USD/JPY impulsive decline favors more downside [Video]

![USD/JPY impulsive decline favors more downside [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/USDJPY/japanese-yen4_XtraLarge.jpg)

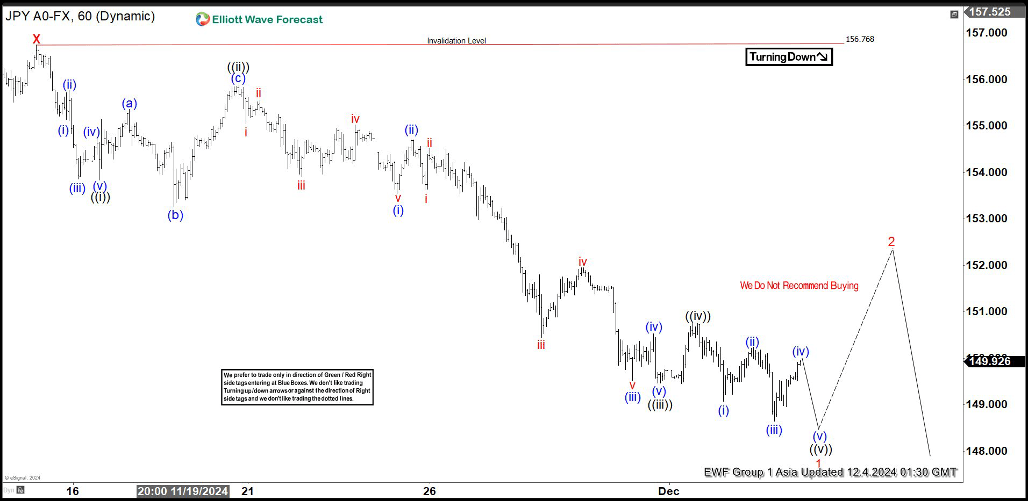

Short Term Elliott Wave structure in USD/JPY suggests that rally to 156.76 ended wave X. This completed correction against cycle from 7.3.2024 high. Pair has now turned lower. Structure of the decline from 156.76 is unfolding as 5 waves impulsive Elliott Wave structure. Down from 156.76 high, wave (i) ended at 155.14 and wave (ii) ended at 155.78. Wave (iii) lower ended at 153.85 and wave (iv) rally ended at 154.74. Final leg wave (v) ended at 153.83 which completed wave ((i)). Corrective rally in wave ((ii)) ended at 155.88 as expanded flat.

Pair has resumed lower in wave ((iii)). Down from wave ((ii)), wave (i) ended at 153.54 and wave (ii) ended at 154.72. Wave (iii) lower ended at 149.52 and wave (iv) ended at 150.53. Final leg wave (v) ended at 149.46 which completed wave ((iii)) in higher degree. Rally in wave ((iv)) ended at 150.74. Expect pair to extend lower 1 more leg to end wave ((v)). This should complete wave 1 in higher degree. Afterwards, it should rally in wave 2 to correct cycle from 11.15.2024 high before turning lower again. Near term, as far as pivot at 156.76 high stays intact, expect rally to fail in 3, 7, 11 swing for further downside.

USD/JPY 60 minutes Elliott Wave chart

USD/JPY Elliott Wave [Video]

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com