At a Financial Crossroads: Will Japan Reshape Global Markets? The Japanese yen, a cornerstone of the carry trade and global finance, stands at a historic juncture. With the Bank of Japan (BOJ) poised for potential intervention, the ramifications could be profound for the yen and ripple effects through global markets. As the yen drops to the lowest in 34 years despite the BOJ rate hike, the world watches eagerly for the BOJ’s next move. How will these strategies alter the course of the global economy? This momentous period beckons a deeper dive into the BOJ’s tactics and their far-reaching impacts.

Assessing the imminence of BoJ’s intervention

Finance Minister Shunichi Suzuki has declared the government’s readiness to battle exchange rate volatility head-on, signaling a clear intent for “decisive action” against erratic market movements—a move financial observers see as a precursor to imminent currency intervention. Amidst this backdrop, Bank of Japan Governor Kazuo Ueda pledges to monitor currency trends vigilantly, underscoring a unified front to stabilize the yen.

Echoing this sentiment, US Treasury Secretary Janet Yellen deemed Japan’s potential measures to tame yen volatility entirely justified in September 2023, essentially green-lighting Tokyo’s approach to market intervention. This international vote of confidence may be the catalyst Japan needs to forge ahead with its plans, promising a strategic pivot that could reshape market dynamics.

How intervention carried out

In Japan, foreign exchange intervention is to be carried out under the authority of the Minister of Finance. As stipulated in the Act on Special Accounts and the Bank of Japan Act, the Bank conducts foreign exchange interventions on behalf of and at the minister’s instruction.

