The USD/JPY pair has found a stable footing around 143.22 as investors carefully analyse the recent comments from Bank of Japan Governor Kazuo Ueda. His remarks suggest that the BoJ is taking a measured approach to monetary policy adjustments, signalling a possible delay in interest rate hikes.

Governor Ueda emphasised the need to thoroughly analyse market and economic conditions before making policy decisions, indicating that immediate rate hikes are unlikely. He also highlighted external risks, including financial market volatility and uncertainties surrounding the US economy, which are critical considerations for Japan's monetary policy.

At its September meeting, the BoJ maintained the interest rate at 0.25% per annum, aligning with market expectations. Speculation suggests that the October meeting may not change the Monetary Policy Committee's structure. Still, by December, the BoJ might gather sufficient evidence to justify a rate increase.

The recent dip in the US dollar, spurred by weak consumer confidence figures in the US, has incidentally strengthened the yen. This shift has heightened expectations for further rate cuts by the Federal Reserve.

Technical analysis of USD/JPY

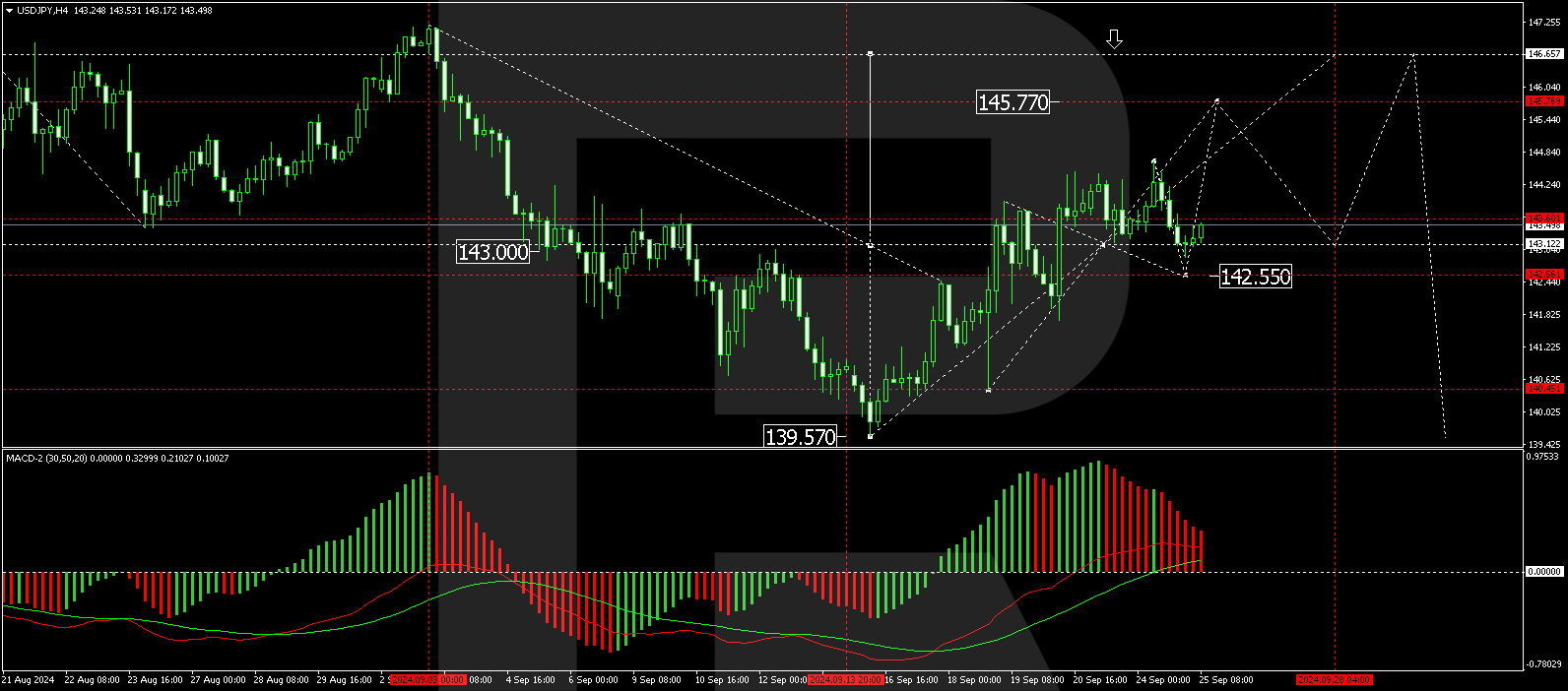

The USD/JPY is currently in a broad consolidation range centred around 143.43, extending to 144.66. The market has initiated a downward movement towards 142.55, testing this level from above. Subsequently, we anticipate a rebound to the upper boundary of this range. A breach above 144.70 could pave the way for a rise to 145.77, potentially extending to 146.66. Conversely, a decline to 142.00 and a subsequent breakdown could signal a trend continuation towards 137.77. The MACD indicator supports this bullish scenario, with its signal line positioned above zero and pointing upwards.

