USD/JPY Price Annual Forecast: Traders set for rocky 2025 on rediverging interest rates, Trump and North Korea

- The Federal Reserve remains the primary driver of USD/JPY and may halt its rate-cut cycle in 2025.

- Bank of Japan officials will probably refrain from bigger rate hikes.

- Wild-card politics are set to stir this currency pair, reflecting a duel of safe-haven currencies.

Over 2,200 pips – that is the movement in the USD/JPY pair in 2024, driven by monetary policy divergence by central banks across the Pacific. In 2025, volatility may even increase further thanks to a potential divergence in the opposite direction and a less predictable geopolitical scene – another factor impacting the pair.

The year that was: Diverging central bank policy, politics rock Japanese Yen

The Japanese Yen (JPY) took a wild ride in 2024, suffering a sharp depreciation against the US Dollar (USD) during roughly the first half of the year to later recover somewhat. Here are the main factors that moved the Yen in 2024.

Negative no more

On March 19, the Bank of Japan (BoJ) finally abandoned negative interest rates and set them at 0%. BoJ Governor Kazuo Ueda lifted borrowing costs in response to rising inflation, which had hit the shores of Japan far later than other countries.

A successful campaign to raise wages during Japan's Shuntō yearly collective bargaining season was the final nail in the coffin of negative rates.

Interest rates in Japan had been negative for years:

Evolution of Japanese interest rates. Source: FXStreet.

Summer sizzle sends USD/JPY above 160

Despite the BoJ's move, the Yen lost steam, in part due to the Federal Reserve's (Fed) hesitation to cut interest rates. USD/JPY hit its yearly high of 161.95 on July 3.

A quick drop followed and raised speculation of intervention by Japan's Ministry of Finance (MoF). The drop's justification came later that month, when the BoJ raised interest rates again, capping them at 0.25%.

Deep dive ahead of the autumn sends it to dip below 140

Fed Chair Jerome Powell sent the US Dollar tumbling at his Jackson Hole speech in late August, when he signaled an imminent rate cut in September.

The Federal Reserve surprised with a 50 basis points(bps) cut in its opening salvo, a move markets came to grips with just ahead of the decision, sending USD/JPY to its yearly low under 140.

The Fed began lowering interest rates in 2024:

Evolution of US interest rates. Source: FXStreet.

Three-pronged political pressure points

Apart from the central bank’s moves, the Yen was impacted by a streak of geopolitical events.

First, the ongoing conflict in the Middle East occasionally boosted the Japanese Yen, which served as a safe-haven currency. However, the influence of hostilities in the region has been diminishing.

Secondly, the election of Shigeru Ishiba as Japanese Primer Minister surprised markets and boosted the Yen – as his opponent was seen as dovish.

However, Ishiba’s decision to call snap elections in October, which led to his party losing its majority, introduced political fragility and weakened the currency.

Third, Donald Trump's victory in the United States (US) presidential election turbo-charged the US Dollar, based on expectations of higher tariffs and elevated interest rates.

Political considerations for USD/JPY in 2025

Politics will likely be more dominant in 2025. The main reason is Trump’s new administration, but political instability in Japan will also play a role.

Trump's tariffs, dependence on Musk and impact on Japan

The US Dollar jumped when Trump prevailed in the US election – throughout the campaign, he said "tariffs" is his favorite word. Slapping tariffs would serve to raise the costs of goods imported into the US, forcing the Federal Reserve to mitigate inflation with higher interest rates.

Tariff policy is worth examining. Trump and his team see tariffs as not only the final goal but also a way to strong-arm friends and foes alike toward his preferred policies. For example, he warned Mexico and Canada of 25% levees on all goods if they don't curb incoming immigration.

In his previous term, Trump struck a deal with China, forcing the Asian giant to buy American goods to reduce the US trade deficit with China. He might settle for another deal in the future.

The incoming president owes some of his success to Elon Musk, the world's richest man and the founder of several companies, including Tesla, which is heavily dependent on production and sales in China. The South African-born billionaire has a special relationship with Beijing.

Trump's transactional instincts could be used to strike deals with his Chinese counterpart, Xi Jinping, rather than pursuing an outright trade war.

In such a scenario, the US Dollar could decline against some currencies but not against the Yen. Why? Because the Japanese currency is a safe-haven asset sensitive to tensions in Asia. If Sino-American tensions ease, it would likely fall.

In case Trump follows through with some of his threats, the Yen could benefit in two ways. First, when worries grow, it benefits, as mentioned earlier.

Secondly, Japan could benefit from trade diverting away from China.

Vietnam has proven a beneficiary of Sino-American tensions by selling its own products and serving as a gateway for Chinese goods to the US. The same goes for Mexico. Japan, despite being a close American ally, could be next.