Current market dynamics: A surge in Yen short-selling

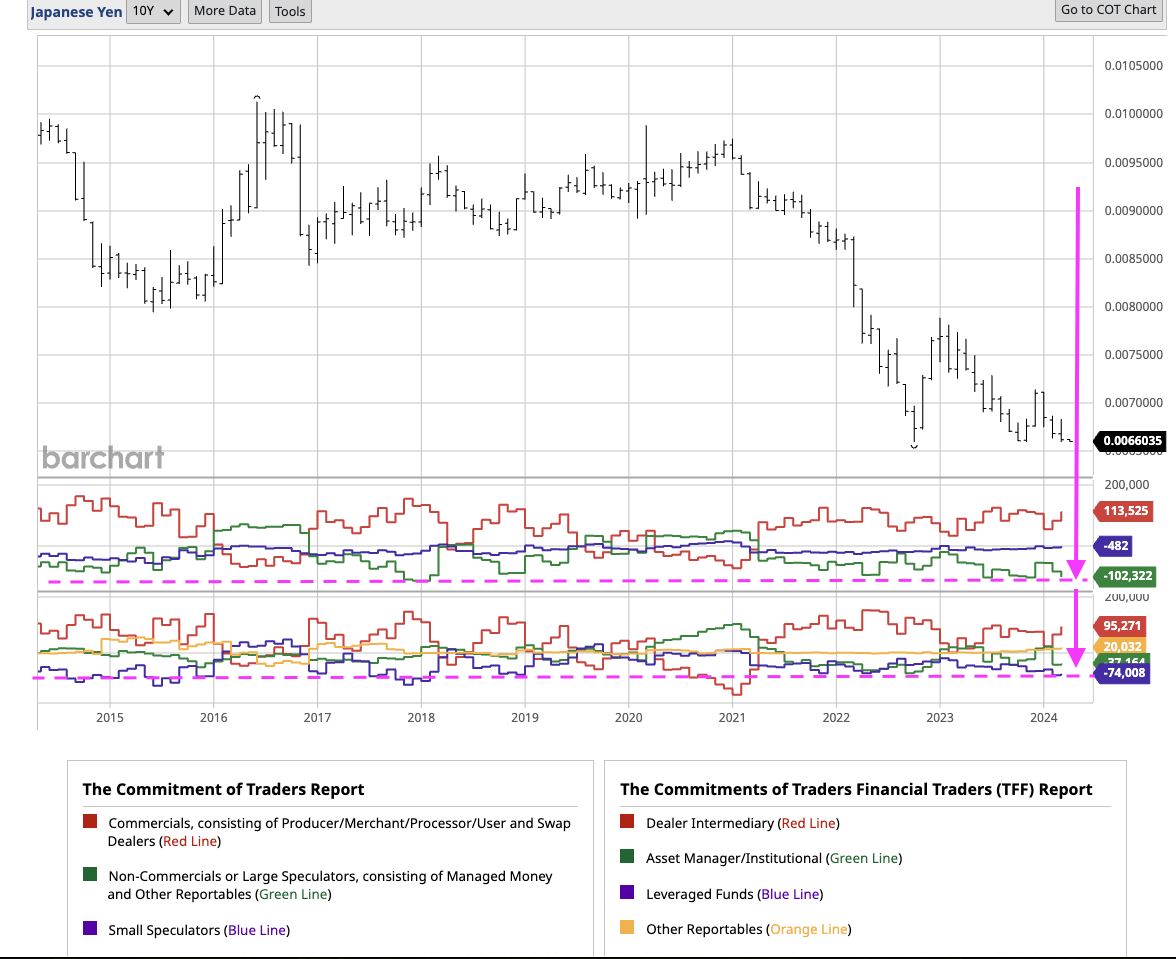

There’s a notable trend among speculative investors—they’re betting heavily against the yen, as seen in the substantial number of short positions in yen futures (highlighted by the purple dotted line). This surge in speculation is largely driven by the yen’s growing appeal as a carry trade currency, especially after the U.S. Federal Reserve’s interest rate hikes. However, this landscape could dramatically shift if the Bank of Japan (BOJ) decides to step in. Any intervention by the BOJ could lead to a rapid reversal of these bets, catapulting the yen’s value upwards and potentially sparking a significant adjustment in global markets.

