USD/JPY outlook: The Dollar came under increased pressure on hints of earlier than expected Fed rate cuts

USD/JPY

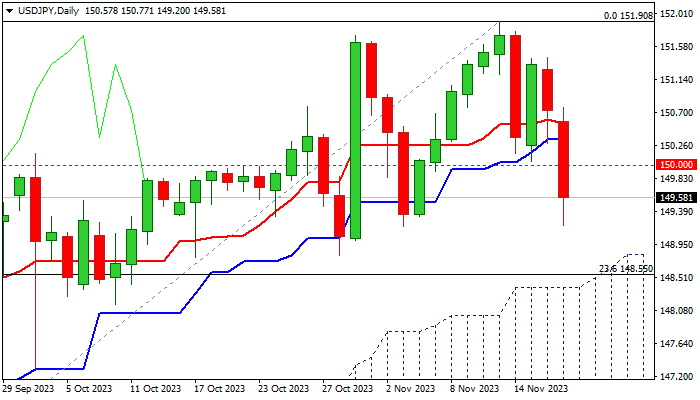

USDJPY came under increased pressure on Friday and extends weakness into second consecutive day, establishing well below psychological 150 level, now acting as good resistance.

The dollar was deflated by signals that the Fed is likely done with policy tightening, while expectations for earlier than expected start of cutting interest rates add to negative outlook.

Market observers pointed to July 2024 as the earlies time when the Fed will start cutting rates, with growing bets that cuts may commence in March and initial signals that the US central bank may act as early as January next year, which further soured demand for the greenback.

As a result, the pair is on track for the biggest weekly loss since mid-July and cracked significant support at 149.24 (55DMA), loss of which would boost initial bearish signals and risk test of next pivotal supports at 148.44/38 (Fibo 23.6% of 137.68/151.90 / top of ascending daily cloud.

Technical studies on daily chart are weakening (south-heading 14-d momentum is close to the midline, dividing positive and negative territory and 10/20 DMA’s are in bearish setup.

Weekly close below 150 barrier is needed to keep near-term bias with bears.

Res: 150.00; 150.46; 150.76; 151.43.

Sup: 149.20; 148.80; 148.38; 147.29.

Interested in USD/JPY technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.