The focus of market participants today will be data on the dynamics of US GDP. The forecast of economists suggests a slowdown in the growth of the US economy in the 1st quarter of 2023 - from 2.6% to 2.0%. This indicator (GDP) is the main indicator of the state of the American economy, and along with data on the labor market and inflation, GDP data are key for the country's central bank in determining the parameters of its monetary policy.

A slowdown in GDP may confirm growing fears of a possible recession in the US, and is likely to also negatively affect the dynamics of the dollar, especially if real GDP data turns out to be even worse.

On Monday and Wednesday, another major indicator will be published: PMI indices (by ISM) of business activity in the manufacturing and service sectors of the American economy. Along with today's GDP data, they will be the last of the most important before the adoption of the Fed decision on Wednesday on the interest rate. Economists are forecasting another 25 basis points increase in US borrowing costs to 5.25% before Fed officials take a pause in increases to move towards monetary easing by the end of the year.

At the end of this week, the last one in April, the Bank of Japan will hold its meeting on monetary policy issues. The Central Bank wants to avoid a sudden normalization of monetary policy, as this will have a big impact on the markets, Kazuo Ueda, the new governor of the Bank of Japan, said recently this month. At the same time, Ueda confirmed that "the Bank of Japan will maintain the current monetary easing." Therefore, most likely, tomorrow there will be no surprises and unexpected decisions on the part of the leadership of the Japanese Central Bank: the interest rate, with a high degree of probability, will be maintained at the same level of -0.1%, as well as the volume of purchases of Japanese government bonds and the parameters for controlling the curve their profitability.

