USD/JPY

USDJPY fell sharply (down 1% in immediate reaction to US jobs data) after US NFP dipped well below expectations in July (114K vs 176K f/c), while June’s figure was revised down to 179K from initial 206K.

Unemployment unexpectedly rose to 4.3% in July from 4.1% June / consensus, while average earnings rose by 0.2% last month vs 0.3% in June and identical forecast.

Weaker than expected labor data, with significant drop in Nonfarm payrolls, added to negative outlook, boosted the latest dovish signals from Fed and strongly boosted expectations for 50bp cut in September (against initial 25 bp) and lifted projections for cuts in 2024 to 110 bp.

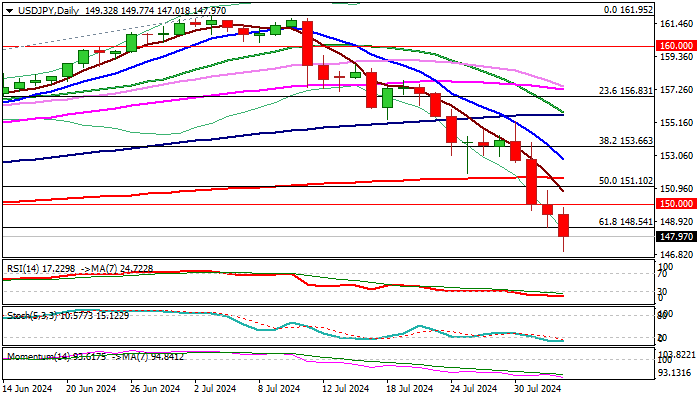

The pair extended further below broken 150 mark and broke below pivotal Fibo support at 148.54 (61.8% of 140.25/161.95 to hit the lowest since mid-March (147.01) in post-NFP acceleration, with weekly close below 150 to confirm negative signal.

Bears eye immediate target at 146.48 (Mar 8/11 higher base) and may extend towards 145.37 (Fibo 76.4%), with consolidation likely to precede as daily studies are oversold.

Upticks should be ideally capped under 150 level (reverted to resistance), guarding 200DMA (151.65).

Res: 148.54; 150.00; 150.80; 151.65.

Sup: 147.01; 146.48; 145.89; 145.37.

Interested in USD/JPY technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD climbs above 1.0900, looks to post weekly gains

EUR/USD gathers bullish momentum and trades above 1.0900 in the American session on Friday, looking to end the week in positive territory. The US Dollar remains under strong selling pressure following the disappointing jobs data, helping the pair push higher.

GBP/USD clings to daily gains near 1.2800 after weak US jobs data

GBP/USD clings to daily gains at around 1.2800 in the second half of the day on Friday. Nonfarm Payrolls in the US rose by 114,000 in July. This reading missed the market expectation of 175,000 by a wide margin and triggered a USD selloff.

Gold pulls away from daily highs, holds above $2,420

After coming within a touching distance of a new all-time high near $2,480 with the immediate reaction to disappointing US labor market data on Friday, Gold reversed its direction and declined below $2,420. Profit-taking ahead of the weekend might be weighing on XAU/USD.

Bitcoin bounces off from the ascending trendline

Bitcoin and Ethereum have retested their key support levels, with a break below these levels potentially signaling a bearish trend ahead. At the same time, Ripple shows resilience and could rally in the coming days after testing its key support level.

Week ahead – RBA and BoJ summary of opinions take center stage

RBA decides on policy as hike bets disappear. BoJ Summary of Opinions awaited for more hike hints. After Fed, Dollar turns to ISM non-manufacturing PMI. New Zealand and Canada jobs data also on tap.