USD/JPY outlook: Japanese yen regains traction vs Dollar on renewed expectations for dovish Fed

USD/JPY

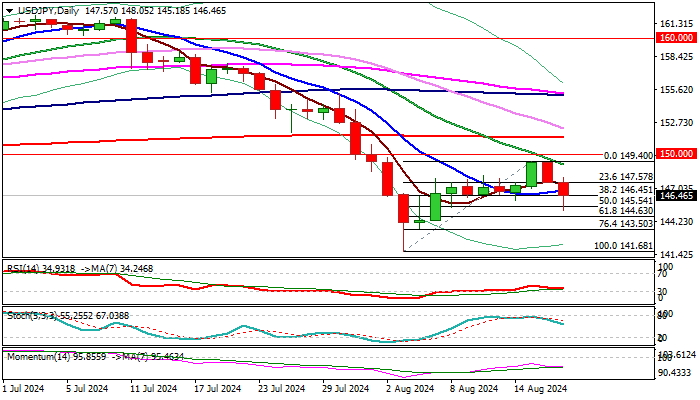

USDJPY dips further on Monday, adding to signals that corrective phase off 141.68 (Aug 5 spike low) is likely over.

Upleg from 141.68 was repeatedly capped at pivotal Fibo barrier at 149.36 (38.2% retracement of 161.80/141.68) with subsequent weakness being sparked by renewed risk appetite.

Yen also appreciates on signals that gap between policies of two central banks (Fed and BOJ) may widen further, as dovish tones returned expectations for Fed’s next steps on monetary policy while Japanese central bank keeps hawkish stance.

Markets focus on two key events of the week – FOMC Minutes of the last policy meeting and speech of Fed Chair Powell in Jackson Hole symposium, which should provide clearer signals about Fed’s next steps (25 bp rate cut in September is widely expected, but renewed narrative of 50 bp easing, adds to expectations for more dovish Fed’ stance, which will further deflate the dollar.

Daily studies are turning into full bearish configuration following today’s breach of 10 DMA (146.93) and probe below 50% retracement of 141.68/149.40 corrective leg), while negative momentum remains strong and RSI / Stochastic head south.

Daily close below 10DMA is required to keep fresh bears in play, while sustained break of 145.51 (50% retracement) to boost bearish signals for extension towards next target at 144.63 and 143.50 (Fibo 61.8% and 76.4% respectively).

Res: 146.94; 147.58; 148.05; 148.22.

Sup: 145.54; 145.18; 144.63; 143.50.

Interested in USD/JPY technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.