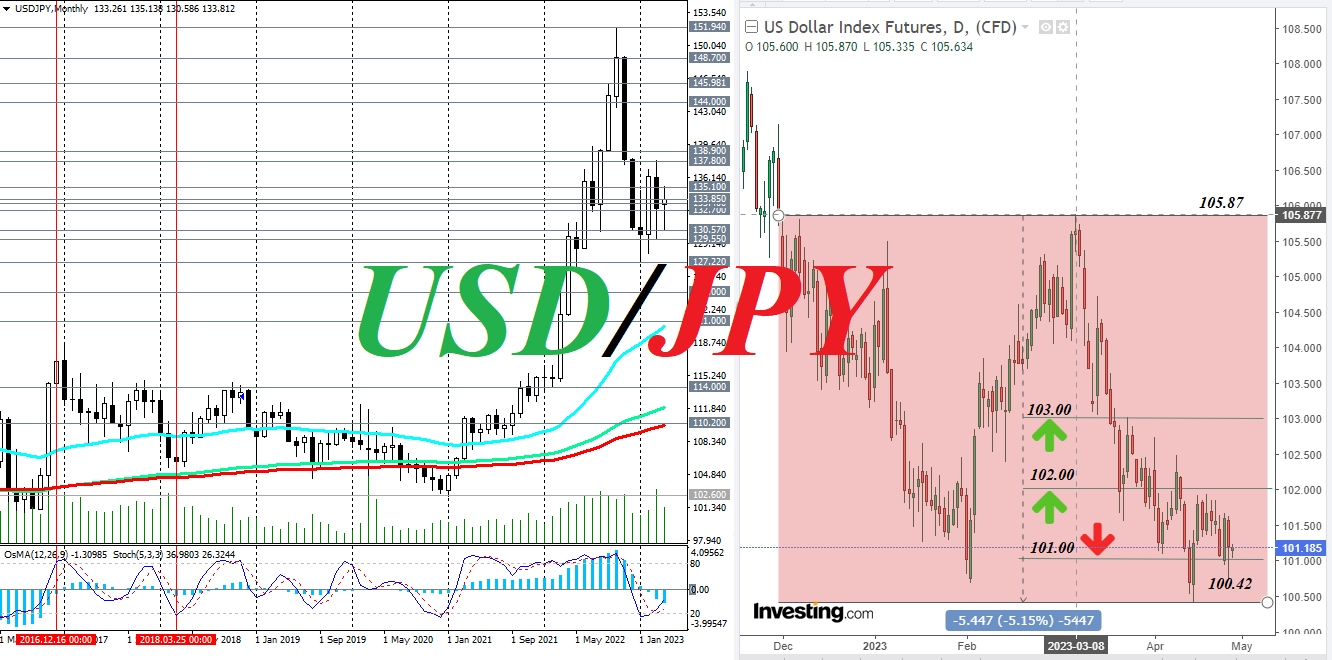

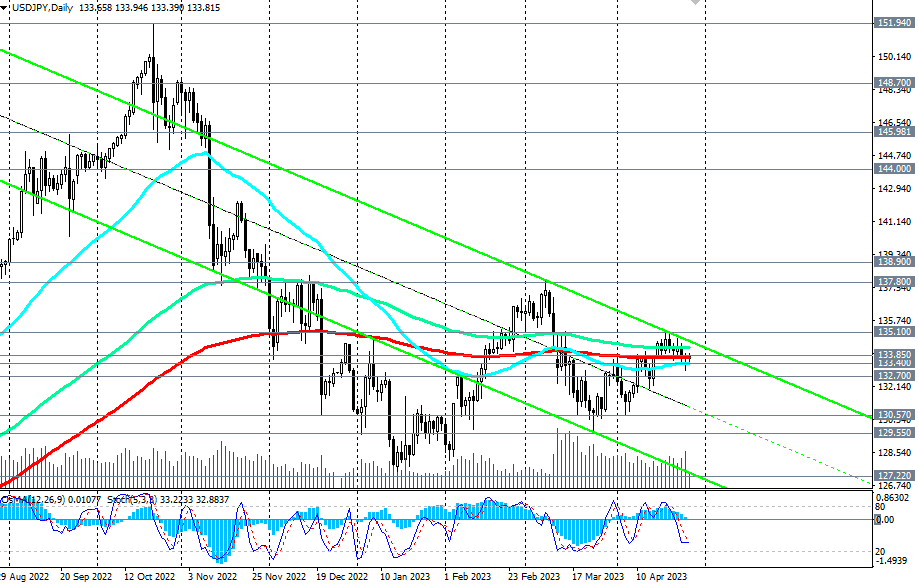

From a technical point of view, you can see how in recent days and on the eve of important publications, the USD/JPY pair is consolidating in the area of the balance line, the role of which is currently played by the 200-period moving average on the daily chart of the pair.

At the same time, the dollar itself and its DXY index maintain a downward trend, falling towards the psychologically significant mark of 100.00.

The dynamics of the USD/JPY pair is also affected, among other things, by the status of protective assets of both the yen and the dollar (under certain circumstances), and very often the USD/JPY pair moves according to its own algorithm, different from the dynamics of other major dollar pairs. Although, technical analysis can also be fully used here.

Support levels: 133.85, 133.40, 133.00, 132.70, 130.57, 129.55, 127.22, 124.00, 121.00.

Resistance levels: 134.25, 135.00, 135.10, 137.00, 137.80, 138.90.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

USD/JPY remains below 158.00 after Japanese data

Soft US Dollar demand helps the Japanese Yen to trim part of its recent losses, with USD/JPY changing hands around 157.70. Higher than anticipated Tokyo inflation passed unnoticed.

AUD/USD weakens to near 0.6200 amid thin trading

The AUD/USD pair remains on the defensive around 0.6215 during the early Asian session on Friday. The incoming Donald Trump administration is expected to boost growth and lift inflation, supporting the US Dollar (USD). The markets are likely to be quiet ahead of next week’s New Year holiday.

Gold hovers around $2,630 in thin trading

The US Dollar returns from the Christmas holidays with a soft tone, although market action seems contained. The positive tone of Asian shares weighs on the Greenback.

Floki DAO floats liquidity provisioning for a Floki ETP in Europe

Floki DAO — the organization that manages the memecoin Floki — has proposed allocating a portion of its treasury to an asset manager in a bid to launch an exchange-traded product (ETP) in Europe, allowing institutional investors to gain exposure to the memecoin.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.