USD/JPY

USDJPY dipped early Friday on widely expected BoJ rate hike by 25 basis points, but the weakness was so far short-lived, despite interest rate rising to the highest in 17 years.

Subsequent bounce (approx. 100 pips) suggests that the dollar remains well supported, particularly by wide gap between the monetary policies of Fed and BoJ.

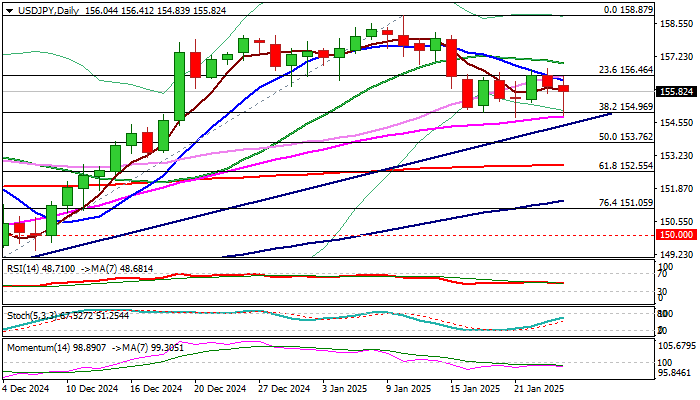

Repeated failure at pivotal Fibo support at 154.97 (38.2% retracement of 148.64/158.87, reinforced by nearby 55DMA and trendline support) where a higher base is forming (still needs confirmation) signals that the pair lacks strength for final break lower.

Near-term action remains within the narrow range for the seventh consecutive day, still looking for direction signal after BoJ’s decision proved to be insufficient to spark stronger move lower.

Formation of bear trap pattern on daily chart adds to initial positive signal which would require more work at the upside to be confirmed (close above rent range top at 156.75 and 20 DMA at 156.94 to verify completion of higher base).

Alternative scenario would see firm break of Fibo support, 55 DMA and trendline support (154.97/50 zone) as strong negative signal, pointing to continuation of pullback from a multi-month peak (157.87).

Technical studies on daily chart remain mixed and lack clearer signal, though overall picture is still firmly bullish, suggesting that limited correction would precede fresh push higher.

Res: 156.46; 156.75; 156.94; 158.08.

Sup: 154.97; 154.76; 154.50; 153.76.

Interested in USD/JPY technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD trims some gains, recedes to 1.1350 Premium

Despite losing some upside momentium, EUR/USD keeps the firm tone around the mid-1.1300s on Thursday, buoyed by renewed US Dollar weakness as investors grappled with the continued stalemate in US–China trade negotiations.

GBP/USD puts the 1.3300 level to the test

GBP/USD hovers around the 1.3300 area on Thursday, supported by a broad rebound in risk-sensitive assets, renewed weakness in the Greenback and lingering uncertainty over US–China trade talks.

Gold sticks to the bullish stance near $3,330

On Thursday, gold regained lost ground after two consecutive days of declines, with XAU/USD climbing back toward $3,300 per troy ounce following an earlier rally to roughly $3,370. The metal drew safe-haven buying as renewed fears of a US–China trade flare-up weighed on broader markets.

Bitcoin Price corrects as increased profit-taking offsets positive market sentiment

Bitcoin (BTC) is facing a slight correction, trading around $92,000 at the time of writing on Thursday after rallying 8.55% so far this week. Institutional demand remained strong as US spot Exchange Traded Funds (ETFs) recorded an inflow of $916.91 million on Wednesday.

Five fundamentals for the week: Traders confront the trade war, important surveys, key Fed speech Premium

Will the US strike a trade deal with Japan? That would be positive progress. However, recent developments are not that positive, and there's only one certainty: headlines will dominate markets. Fresh US economic data is also of interest.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.