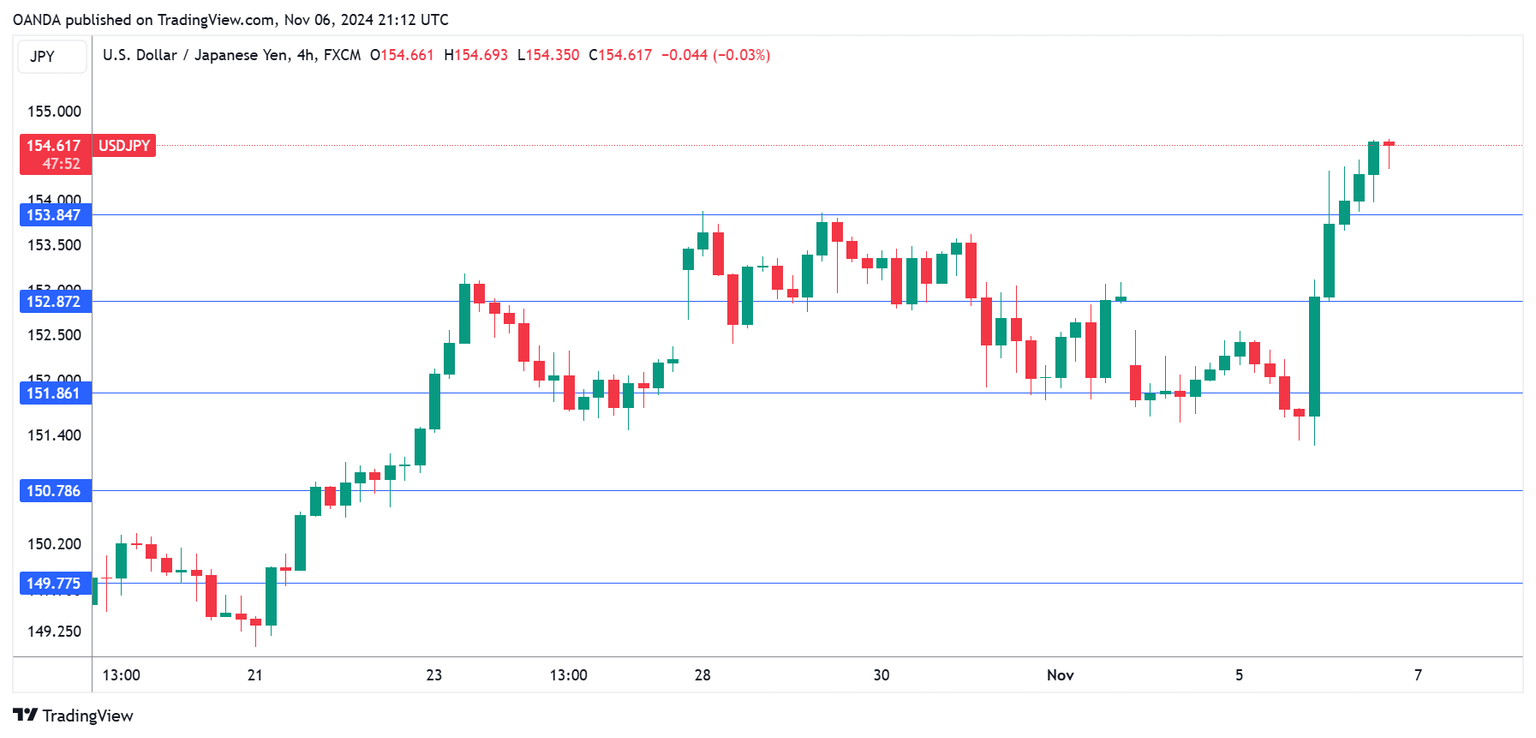

USD/JPY has pushed past resistance at 151.86, 152.87 and 153.84. The next resistance line is 153.95.

-

150.78 and 149.77 are providing support.

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.