Korean wild card

Imposition of martial law – such headlines don't make the news in North Korea, but when impeached South Korean President Yoon Suk Yeol announced it on TV, the world was shocked. The Korean Peninsula has seen varying degrees of tension and things could flare up again.

As President, Trump met North Korea's dictator Kim Jong-un twice and portrayed himself as a peacemaker. Will the White House receive new "beautiful letters" from Pyongyang? There is high uncertainty about everything related to the Korean peninsula, from ongoing American support for the South to the behavior of the Kim dynasty in the North.

After a few quiet years, I expect the region to become more prominent in the news. In this case, the trade in USD/JPY is straightforward: higher tensions mean a stronger Yen, and better relations in the region mean a weaker currency.

Once again, the Yen's role as a safe haven is key. Money lent in Yen for more risky investments is repatriated – even if Japan is in danger of North Korean missiles. That is how it works.

Japanese politics will likely have a greater impact on the Yen

Governments impact currencies via their fiscal policy – and in Japan, they also have a direct effect via interventions in foreign exchange, either to weaken or strengthen the Yen. While the BoJ does the actual selling or buying, it works on behalf of the Ministry of Finance (MoF).

The ruling Liberal Democratic Party (LDP) lacks a majority in parliament, which means it could be forced to call fresh elections. A clearer victory for the LDP would ensure some stability and potentially strengthen the Yen.

However, if the opposition finally gets its act together and returns to power, there is room for fiscal expansion that could weaken the currency.

If the government continues without an election, its budget will likely be less ambitious, thus maintaining the Yen bid.

Monetary policy diverging against current trends

Despite the growing impact of politics, when it comes to currency trading, the main dish remains monetary policy. As mentioned, the Fed slashed borrowing costs in 2024 while the BoJ raised them. Here is why that could flip in 2025.

Fed may keep rates high on US economic strength

The US economy is doing well – that is what the numbers show and what Americans report about their personal well-being. While many complain about the general state of matters and long for lower prices, they keep consuming.

As of late 2024, the jobless rate is close to 4% and inflation is edging closer to the Fed's 2% target. America remains exceptional in rich-world growth, expanding the gap with other developed nations.

Will this change in 2025? The economy is expected to remain robust, almost regardless of Trump's policies. Advancements in artificial intelligence (AI) will begin showing up in productivity figures and the US is best suited to take advantage of new technology.

That means more consumption, pushing prices higher and forcing the Federal Reserve to keep interest rates high.

Fiscal policy could add to the mix. First, tariffs would raise the prices of imported goods. That is somewhat priced in by markets.

Secondly, Republicans have full control of the government, which means there are no problems with higher deficits. Tax cuts would further fuel consumption.

The Fed isn’t expected to raise rates in 2025, but refraining from bringing borrowing costs back to around 3% – nor intending to do so – would be enough to keep the US Dollar at an advantage over all currencies, including the safe-haven Yen.

BoJ to refrain from rocking the boat

Central banks are slow movers, and the Bank of Japan – especially under Governor Kazuo Ueda – is even slower. Ueda and his colleagues are expected to drag their feet and only mention rate hikes as an effort to keep the Yen supported.

While inflation hit the shores of Japan, it is hard to see the BoJ further raising rates while the entire world is slashing them.

Moreover, Japan's current immigration policy remains restrictive, meaning the population and the economy are bound to shrink. It is hard to see where inflationary pressures will come from.

Policymakers have made massive achievements in lifting Japan out of its deflationary mindset, especially thanks to the efforts of former BoJ Governor Haruhiko Kuroda (2013-2023).

However, moving toward an American-style consumption mindset is too hard, especially without migrants. I expect the BoJ to leave rates unchanged.

That does not mean a lack of movement in the Yen in response to the central bank. Markets may become disillusioned with hopes of rate hikes and put pressure on the Yen – similar to upside moves in the US Dollar as investors price out rate cuts by the Fed.

