USD/JPY Price Forecast: Seems vulnerable near two-month low amid rising BoJ rate hike bets

- USD/JPY dives to over a two-month low on Thursday amid a notable JPY demand.

- Rising BoJ rate hike bets push JGB yields to a multi-year high and boost the JPY.

- Trump’s tariff threats revive trade war fears and also benefit the safe-haven JPY.

The USD/JPY pair drifts lower for the second straight day – also marking the first day of a negative move in the previous six – and dives to its lowest level since December 9 during the early part of the European session on Thursday. Spot prices currently trade just above the 150.00 psychological mark and seem vulnerable to prolonging the recent downtrend witnessed over the past month or so amid hawkish Bank of Japan (BoJ) expectations.

In fact, BoJ Governor Kazuo Ueda and Deputy Governor Himino recently signaled the possibility of another interest rate hike if the economy and prices align with the projections. Adding to this, BoJ Board Member Hajime Takata said on Wednesday that Japan's real rates remain deeply negative and the central bank must adjust the degree of monetary support further if the economy moves in line with forecasts. This comes on top of Japan's strong Gross Domestic Product (GDP) report released earlier this week and signs of broadening inflationary pressures, which suggests that the BoJ would raise borrowing costs sooner.

In fact, a Reuters poll published this Thursday showed that a majority of economists expect the BoJ to hike interest rates during the third quarter, to 0.75%. This, in turn, pushes the yield on the benchmark 10-year Japanese government bond (JGB) to its highest since November 2009 and provides a strong boost to the Japanese Yen (JPY). Meanwhile, US President Donald Trump's threat that he will announce tariffs on a number of products next month or even sooner fuels concerns about a global trade war. This, in turn, tempers investors' appetite for riskier assets and further underpins demand for the safe-haven JPY.

Furthermore, the flight to safety is reflected by a slide in the US Treasury bond yields. The resultant narrowing of the US-Japan rate differential turns out to be another factor driving flows toward the lower-yielding JPY. Moreover, declining US bond yields fail to assist the US Dollar (USD) to build on this week's modest bounce from the vicinity of a two-month low and contribute to the heavily offered tone surrounding the USD/JPY pair. That said, expectations for an extended pause on rates by the Federal Reserve (Fed), bolstered by hawkish FOMC minutes released on Wednesday, act as a tailwind for the USD.

At last month's policy meeting, Fed officials noted a high degree of uncertainty that requires the central bank to take a careful approach in considering any further interest rate cuts. Fed Vice Chairman Philip Jefferson noted that the US labor market is solid, the economic performance has been quite strong, inflation has eased but is still elevated, and the path back to the 2% target could be bumpy. Separately, Chicago Fed President Austan Goolsbee said that inflation has decreased but it is still excessive. This holds back the USD bears from placing aggressive bets and could limit losses for the USD/JPY pair.

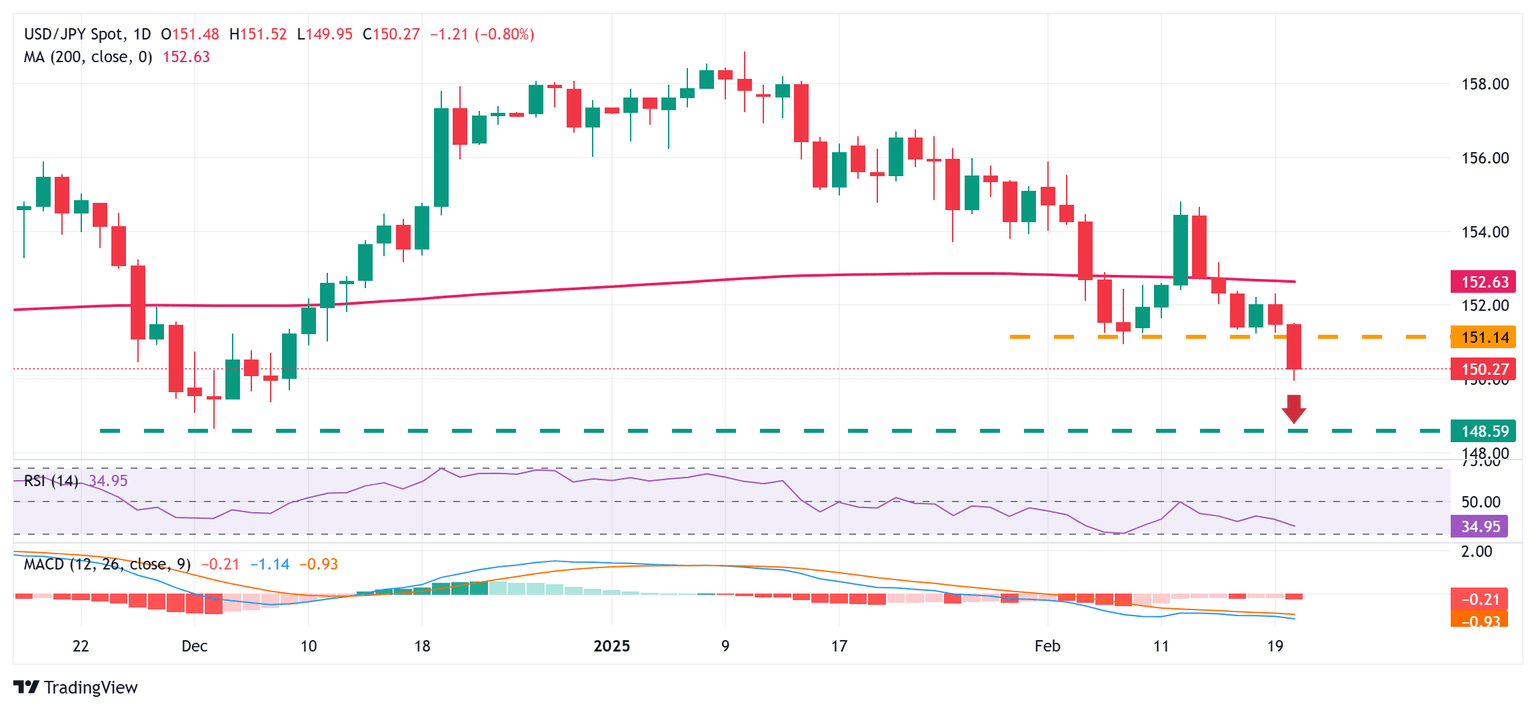

USD/JPY daily chart

Technical Outlook

From a technical perspective, Thursday's sustained break below the 151.00-150.90 region could be seen as a fresh trigger for bearish traders. Moreover, oscillators on the daily chart are holding deep in negative territory and are still away from being in the oversold zone. This, in turn, suggests that the path of least resistance for the USD/JPY pair remains to the downside. However, bearish traders might now wait for acceptance below the 150.00 mark before placing fresh bets. Spot prices might then accelerate the fall towards the 149.60-149.55 region en route to the 149.00 mark and the December 2024 low, around the 148.65 region.

On the flip side, any meaningful recovery attempt might now confront stiff resistance near the 150.90-151.00 horizontal support breakpoint. Some follow-through buying, however, could trigger a short-covering rally and lift the USD/JPY pair to the 151.40 hurdle en route to the 152.00 round-figure mark. That said, a further move up could be seen as a selling opportunity and runs the risk of fizzling out rather quickly near the 152.65 area. The latter represents the very important 200-day Simple Moving Average (SMA), which if cleared decisively might shift the near-term bias in favor of bullish traders.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.