USD/JPY Forecast: Under pressure ahead of US employment data

USD/JPY Current Price: 105.57

- The poor performance of equities and falling Treasury yields weighed on the pair.

- Japan’s June Leading Economic Index is foreseen at 78.8 from 78.4 in the previous month.

- USD/JPY offers a bearish bias, needs to break the weekly low at 105.31.

The USD/JPY pair is trading lower in range, heading into the Asian opening trading at around 105.45. The pair was weighed by the poor performance of equities during the first half of the day, and falling Treasury yields, which flirted with their recent lows amid uncertainty about the next US stimulus package. So far, Congress keeps discussing it, with US Republican Senator Shelby saying that the two parties are still far apart on a deal. US President Trump has tweeted that he would proceed with an executive order if lawmakers maintain the deadlock.

Japan will publish this Friday, June Labor Cash Earnings and Overall Household Spending. Later into the day, the country will publish the preliminary estimate of the June Leading Economic Index, foreseen at 78.8 from 78.4 in the previous month. The Coincident Index for the same period is expected unchanged at 73.4.

USD/JPY short-term technical outlook

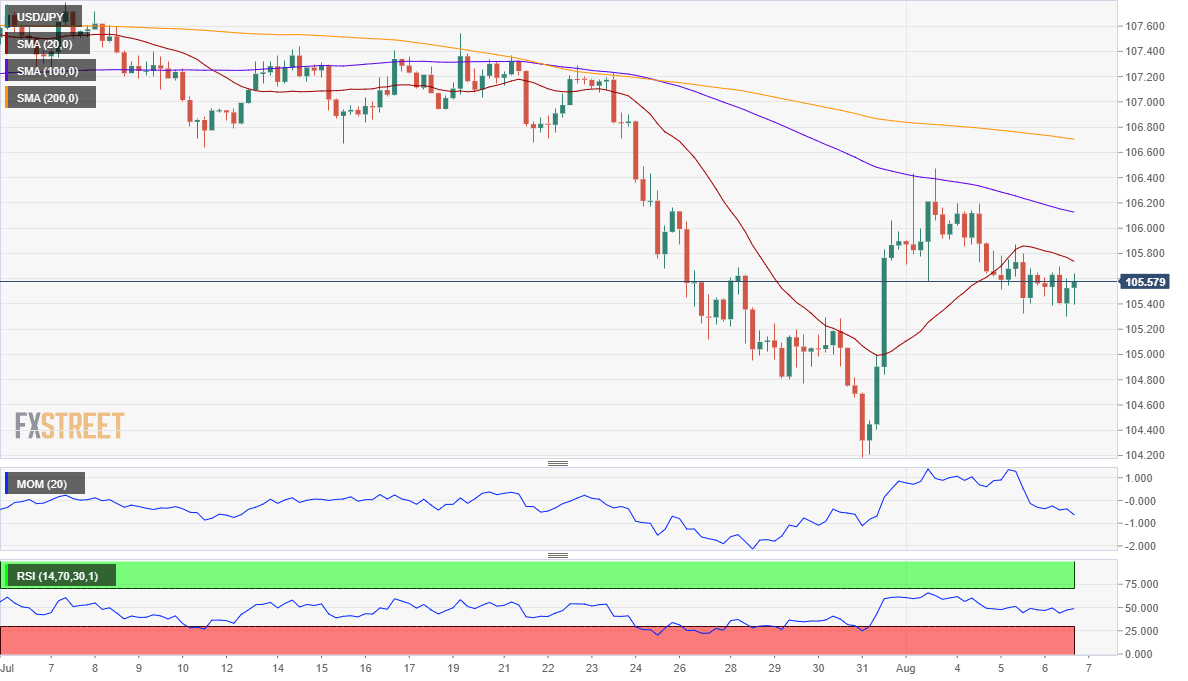

The USD/JPY pair maintains its bearish bias according to intraday technical readings. The 4-hour chart shows that the 20 SMA is gaining bearish strength above the current level and below the larger ones. Technical indicators in the mentioned time-frame remain within negative levels, the Momentum heading lower and the RSI stable at around 48. The main support is the weekly low at 105.31, with a break below it opening doors for a steeper slide.

Support levels: 105.30 104.90 104.40

Resistance levels: 105.75 106.10 106.50

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.