USD/JPY surges as Bank of Japan stays pat

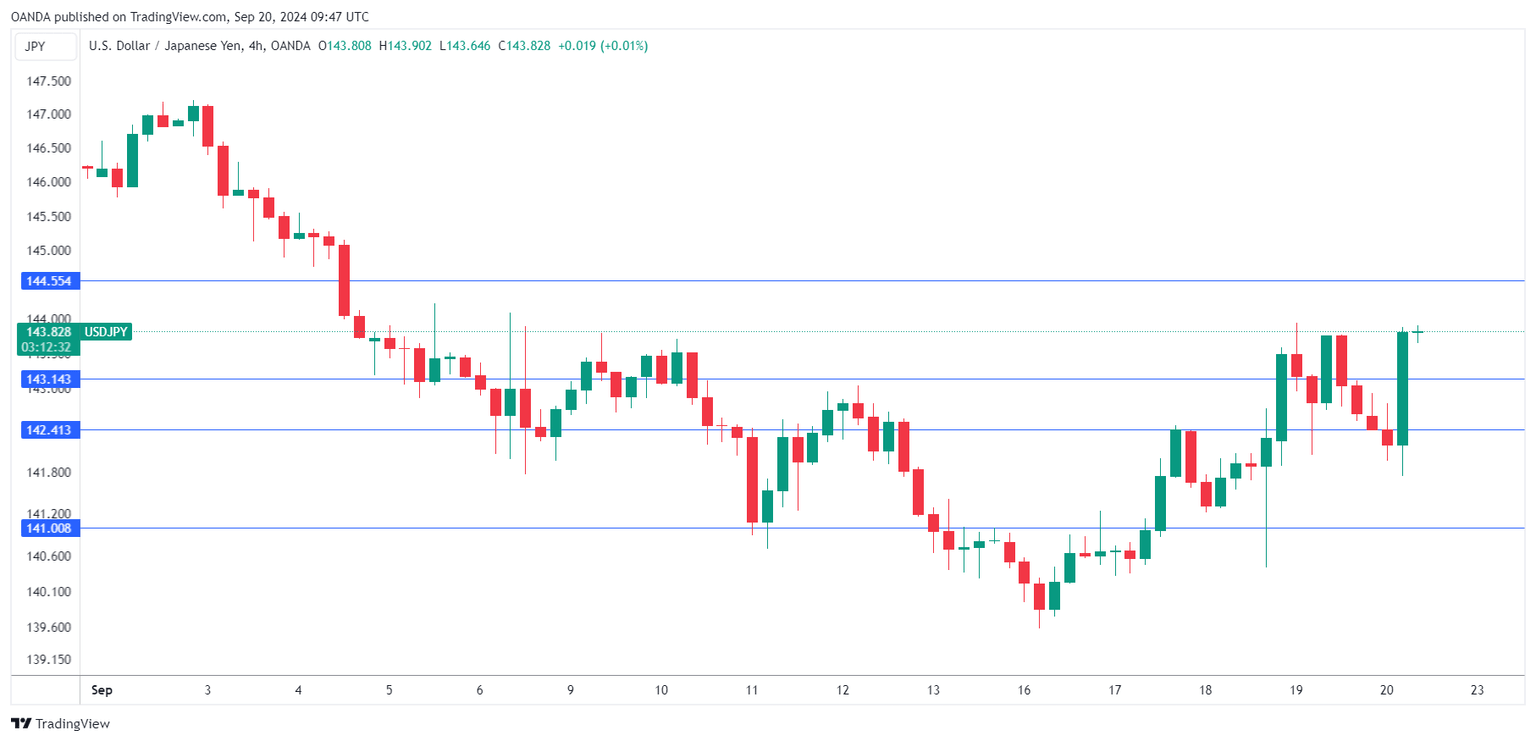

The US dollar has posted sharp gains on Friday. In the European session, USD/JPY is trading at 143.85, up 0.88% at the time of writing. The yen hit a 14-month high on Monday but the dollar has rebounded and is up 2.1% this week. It’s an unusually quiet Friday with no US events on the calendar.

Bank of Japan stays on sidelines

The Bank of Japan held its rate decision just after the Federal Reserve, but there was little drama at the BoJ meeting. The markets had expected the central bank to maintain rates at “around 0.25%” and the BoJ didn’t provide any clues about future hikes. The rate statement didn’t reveal much, stating that the economy had “recovered moderately” but some weakness remained.

The statement noted concern over “developments in financial and foreign exchange market and their impact on Japan’s economic activity and prices”. Governor Ueda said last month that the BoJ would raise rate if the economy and inflation were in line with the Bank’s projections. If key data, particularly inflation, is stronger than expected in the coming weeks, we could see a rate hike at the October meeting.

With inflation in the US largely under control, the Federal Reserve is keeping a worried eye on the labor market, as job growth as deteriorated quickly. That slide has unnerved financial markets and may have been a key factor in the Fed’s jumbo rate cut of 50 basis points this week. Thursday’s unemployment claims for the period ending Sept. 14 were better than expected, at 219 thousand. This was well below the revised 231 thousand reading a week earlier and beat the market estimate of 230 thousand.

USD/JPY technical

-

USD/JPY pushed above resistance at 142.41 earlier. The next resistance line is 144.55

-

There is support at 142.41 and 141.00

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.