USD/JPY Price Forecast: Divergent BoJ-Fed expectations support prospects for further losses

- USD/JPY drifts lower for the third straight day and drops to a one-month low on Thursday.

- The divergent BoJ-Fed policy expectations turn out to be a key factor exerting pressure.

- A softer risk tone underpins the safe-haven JPY and contributes to the ongoing downfall.

The USD/JPY pair remains under some selling pressure for the third successive day and drops to the 143.00 neighborhood, or a one-month low during the early European session on Thursday. The Japanese Yen (JPY) got a boost following the release of domestic data, which showed that inflation-adjusted wages in the world's fourth-largest economy rose for the second straight month in July. Adding to this, Bank of Japan (BoJ) board member Hajime Takata said that if the economy and prices move in line with the forecast, the central bank will adjust the policy rate in several stages. This comes on top of BoJ Governor Kazuo Ueda's hawkish remarks last month and reaffirms expectations that the central bank will hike interest rates again by the end of this year.

This marks a big divergence in comparison to rising bets for a larger interest rate cut by the Federal Reserve (Fed), bolstered by signs of softening the US labor market. The Job Openings and Labor Turnover Survey (JOLTS) published by the US Bureau of Labor Statistics on Wednesday indicated that job openings fell to 7.673 million in July, or the lowest level since January 2021. Moreover, the reading for June was revised down to 7.910 million against the previously reported 8.184 million. Adding to this, the Fed's Beige Book revealed that nine out of 12 regional districts reported flat or declining economic activity in August. This, along with remarks by Fed officials, lifts expectations that the US central bank will cut borrowing costs by 50 basis points in September.

Atlanta Federal Reserve President Raphael Bostic said that price pressures are diminishing quickly and that the US central bank must not maintain a restrictive policy stance for too long. Separately, San Francisco Fed President Mary Daly said that the central bank needs to cut rates to keep the labor market healthy, but it is now down to incoming data to determine by how much. The dovish outlook drags the yield on the rate-sensitive two-year US government bond to its lowest level since May 2023 and the benchmark 10-year US Treasury yield to its lowest since July 2023. This keeps the US Dollar (USD) bulls on the defensive, which contributes to the offered tone surrounding the USD/JPY pair and supports prospects for a further depreciating move.

Meanwhile, the disappointing US labor market report raises concerns about a downturn in the US economy and tempers investors' appetite for riskier assets. This is evident from a generally weaker tone around the equity markets, which should benefit the JPY's relative safe-haven status and validate the near-term negative outlook for the USD/JPY pair. Traders now look to Thursday's US economic docket – featuring the release of the ADP report on private-sector employment, the usual Weekly Initial Jobless Claims and the ISM Services PMI. The focus, however, remains on the US monthly employment details, or the Nonfarm Payrolls (NFP) report on Friday, which will drive the USD demand and provide meaningful impetus to the currency pair.

Technical Outlook

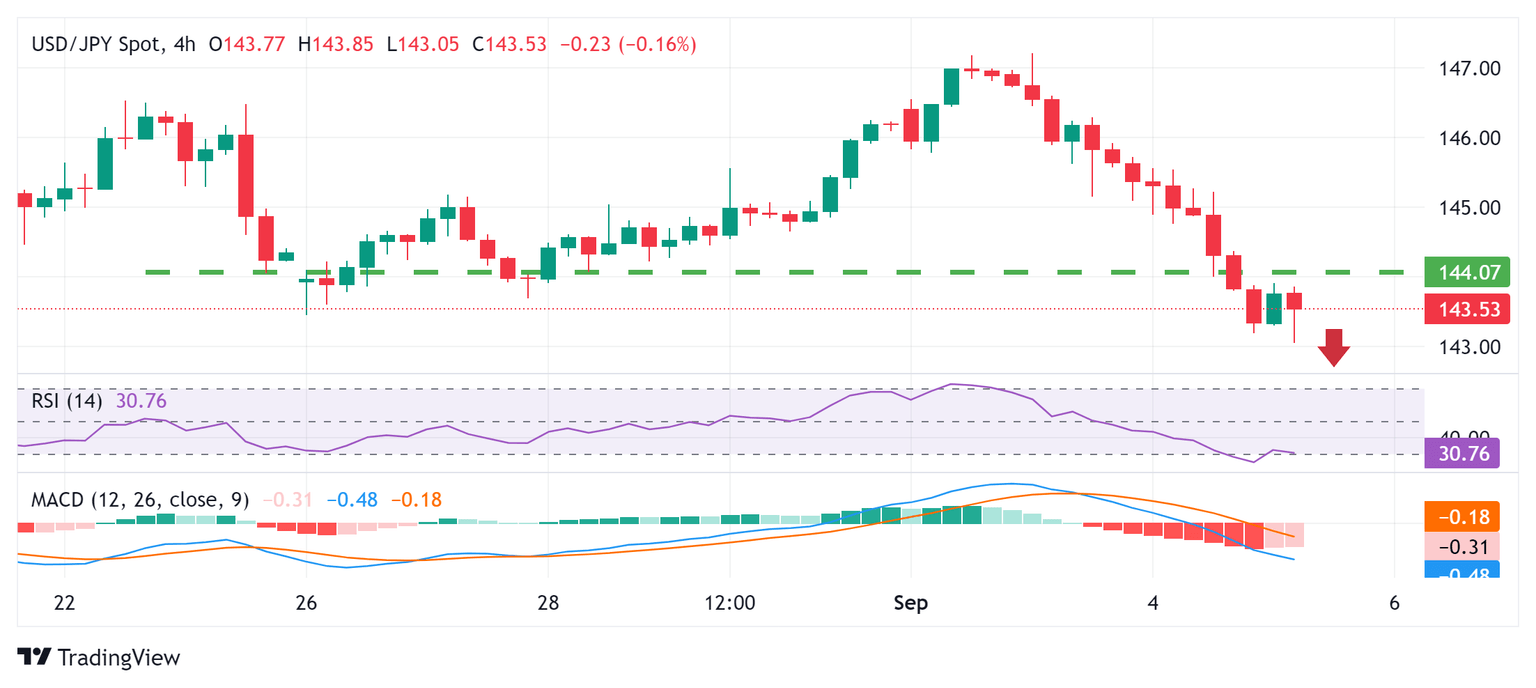

From a technical perspective, the overnight breakdown through the 144.00 mark was seen as a fresh trigger for bearish traders. Moreover, oscillators on the daily chart are holding deep in the negative territory and are still away from being in the oversold zone, suggesting that the path of least resistance for the USD/JPY pair remains to the downside. Acceptance below the 143.00 round figure will reaffirm the negative bias and drag spot prices further towards the 142.30-142.25 intermediate support en route to the 142.00 mark and the 141.70-141.65 region, or a seven-month low touched in August.

On the flip side, any meaningful recovery beyond the 144.00 mark is likely to attract fresh sellers and remain capped near the 144.50 supply zone. The latter should act as a key pivotal point, which if cleared decisively might trigger a short-covering rally and lift the USD/JPY pair beyond the 145.00 psychological mark, towards the next relevant hurdle near the 145.60 area. The momentum could extend further towards the 146.00 round figure en route to the 146.35-146.40 region.

USD/JPY 4-hour chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.