USD/JPY outlook: Bulls are pausing ahead of Fed's decision

USD/JPY

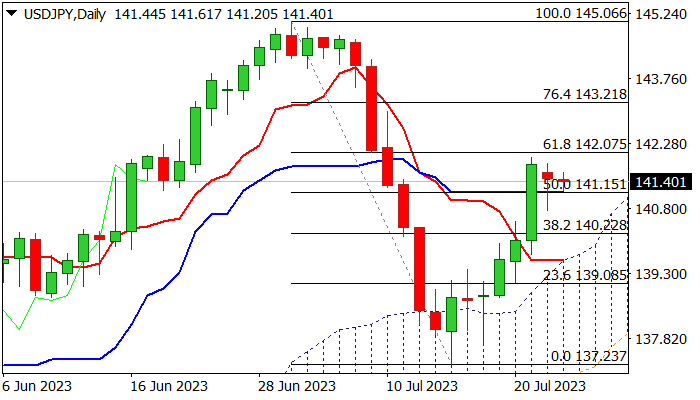

Near-term action is holding in a sideways mode for the second consecutive day, after 2.1% acceleration of last Wed/Thu/Fri ran out of steam on approach to 142.00 zone (psychological / Fibo 61.8% of 145.06/137.23 fall).

Still strong bids limited Monday’s dip, with close above broken daily Kijun-sen (141.15), keeping near-term bias with bulls.

The action remains underpinned by rising daily cloud, but overall picture is still bearishly aligned as 14-d momentum is deeply in the negative territory and stochastic is overbought, keeping the downside vulnerable.

Quiet mode is likely to extend as the US Federal Reserve starts its two-day policy meeting today.

The US central bank is widely expected to raise interest rates by additional 25 basis points, but traders will be focusing on signals about Fed’s next steps.

Initial message that July’s hike would be the last one in sharp tightening cycle, is questioned by the latest signals of possible extension of tightening phase as the US economy is in better condition than expected, despite high borrowing cost.

Loss of initial support at 141.15 will generate initial bearish signal and risk test of key supports at 140 zone (broken Fibo 38.2% and 140.22; psychological/daily cloud top at 139.73).

Conversely, firm break through 142.00 resistance zone will signal continuation of bull-leg from 137.23 (July 14 trough).

Res: 142.07; 142.49; 143.00; 143.21.

Sup: 141.15; 140.91; 140.22; 140.00.

Interested in USD/JPY technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.