USD/JPY hits 14-week high amid US election dynamics

The USDJPY pair has surged to a 14-week peak, touching 153.83 as demand for the US dollar strengthens with the unfolding US presidential election. This rally aligns with increasing support for Donald Trump, whose lead in critical states has fuelled investor optimism.

This week, US political developments are poised to dominate market attention, with the outcome still pending in several swing states.

In Japan, the recent Bank of Japan (BoJ) meeting minutes indicate a consensus among board members to persist with interest rate hikes, aligning with their inflation and economic objectives. Despite this, there is no immediate expectation for a rate increase until at least January 2025, reflecting the prevailing global economic uncertainties and market volatility.

Currently, the Japanese yen is not favoured as a safe-haven asset, with the market focus sharply pivoting towards the US dollar.

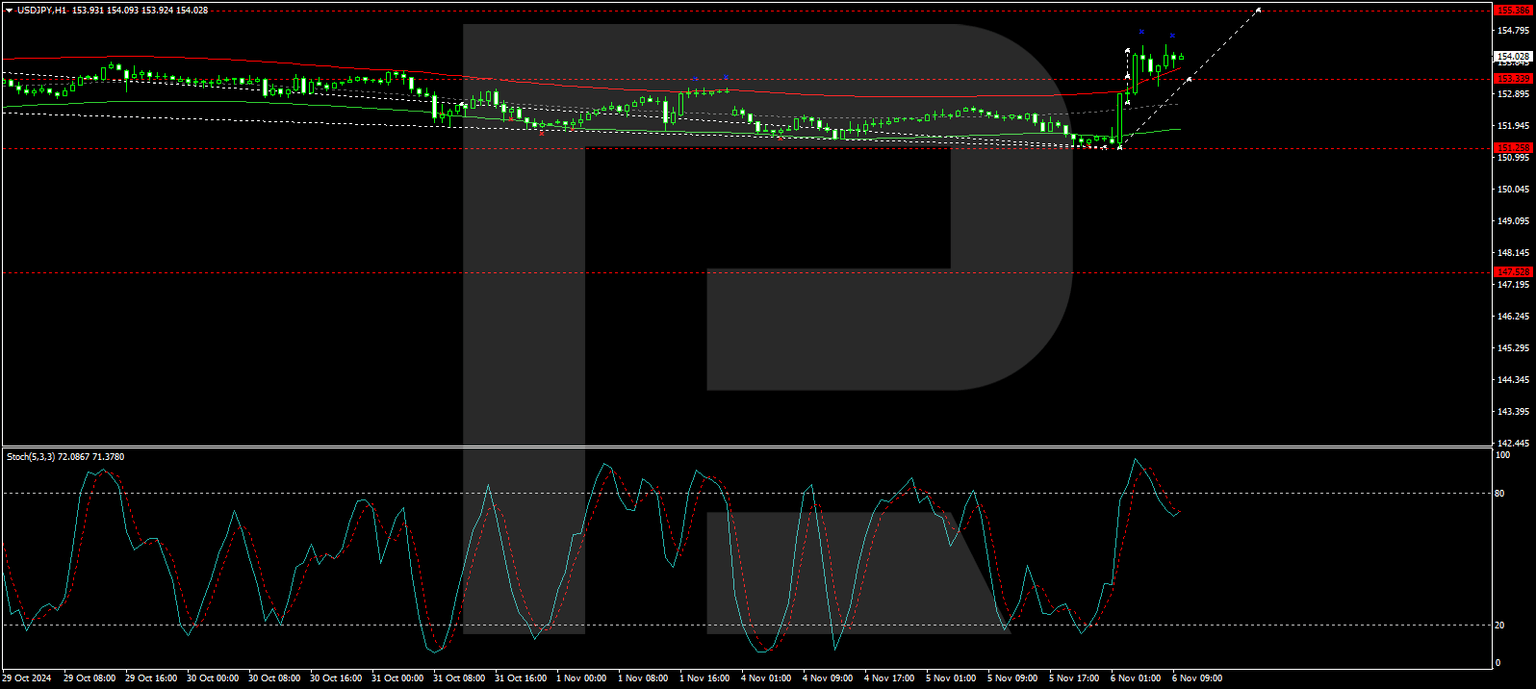

Technical analysis of USD/JPY

The USDJPY pair has completed a corrective phase to 151.28 and initiated the fifth wave of growth towards 155.38. A consolidation phase around 153.33 suggests the potential for an upward breakout, continuing the ascent towards 155.38. This bullish scenario is supported by the MACD indicator, which shows a solid upward momentum from below the zero level.

Following a full correction to 151.28, the pair found strong support and advanced to 153.33. The market is now consolidating at this level, and a continuation of the upward trend to 155.38 is anticipated. This view is corroborated by the Stochastic oscillator, positioned near 80, indicating sustained upward pressure.

Author

Andrey Goilov

RoboForex

Higher economic education. Andrey Goilov has been working on the Forex market since 2005. A financial analyst and successful trader. Preference in trading is highly volatile instruments.