- USD/JPY dropped as the Fed went dovish but never went too far.

- US GDP, housing figures, and more events could rock the boat.

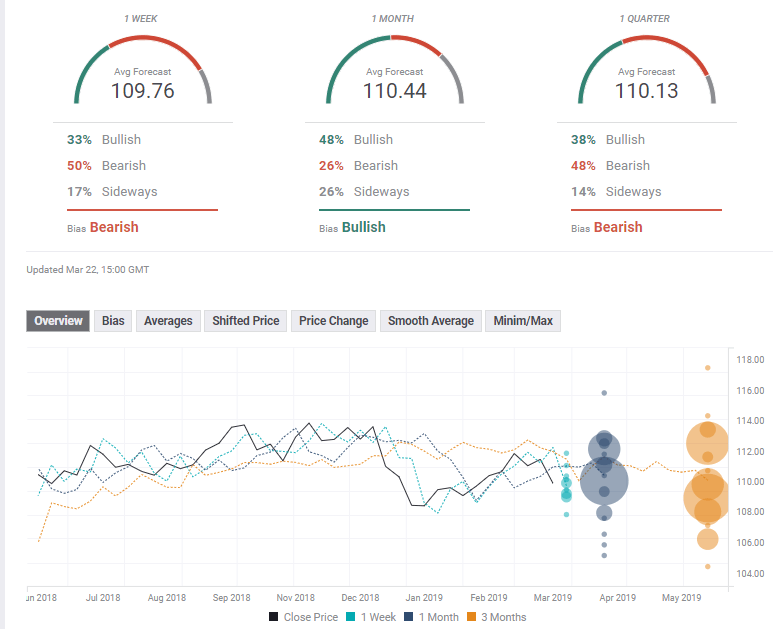

- The technical picture is bearish for the pair. Experts are bearish in the short term.

This was the week: Dovish Fed, Brexit drama

The Federal Reserve took another dovish twist. After pledging patience in January, the Fed slashed its interest rate forecast to no hikes in 2019. Chair Jerome Powell added that the current data does not suggest where the next move could be, opening the door to a rate cut.

Also, the Fed will stop squeezing its balance sheet in September, after tapering down in May. This is a quicker pace than thought. The world's most powerful central bank also downgraded its forecasts for growth, upgraded the unemployment forecast, and described inflation as "muted."

The announcement sent the US Dollar diving across the board, and even the safe-haven yen enjoyed it.

The safe-haven yen also rose on the Brexit drama. UK PM Theresa May was unable to submit the Brexit accord to a third vote and blamed MPs. She eventually asked for a short delay to Brexit, until June 30th but the EU approved only until May 22nd, assuming Parliament approves it by April 12th. If not, it's either a hard Brexit or a long extension. Markets did not like the uncertainty and the growing fear that May will opt for a hard-Brexit.

On the trade front, there were reports that China is backtracking on previous commitments and this weighed on the mood. President Donald Trump publicly said that talks are going very well, but that tariffs will likely stay.

On the other hand, he reportedly wants China to buy more US goods, something that will be easy to achieve. The key sticking points are Intellectual Property and the forced transfer of knowledge. China is willing to open its purse, but not make structural changes.

US data was mixed, with factory orders rising by only 0.1%, while the Philly Fed Manufacturing PMI jumping to 13.7 points.

The Bank of Japan's Meeting Minutes did not offer any news. The Tokyo-based institution remains very dovish.

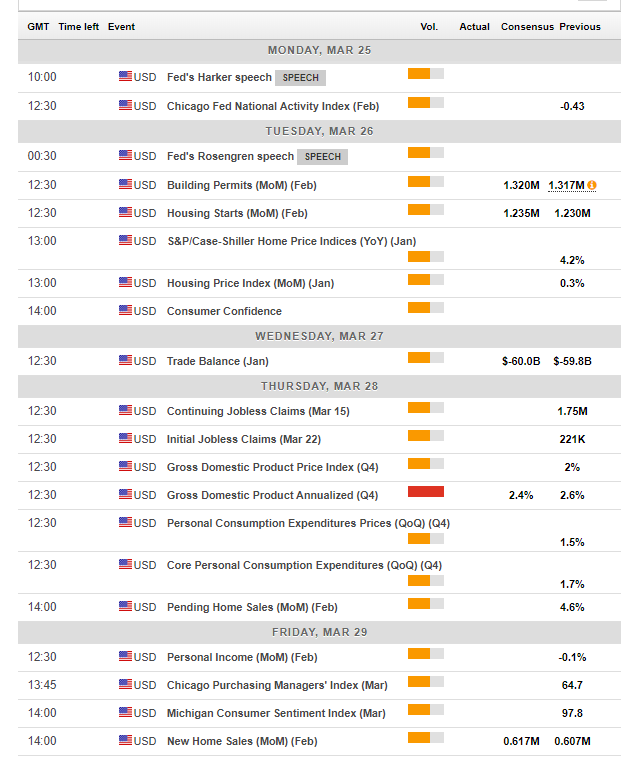

US events: GDP, housing, and more

The US calendar is jam-packed with activities. The week kicks off with a speech by the FOMC's Patrick Harker and continues with his peer Eric Rosengren.

