USD/JPY hits new high, but caution lingers

-

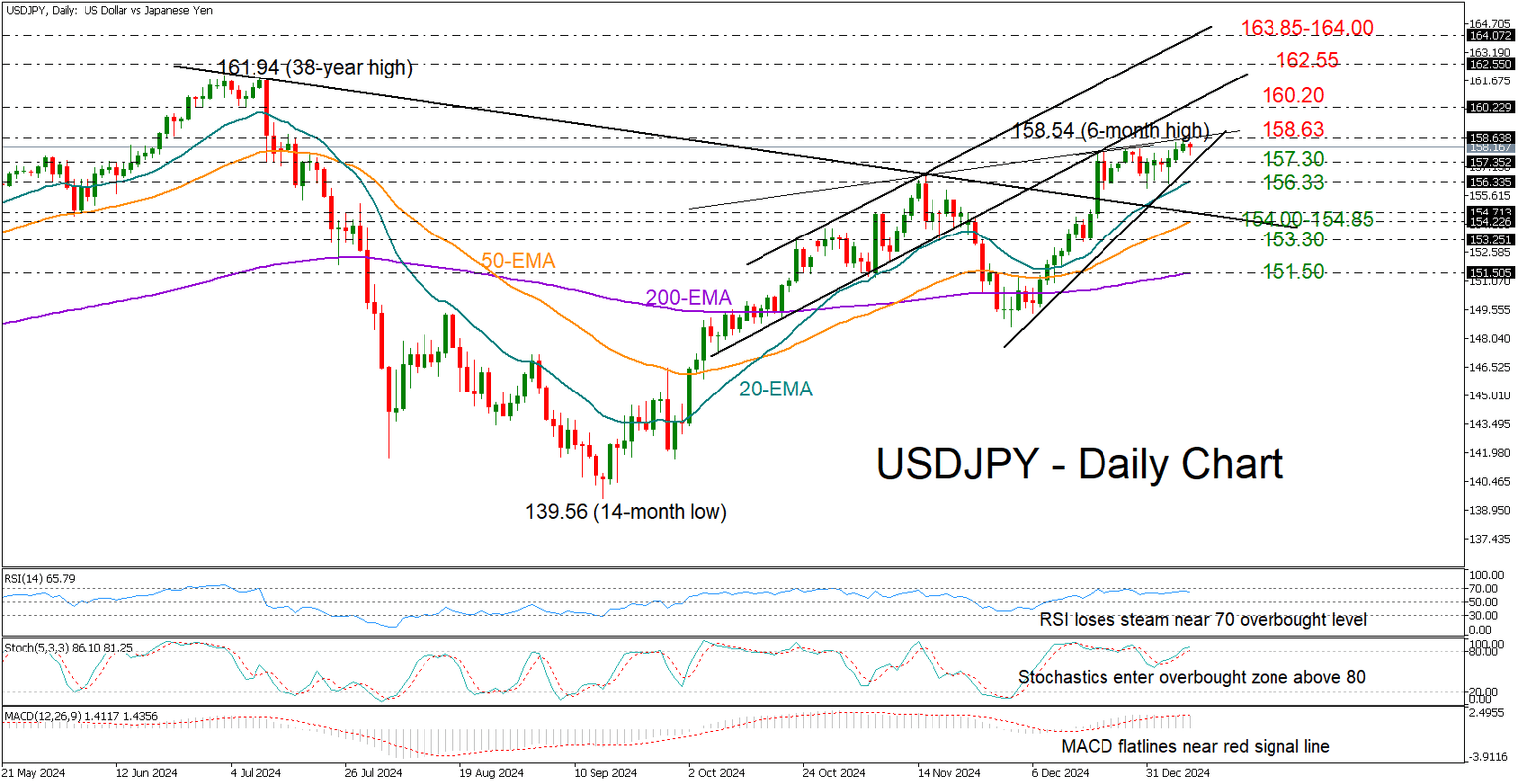

USDJPY takes a pause after reaching a six-month high.

-

Resistance at 158.63, Support between 156.33-157.30.

USDJPY has been steadily climbing over the past few days, hitting a six-month high of 158.54 on Wednesday. However, it couldn’t push past the resistance line formed by the November highs, suggesting the market is staying cautious for now.

With the RSI and stochastic indicators hovering near overbought levels, the pair could face a pullback or some sideways movement. The support trendline at 157.30 and the 20-day exponential moving average (EMA) at 156.33 could cool down selling interest in this case. Otherwise, the pair could drop toward the broken resistance trendline at 154.70, where the 50-day EMA is converging. If the 153.30 level is breached as well, selling pressures could pick up steam toward the 200-day EMA seen around 151.50.

On the upside, if the price closes decisively above 158.63, it could move toward the 160.20 mark, which was last seen in July and April 2024. Moving higher, the bulls may take a breather around 162.55 before heading for the 163.85-164.00 area, where a previous resistance trendline is located.

In short, USDJPY is still trending upward, but there are signs of caution. Sellers are unlikely to step in unless the price drops below 156.30.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.