USD/JPY outlook: Bulls hesitate on approach to 160.00 barrier, potential intervention trigger

USD/JPY

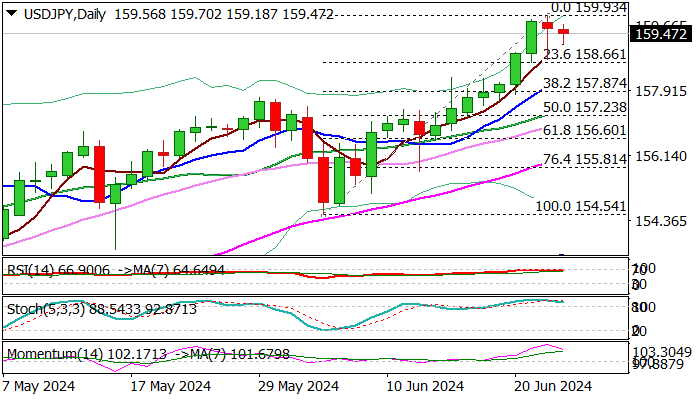

USDJPY edges lower after hitting levels just ticks away from 160 barrier, which many see as a trigger for intervention, as Japan’s authorities intervened at the end of April when the pair cracked 160 barrier.

Monday’s trading was closed in red for the first time in eight days, although long tail of daily candle suggests that bids are still very strong and markets may attack 160 level again, despite intervention threats.

Dips were so far shallow and contained by rising 5 DMA, keeping lower triggers at 158.25/157.87 (rising 10DMA / Fibo 38.2% of 154.54/159.93 upleg) out of reach for now.

Fading bullish momentum and overbought conditions on daily chart add to correction signals.

Any pullback above these supports should be considered as a healthy correction and keep larger bulls intact.

On the other hand, firm break here would point to deeper correction.

Res: 159.70; 160.00; 160.19; 160.87.

Sup: 158.66; 158.25; 157.87; 157.38.

Interested in USD/JPY technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.