Political news has dominated today’s headlines on both sides of the Atlantic.

In the UK this morning, Brexit Secretary Raab reiterated that he was confident that a trade deal with the European Union, surprising absolutely no one, though rumors of a potential snap election in November certainly caused some traders to raise their eyebrows.

Meanwhile in the US, rumors swirled that Deputy Attorney General Rod Rosenstein was quitting his post before getting fired…then that he was refusing to quit and would have to be fired…and now ultimately will remain in his post until at least Thursday, when he will meet with President Trump once again.

The news hit risk assets hard, as it could prompt a potential constitutional crisis if the next Department of Justice ranking member (Solicitor General Noel Francisco) tries to shut down Special Council Mueller’s investigation of the President. As of writing, all major US indices are in the red and the so-called “commodity dollars” (CAD, AUD, and NZD) are among the worst-performing major currencies on the day.

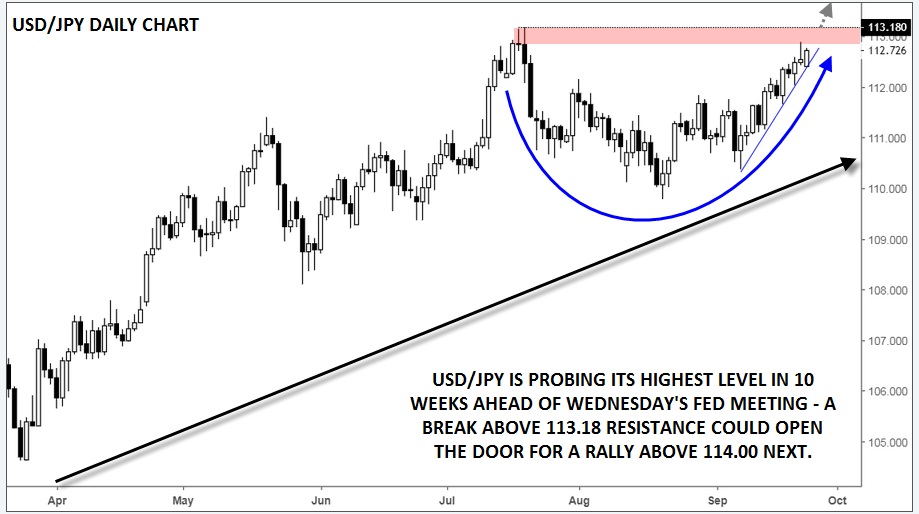

Interestingly, the “safe haven” yen hasn’t caught much of a bid on the headlines. In fact, USD/JPY is trading higher on the day to test Friday’s10-week high in the upper-112.00s. Technically speaking, the pair remains in an uptrend on both a medium term and short-term horizon, as the chart below shows. Rates have formed a “rounded bottom” of sorts over the last two months, and bulls have now turned their eyes to July’s intraday highs around the 113.00 handle, which also marks the highest level the pair has traded at since the first week of the year. A confirmed break above the 113.18 level could expose the highs from May, July and November 2017 above 114.00 next.

Source: TradingView

Beyond political headlines, Wednesday’s FOMC meeting may be the biggest market mover of the week. Even though the central bank’s presumed plan to raise interest rates another 25bps has already been completely discounted, traders will closely parse the accompanying statement, economic projections, and press conference with Fed Chair Powell for insights into how likely the Fed is to raise rates in December (currently priced at about an 80% probability according to the CME’s FedWatch tool) and how many times Powell and Company plan to hike rates in 2019.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

EUR/USD holds gains near 1.0900 amid weaker US Dollar

EUR/USD defends gains below 1.0900 in the European session on Monday. The US Dollar weakens, as risk sentiment improves, supporting the pair. The focus remains on the US political updates and mid-tier US data for fresh trading impetus.

GBP/USD trades sideways above 1.2900 despite risk recovery

GBP/USD is keeping its range play intact above 1.2900 in the European session on Monday. The pair fails to take advantage of the recovery in risk sentiment and broad US Dollar weakness, as traders stay cautious ahead of key US event risks later this week.

Gold price remains on edge on firm prospects of Trump’s victory

Gold price exhibits uncertainty near key support of $2,400 in Monday’s European session. The precious metal remains on tenterhooks amid growing speculation that Donald Trump-led-Republicans will win the US presidential elections in November.

Solana could cross $200 if these three conditions are met

Solana corrects lower at around $180 and halts its rally towards the psychologically important $200 level early on Monday. The Ethereum competitor has noted a consistent increase in the number of active and new addresses in its network throughout July.

Election volatility and tech earnings take centre stage

/stock-market-graph-gm532464153-55981218_XtraSmall.jpg)

The US Dollar managed to end the week higher as Trump Trades ensued. Safe-havens CHF and JPY were also higher while activity currencies such as NOK and NZD underperformed.