USD/JPY outlook: Larger bears to resume after consolidation

USD/JPY

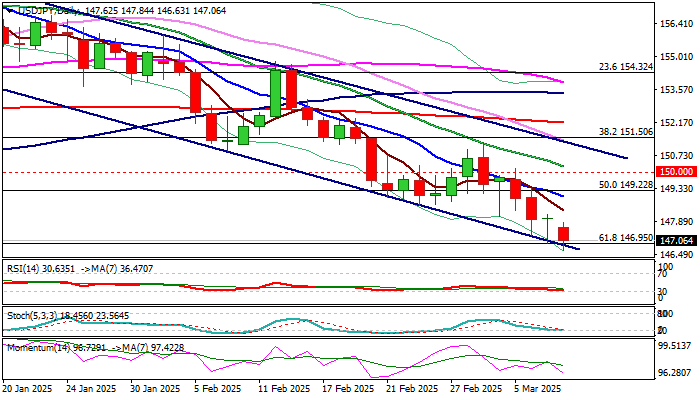

USDJPY falls further on Monday, as dollar remains under increased pressure on tariffs uncertainty and growing threats of recession, while growing safe haven demand and signals of further rate hike as BoJ is coming close to its 2% inflation target.

Fresh drop on Monday cracked important supports at 146.95/80 (Fibo 61.8% of 139.57/158.87 rally / lower boundary of larger bear channel.

Firm break of these levels to validate fresh bearish signal and open way for further weakness however, bears may lose steam at this zone as lower 20-d Bollinger band (146.58) provided a temporary footstep, with headwinds expected at this zone due to oversold daily studies and significance of supports (Fibo / channel support line).

Limited upticks should stay below falling 10DMA (148.96) to keep larger bears intact and offer better levels to re-enter bearish market.

Res: 148.20; 148.49; 148.96; 149.22.

Sup: 146.80; 146.49; 145.91; 145.00.

Interested in USD/JPY technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.