Building permits, housing starts, and the S&P Case Shiller HPI are of interest on Tuesday. The housing sector has shown some signs of recovery. The Conference Board's Consumer Confidence is set to remain on the high ground in March.

Wednesday features the trade balance report which is politically-sensitive given the ongoing negotiations between the US and China.

Thursday is a busy day with the final GDP reading for the US for Q1. The first report was published late due to the government shutdown and came out better than expected with 2.6%. A small downgrade is due now due to disappointing data. Any significant change will rock the US dollar. This is the most significant publication of the week.

Friday sees the Fed's preferred measure of inflation, the Core PCE Price Index. Also, personal income and personal spending are of interest. The last word of the week is reserved for the housing sector. New home sales are expected to remain stable after recovering from the lows.

Apart from the flow of data, headlines related to trade are eyed. US Treasury Secretary Steven Mnuchin and US Trade Representative Robert Lighthizer will travel to Beijing for high-level talks. Any reports or tweets from Trump will be of interest.

Speaking of Trump, speculation mounts in Washington about the Mueller investigation. The Special Counsel may publish his report on the alleged involvement of Russia in the 2016 elections.

Here are the top US events as they appear on the forex calendar:

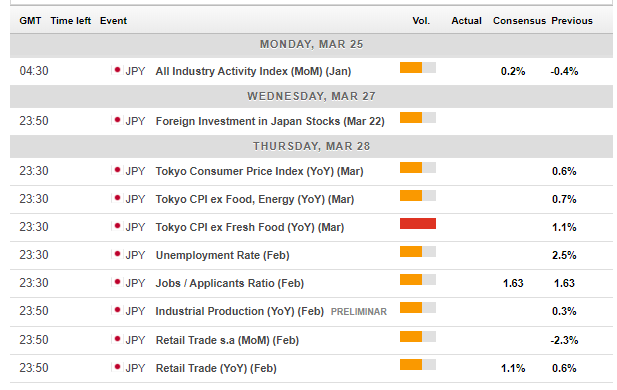

Japan: Safe-haven yen set to move on Brexit

Among Japanese events, the inflation data for the Tokyo region stands out. It is early data for March and comes ahead of the national figures. The most significant data point is the measure of excluding fresh food, which reached 1.1% YoY in February. This is an improvement, but still below the elusive 2% target.

Besides, it is important to note that the fiscal year ends in Japan and portfolio managers rush to balance their books. Choppy movements in USD/JPY are not rare during this week.

Sentiment affects the yen, with trade talks discussed earlier playing a significant role: progress is set to weigh on the Japanese currency while a worsening atmosphere is due to boost JPY. The same goes for Brexit: if the prospects for a no-deal Brexit rise, the safe haven yen will likely enjoy higher demand. Hopes for a second referendum can push the pair higher.

Here are the events lined up in Japan:

USD/JPY Technical Analysis

Dollar/yen fell out of the uptrend channel it traded in since early in the year. The pair is trading just below the 50-day Simple Moving Average which comes out around 110.30 at the time of writing. Momentum turned down and the Relative Strength Index is also leaning lower.

All in all, the picture turned from slightly bullish to bearish for the pair.

109.50 is the next significant support line after providing some support early last month. 109.10 was a support line in January, and 108.50 was a swing low in late January.

110.30 was a support line in February and should be noted. 110.80 provided support in early March and is fought over now. 111.50 is where the 200-day SMA meets the price. 112.15 was the high point in March. The next lines date back to 113.15 and 113.70.

USD/JPY Sentiment

The global economy keeps slowing down. While stocks rallied on the Fed's dovish stance, the shift represents worries and worries could send stocks and USD/JPY lower. Adding a downgrade to US GDP and ongoing uncertainty on trade and Brexit, another slide is due.

The FXStreet Poll a bearish trend in the short term, a bullish one in the medium term and a bearish one once again later on. The average targets have hardly changed in the past week. Are forecasters too accustomed to low volatility?

Related Forecasts

- USD/JPY Forecast 2019: A barometer of global growth and markets

- EUR/USD Forecast: USD the cleanest dirty shirt in the laundry basket

- GBP/USD Forecast: After Brextension, pound pushed and pulled by Parliament, three scenarios

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD appreciates as US Dollar remains subdued after a softer inflation report

The Australian Dollar steadies following two days of gains on Monday as the US Dollar remains subdued following the Personal Consumption Expenditures Price Index data from the United States released on Friday.

USD/JPY consolidates around 156.50 area; bullish bias remains

USD/JPY holds steady around the mid-156.00s at the start of a new week and for now, seems to have stalled a modest pullback from the 158.00 neighborhood, or over a five-month top touched on Friday. Doubts over when the BoJ could hike rates again and a positive risk tone undermine the safe-haven JPY.

Gold downside bias remains intact while below $2,645

Gold price is looking to extend its recovery from monthly lows into a third day on Monday as buyers hold their grip above the $2,600 mark. However, the further upside appears elusive amid a broad US Dollar bounce and a pause in the decline of US Treasury bond yields.

Week ahead: No festive cheer for the markets after hawkish Fed

US and Japanese data in focus as markets wind down for Christmas. Gold and stocks bruised by Fed, but can the US dollar extend its gains? Risk of volatility amid thin trading and Treasury auctions.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

-636888657599687199.png)