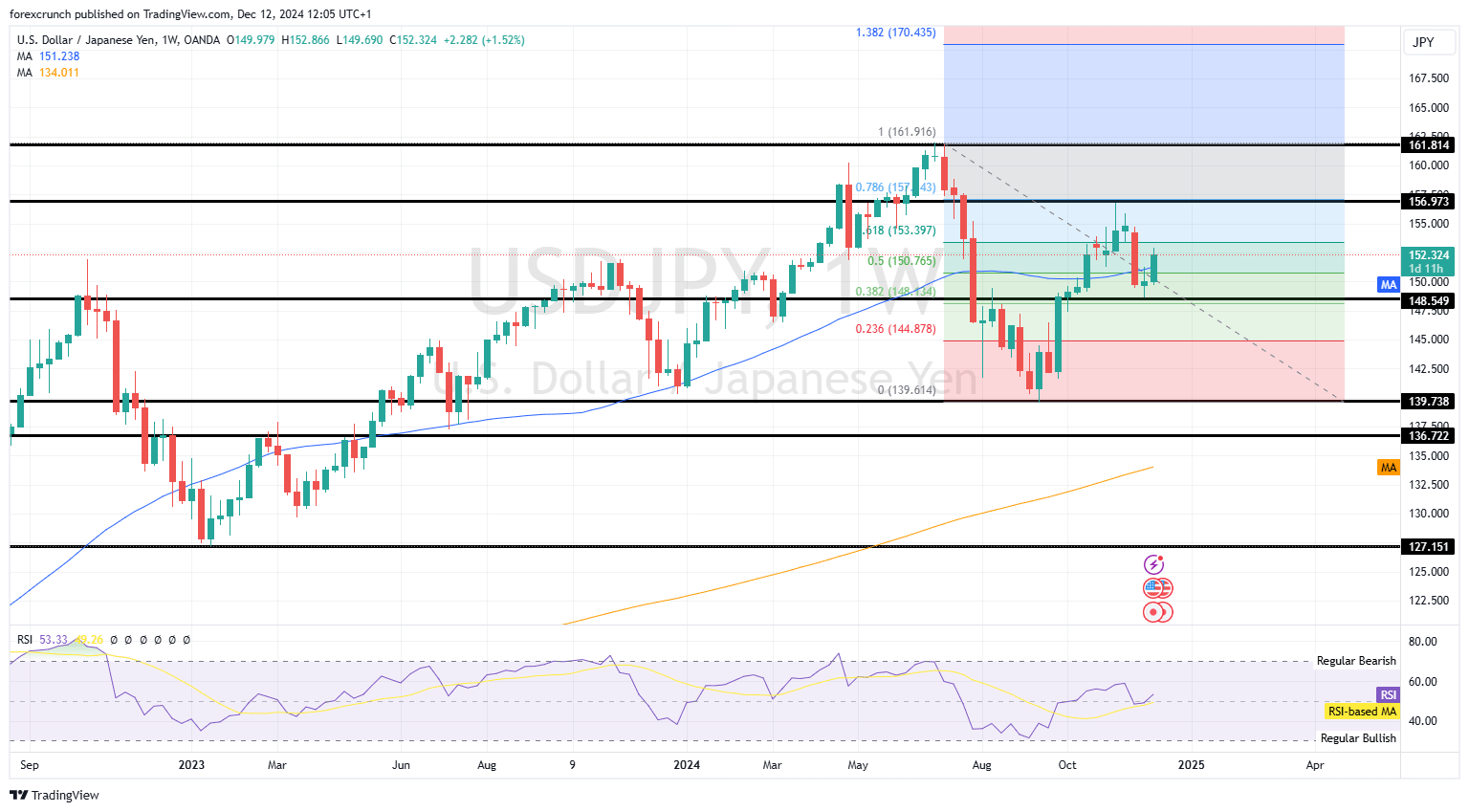

USD/JPY Technical Analysis: Uptrend looks solid

The USD/JPY pair remains in a long-term uptrend according to the weekly chart. The pair broke above the 50-week Simple Moving Average (SMA) and the Relative Strength Index (RSI) is above 50. Moreover, the 200-week SMA is clearly trending up.

Resistance is at 156.97, the late 2024 peak, which is followed by 161.81, the yearly high. Beyond that point, the next line to watch is 170.43. The round 170 level almost perfectly converges with the 138.2% Fibonacci extension of the yearly range of 138.73 to 161.81.

Support is at 147.54, the higher low set in late 2024, and then 139.73, the yearly low. It is followed by 136.72 and far below by 127.15.

Conclusion: How I expect USD/JPY to evolve in 2025

"It's tough to make predictions, especially about the future," said Yogi Berra, a famous baseball player. He was probably not the first one to be cynical about the power of projections, but I will give it a go anyway.

I expect USD/JPY to kick off the year tumbling down, as Trump enters the White House, trade wars are feared and markets expect the Fed to continue cutting rates.

However, my outlook is for a bullish year beginning in the spring. While Trump's volatile mood may be reflected in markets, I believe he will strike deals that he will label as victories—accords that would keep global trade stable. This would weigh on the safe-haven Yen.

In addition, I expect USD/JPY to move up in the latter half of the year in response to more hawkish Fed policy and disillusionment with the BoJ's lack of rate hikes.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.