USD/JPY outlook: Bear-trap underpins but recovery still faces headwinds

USD/JPY

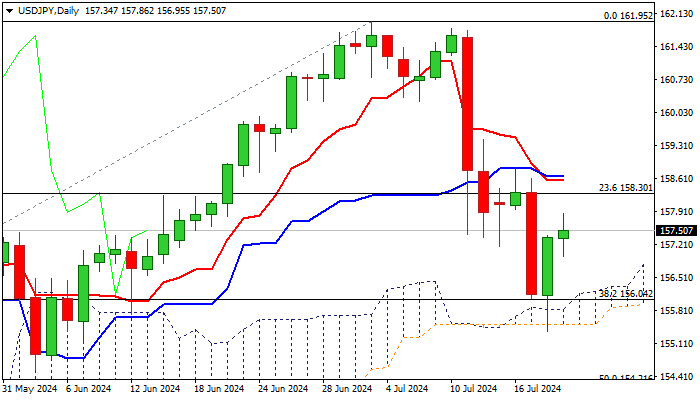

USDJPY remains constructive on Friday and attempts to further extend Thursday’s strong bounce, with recovery being supported by signals of a double bear-trap, following a false break below pivotal Fibo support at 156.04 and thin daily cloud (spanned between 155.83 and 155.50).

Rising and thickening daily cloud also underpins near-term action, however, headwinds are still to be expected, as structure on daily chart is still bearish.

Recovery needs to clear initial pivots at 157.73/88 (55DMA / Fibo 38.2% of 161.95/155.36) to reduce downside risk and open way for fresh acceleration towards next targets at 158.65/78 (falling 10DMA/50% retracement).

Caution on repeated daily close under 55DMA.

Res: 157.73; 158.30; 158.86; 159.52.

Sup: 156.91; 156.04; 155.36; 155.18.

Interested in USD/JPY technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.