USD/JPY outlook: Falls below 150.00 mark on dovish Fed

USD/JPY

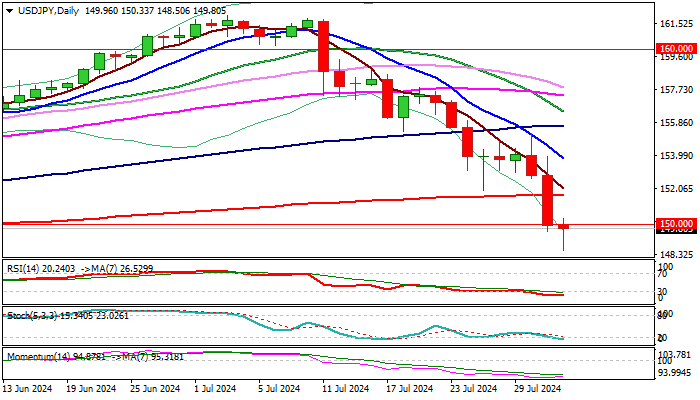

USDJPY remains firmly in red and extends steep fall through psychological 150 support, hitting the lowest since mid-March in early Thursday’s trading.

The dollar was deflated by dovish Fed, as the central bank kept interest rates unchanged in July policy meeting and opened the door for the first rate cut in September, with more easing expected towards the end of the year.

On the other hand, BoJ raised interest rates to the levels not seen in 15 years and announced plan to halve its monthly bond buying as of Q1 2023, that further boosted yen, already fueled by recent interventions.

Japanese currency may advance more on BoJ/Fed policy convergence, as Bank of Japan is on track to policy normalization, while the Fed is about to start cutting rates.

The pair is on track for the fourth consecutive big weekly loss and fell 6.7% in July (the biggest monthly fall since Nov 2022).

Daily studies are firmly bearish but oversold, warning that larger bears may take a breather for consolidation before resuming the downtrend.

Broken 150 level reverted to immediate resistance, followed by 200DMA (151.66), which should ideally cap upticks.

Res: 150.33; 151.10; 151.66; 152.06.

Sup: 148.50; 146.48; 145.89; 145.37.

Interested in USD/JPY technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.