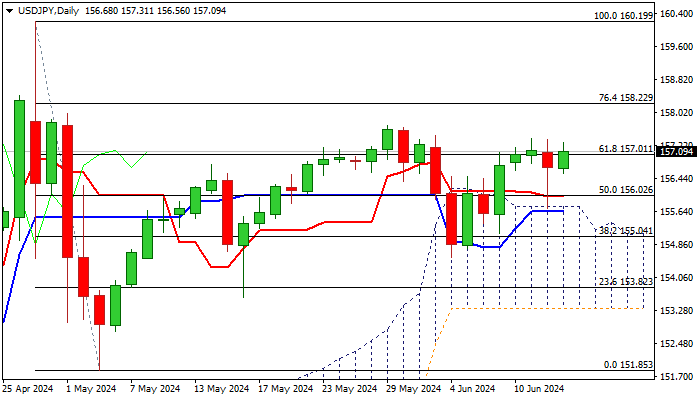

USDJPY remains resilient following limited negative impact from CPI/Fed on Wednesday and today’s jobless claims and PPI data but continues to struggle to clear June’s peak at 157.47.

Near-term action is holding within a range which extends into fourth straight day, ahead of Friday’s BoJ policy meeting, which may have stronger impact only if cb’s decision significantly diverges from expectations.

Daily studies are bullishly aligned but overbought conditions may cause headwinds, which may shape weekly action in the third consecutive Doji candle.

We look for initial positive signal on break of 157.47 and verification on list above May’s peak at 157.98, to open way towards targets at 160.00/19 (psychological / Apr 29 peak), though increased risk of intervention could be expected in such case.

Bullish near-term bias expected above 10DMA (156.45) while violation of daily Tenkan-sen (156.00) would risk test of lower pivot at 155.76 (daily cloud top).

Res: 157.31; 157.47; 157.70; 158.00.

Sup: 156.56; 156.00; 155.76; 155.04.

Interested in USD/JPY technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

AUD/USD gains as the USD backs off

The Australian Dollar holds the bounce above 0.6350 in Monday’s session, supported by mixed Chinese economic releases and a softer US Dollar. Traders remain focused on Wednesday’s Federal Reserve interest rate decision, which could shape near-term price action.

USD/JPY flat lines around 154.00, eyes on US Retail Sales release

The USD/JPY pair trades flat around 154.10 during the early Asian session on Tuesday. Traders prefer to wait on the sidelines ahead of the Federal Reserve and the BoJ interest rate decision later this week. On Tuesday, the US November Retail Sales will be published.

Gold stuck around $2,650 ahead of fresh clues

Gold opens the week on a moderately positive tone and trades above $2,650, favored by a mild US Dollar (USD) reversal amid lower US Treasury yields. The precious metal, however, is still close to recent lows following a 2.5% sell-off late last week.

Crypto Today: MicroStrategy drives BTC to $107K as Fed cut hype sparks Ondo, Chainlink rallies

The global crypto market snapped out of a tepid start to the month after hotter-than-expected consumer inflation data sparked hopes of a third consecutive US Fed rate cut.

Five fundamentals for the week: Fed dominates the last full and busy trading week of the year Premium

Christmas is coming – but there's a high likelihood of wild price action before the holiday season begins. Central banks take center stage, and there is enough data to keep traders busy outside these critical decisions.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.