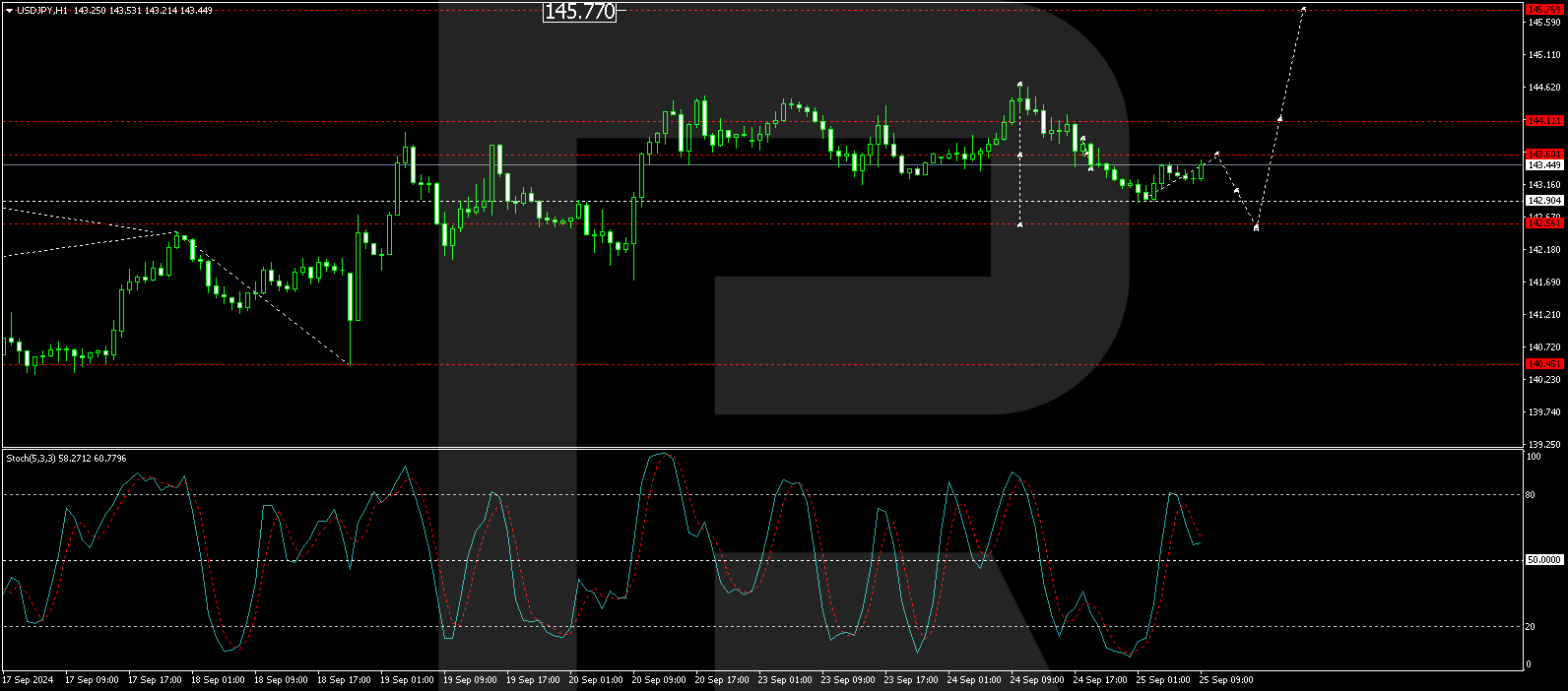

On the H1 chart, USD/JPY has crafted a consolidation range around 143.60, achieving the 142.90 local downside target. The pair is now moving upward towards 143.60, testing this level from below. The current setup suggests a retest of 143.60 could be followed by a new decline towards 142.55. The Stochastic oscillator, with its signal line above 50 and pointing upwards, corroborates this potential for a brief uptick followed by a continued downward trajectory.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD accelerates losses to 1.0930 on stronger Dollar

The US Dollar's recovery regains extra impulse sending the US Dollar Index to fresh highs and relegating EUR/USD to navigate the area of daily troughs around 1.0930 in the latter part of Friday's session.

GBP/USD plummets to four-week lows near 1.2850

The US Dollar's rebound keep gathering steam and now sends GBP/USD to the area of multi-week lows in the 1.2850 region amid the broad-based pullback in the risk-associated universe.

Gold trades on the back foot, flirts with $3,000

Gold prices are accelerating their daily decline, steadily approaching the critical $3,000 per troy ounce mark as the Greenback's rebound gains extra momentum and US yields tighten their retracement.

Can Maker break $1,450 hurdle as whales launch buying spree?

Maker holds steadily above $1,250 support as a whale scoops $1.21 million worth of MKR. Addresses with a 100k to 1 million MKR balance now account for 24.27% of Maker’s total supply. Maker battles a bear flag pattern as bulls gather for an epic weekend move.

Strategic implications of “Liberation Day”

Liberation Day in the United States came with extremely protectionist and inward-looking tariff policy aimed at just about all U.S. trading partners. In this report, we outline some of the more strategic implications of Liberation Day and developments we will be paying close attention to going forward.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.