Source: barchart.com

Technical overview

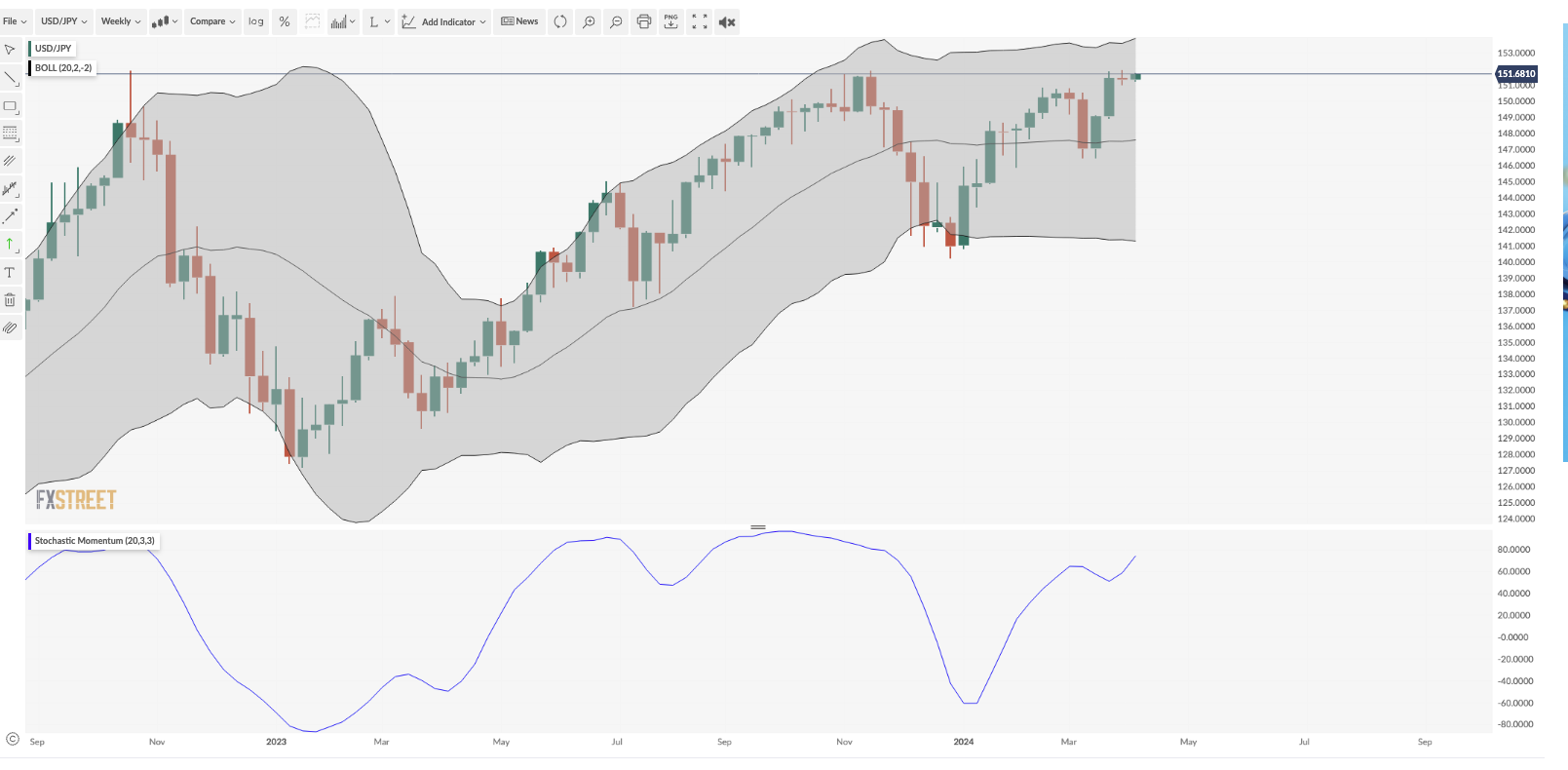

Source: FXstreet

The USD/JPY pair has rallied sharply, rebounding from the lower Bollinger Band as the Bank of Japan (BOJ) decisively moves away from its negative interest rate policy. On the weekly charts, we see the moving averages stabilizing, with a crucial resistance point at 153.4 on the Bollinger Band. Crossing this line could signal rising market volatility, drawing attention and potential concern from the finance ministry. This situation sets the stage for potential BOJ intervention if the pair moves between 153.4 and 155.4. Furthermore, the stochastic indicator suggests there’s still potential for upward momentum before reaching overbought levels. Should the BOJ intervene and traders start covering their short positions, the USD/JPY might then seek lower levels of support, possibly testing the 128 and 135 thresholds.

The information contained within this article is for educational purposes only and is not intended as financial or investment advice. It is considered accurate and correct at the date of publication. Changes in circumstances after the time of publication may impact the accuracy of the information. The performance figures quoted refer to the past, and past performance is not a guarantee of future performance or a reliable guide to future performance. No representation or warranty is given as to the accuracy or completeness of this information. Do your own research before making any trading decisions.

Recommended Content

Editors’ Picks

EUR/USD stays defensive below 1.1050, as US NFP data looms

EUR/USD stays defensive below1.1050 in the European morning on Friday. The pair lacks a clear directional impetus, as traders refrain from placing fresh bets ahead of the key US Nonfarm Payrolls data. The focus remains on ECB-speak as well.

GBP/USD recovers to near 1.3150 ahead of US NFP data

GBP/USD has recovered ground to near 1.3150 heading into the European opening bells on Friday. The further upside, however, appears elusive, as traders brace for the highly-anticipated US Nonfarm Payrolls data for fresh cues on the Fed interest rate outlook.

Gold: Will US Nonfarm Payrolls drive XAU/USD to fresh record highs?

Gold price extends a side trend below the key $2,670 resistance amid the Israel-Iran conflict. The US Dollar eases off six-week highs, as traders reposition ahead of the Nonfarm Payrolls data.

Nonfarm Payrolls set to grow moderately in September as markets mull bets of another big Fed rate cut

Economists expect the Nonfarm Payrolls report to show that the US economy added 140,000 jobs in September, following a job gain of 142,000 reported in August.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.