USD/JPY Price Forecast: Range play intact as trades seek clarity on BoJ rate-hike path

- USD/JPY attracts some dip-buyers following a stronger Japanese CPI-led downtick.

- The BoJ rate-hike uncertainty, along with a positive risk tone, undermines the JPY.

- Bets for a less dovish Fed and elevated US bond yields lift USD to a fresh YTD top.

The USD/JPY pair seesaws between tepid gains/minor losses through the first half of the European session on Friday and remains confined in a familiar range. As investors look past the release of the latest consumer inflation figures from Japan, the uncertainty tied to the Bank of Japan's (BoJ) rate-hike plans and the upbeat market mood undermines the Japanese Yen (JPY). This, along with an extension of the post-US election US Dollar (USD) rally, acts as a tailwind for the currency pair.

The Japan Statistics Bureau reported this Friday that the National Consumer Price Index (CPI) eased from 2.5% to the 2.3% YoY rate in October, while the core CPI, which excludes volatile fresh food items, grew 2.3%. Additional details revealed that a core inflation reading that excludes both energy and fresh food costs remained above the Bank of Japan's 2% annual target and rose to 2.3% in October from 2.1% in the prior month. This comes on top of BoJ Governor Kazuo Ueda's hawkish remarks on Thursday and keeps the door open for another rate hike move in December. Investors, however, remain cautious in the wake of increased domestic political uncertainty, which might restrict the BoJ to tighten its monetary policy further.

Meanwhile, Japan's Prime Minister Shigeru Ishiba said that the economic stimulus package would be around ¥39 trillion, though fails to impress the JPY bulls. The US Dollar (USD), on the other hand, continues to draw support from speculations that the Federal Reserve (Fed) might cut interest rates slowly amid concerns that US President Donald Trump's policies could reignite inflation. Adding to this, Trump's expansionary plans continue to fuel worries over a possible rise in the US fiscal deficit, which remains supportive of elevated US Treasury bond yields. This, in turn, lifts the USD to its highest level since October 2023 and contributes to driving flows away from the lower-yielding JPY, offering additional support to the USD/JPY pair.

Furthermore, the prevalent risk-on environment, which tends to undermine the safe-haven JPY, suggests that the path of least resistance for the currency pair is to the upside. That said, the threat of a possible government intervention to prop up the domestic currency might hold back the JPY bears from placing aggressive bets and keep a lid on any runaway rally for the USD/JPY pair. This, in turn, points to an extension of the range-bound price action ahead of the flash US PMI prints, due later during the North American session. Apart from this, comments from influential FOMC members, along with the US bond yields, will drive the USD demand and produce short-term trading opportunities on the last day of the week.

Technical Outlook

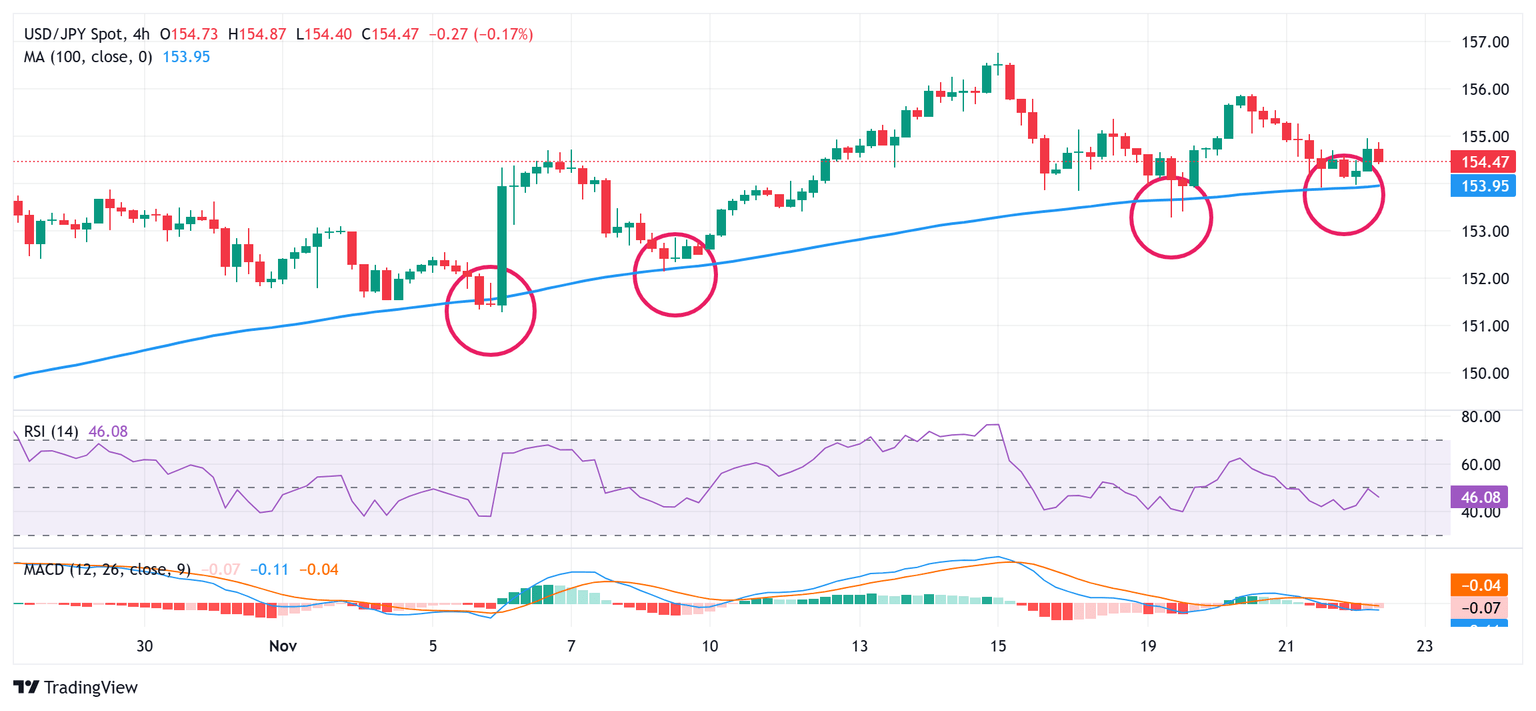

From a technical perspective, the USD/JPY pair once again manages to defend and bounce off the 100-period Simple Moving Average (SMA) on the 4-hour chart. The said support is currently pegged near the 154.00-153.95 region and should act as a key pivotal point. A convincing break below might prompt some technical selling and drag spot prices to the weekly swing low, around the 153.30-153.25 region. Some follow-through selling, leading to a subsequent weakness below the 153.00 mark, could pave the way for some meaningful corrective decline from a multi-month peak touched last week.

Meanwhile, oscillators on the daily chart are holding comfortably in positive territory and validate the near-term bullish outlook for the USD/JPY pair. A sustained strength beyond the 155.00 psychological mark will reaffirm the constructive outlook and allow spot prices to surpass the 155.40 supply zone and reclaim the 156.00 round figure. The momentum could extend further towards the 156.25-156.30 intermediate hurdle en route to the 156.75 region, or the highest level since July 23 touched last Friday.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.