USD/JPY outlook: USD/JPY keeps firm tone ahead of FOMC minutes

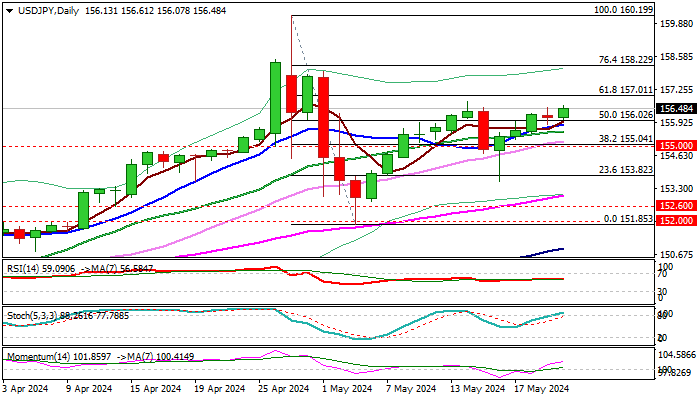

Bulls hold grip and keep initial targets at 156.78 (May 14 high) and 157.01 Fibo 61.8% of 160.19/151.85 correction.

The pair hit new weekly high on Wednesday, as the dollar stands at the front foot ahead of release of minutes of Fed’s last policy meeting, as traders await fresh signals about the central bank’s next steps regarding interest rates.

Technical picture remains bullish on daily chart and supports near-term action, though some headwinds on approach to 156.78/157.01 barriers cannot be ruled out, as stochastic broke into overbought territory.

Limited dips should be ideally contained above 156.00/155.85 zone (broken 50% retracement/10DMA) to keep immediate bulls intact for probes through pivotal 157 resistance zone.

Caution on potential break below 155.00 support (broken Fibo 38.2% / psychological) which would put bulls on hold.

Res: 156.78; 157.01; 157.98; 158.22.

Sup: 156.00; 155.85; 155.00; 154.69.

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.