USD/JPY outlook: Key supports under pressure

USD/JPY

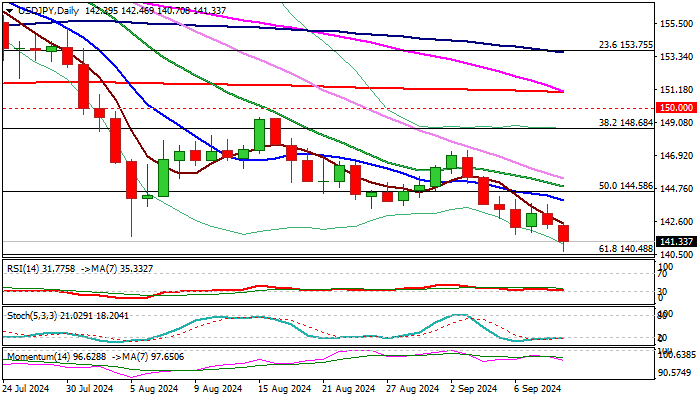

USDJPY fell to the lowest in 8 ½ months on Wednesday (140.70) following probe through pivotal support at 141.68 (Aug 5 spike low).

Subsequent bounce came from oversold conditions on daily chart, with partial profit taking to lift the price and position for fresh push lower.

Close below 141.68 is needed to confirm bearish continuation signal and open way for attack at next key levels: 140.48 (Fibo 61.8% of 127.22/161.95), 140.25 (Dec 28 low) and 140.00 (psychological), loss of which to risk deeper fall.

Upticks should be ideally capped under 142.50/143.00 zone to keep larger bears intact and provide better levels to re-enter larger downtrend.

Falling 10DMA (143.98) and broken Fibo 50% (144.58) mark upper pivots, violation of which would sideline bears.

Daily studies maintain strong negative momentum, with MA’s in full bearish configuration and converged 55/200DMA’s about to for a Death-cross and reinforce bearish signal.

Res: 141.55; 141.76; 142.50; 143.90.

Sup: 140.48; 140.25; 140.00; 138.60.

Interested in USD/JPY technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.