USD/JPY outlook: Holds bullish bias but daily techs mixed, all eyes on US inflation data

USD/JPY

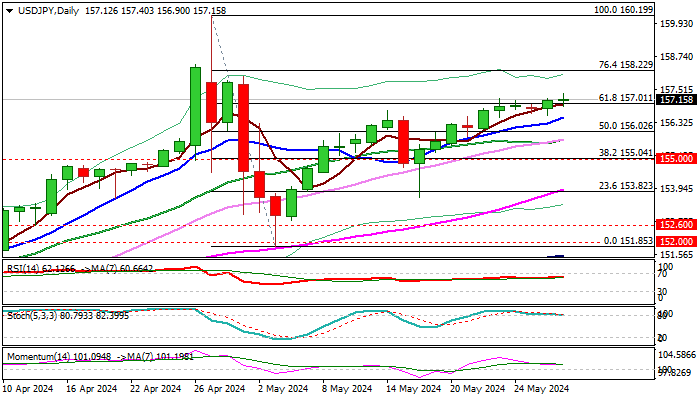

USDJPY attempts to break above near-term narrow range and sustain gains after Tuesday’s marginal close above pivotal Fibo barrier at 157.01 (61.8% of 160.19/151.85 pullback), where attacks repeatedly failed last week.

Technical signals are mixed on daily chart as Tenkan-sen crossed above Kijun-sen, but positive momentum is fading and stochastic is about to emerge from overbought zone after forming a bearish divergence.

Traders look for stronger direction signals, with speech from BOJ official earlier today suggesting that the central bank will remain on track of adjusting interest rates if inflation moves towards 2%, though lacking to provide more details about timing of next rate move, which as slightly negative factor for yen.

On the other hand, Friday’s release of US PCE report (Fed’s preferred inflation gauge) is expected to give fresh information about inflation in the US and contribute to Fed’s plans on monetary policy.

According to forecasts, core PCE is expected to remain unchanged in April, which would add to Fed’s hawkish stance (keeping rates unchanged) which would further inflate the dollar.

Holding above 157.01 pivot would boost prospects for gains towards 158.22 (Fibo 76.4%) and unmask key barriers at 160.00/19 (psychological / Apr 29 multi-year high).

Rising 10DMA port at 156.51, followed by 20DMA (155.71).

Res: 157.40; 157.98; 158.43; 159.00.

Sup: 156.51; 156.00; 155.71; 155.04.

Interested in USD/JPY technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.