USD/JPY

USDJPY accelerated higher on Wednesday, as traders collected some profits from steep fall in past few days, fueled by risk aversion which boosted demand for safe haven yen.

Japanese currency made an impressive rally of 8.5% vs US dollar in July and early August, boosted by recent interventions and BOJ rate hike, while the latest strong migration into safety lifted yen to eight-month high.

Today’s comments by BOJ official showed unexpected shift in policy outlook, souring the sentiment and adding pressure on yen.

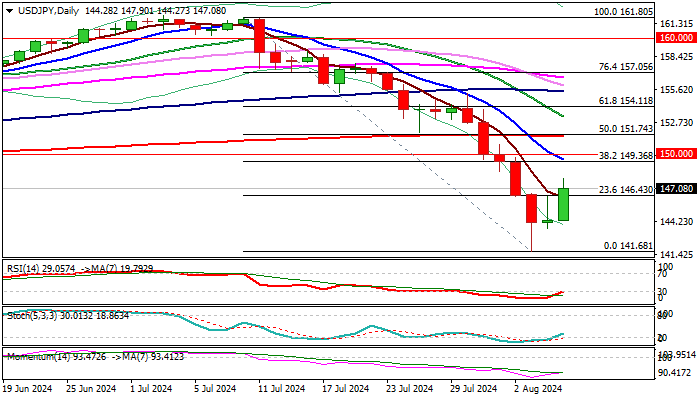

Fresh acceleration after Tuesday’s Doji candle with long upper shadow signaled indecision, adds to recovery signals and the price broke above initial resistance at 146.43 (Fibo 23.6% of 161.80/141.68 fall) with close above this level to reinforce near term structure for extension towards targets at 149.36 and 150.00 (Fibo 38.2% / psychological).

Adding to positive near term signals was a false penetration into weekly cloud, with long tailed weekly Doji and formation of a bear trap.

However, daily studies are predominantly in bearish configuration (MA’s above the price / momentum deeply in negative territory) and require caution.

Lift above daily Tenkan-sen (148.45) will be needed to ease existing downside risk, while break of 149.36/150.00 pivots to signal reversal.

Res: 147.90; 148.45; 149.36; 150.00.

Sup: 146.43; 143.62; 141.68; 140.00.

Interested in USD/JPY technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0900 as risk mood improves

EUR/USD continues to move sideways above 1.0900 in the second half of the day on Wednesday. In the absence of high-tier data releases, the positive shift seen in risk sentiment, as reflected by strong gains in Wall Street's main indexes, helps the pair hold its ground.

USD/JPY holds near 147.00 after BoJ's Uchida-led volatility

USD/JPY remains strongly bid near 147.00 after testing 148.00 early Wednesday. Traders digest the dovish comments from the BoJ official Uchida, helping the Japanese Yen recover some ground, despite the upbeat mood. The Fed- BoJ policy divergence stays in the spotlight.

Gold tries to reclaim $2,400 following two-day slide

Gold stages a rebound and looks to stabilize at around $2,400 after closing the first two days of the week deep in negative territory. Rising US Treasury bond yields seem to be limiting XAU/USD's upside ahead of the 10-year US Treasury note auction.

Crypto Today: Morgan Stanley to offer Bitcoin to clients, Ethereum gears for $3,000, XRP steady above $0.50

Morgan Stanley advisors are ready to offer Bitcoin Spot ETF to their clients starting Wednesday, August 7. Bitcoin makes a comeback above $57,000, Ether gears for recovery to $3,000 and XRP gains ground above support at $0.50.

JPY weaker, VIX falling, stocks rebound, what's next?

The Dollar is currently starting to appreciate again against most other currencies. In light of the negative headlines from the economic sight the Greenback might weaken again, though.