USD/JPY Forecast: Trump's art of the trade deal may trigger extended rally

- USD/JPY has surged as the US and China were getting closer to a partial trade deal.

- Trade developments and US retail sales stand out in the upcoming week.

- Mid-October's daily chart is painting a marginally bullish picture.

- The FX Poll is showing falls for the pair in the longer terms.

USD/JPY has experienced high volatility amid trade headlines but emerges as a winner as a deal looks close. Uncertainty about trade and also politics is set to prevail in the upcoming week. US retail sales and Fed speeches are also eyed.

This week in USD/JPY: Whipsawed by trade headlines

High-level trade talks seemed doomed before they began and initially sent USD/JPY down. The US blacklisted 28 Chinese firms involved in human rights violations in the western Chinese province of Xinjiang. It then followed by slapping visa limitations on Chinese officials involved in wrongdoing. Beijing responded angrily by calling the US to stay out of its internal issues and promising retaliation.

Reports that the Chinese delegation may cut short its visit to Washington also weighed on market sentiment and the currency pair. Optimism came from other stories suggesting that the world's largest economies may reach a pact to control the value of the yuan and refrain from more tariffs changed the mood for the better – sending USD/JPY to new highs.

However, markets remain cautious as a deal consisting of small measures may be insufficient for the US to sign on – President Donald Trump reiterated his desire to clinch a comprehensive agreement. Avoiding sensitive topics such as intellectual property and government planning may eventually result in a collapse of talks.

At the time of writing, President Donald Trump and Chinese officials are hinting that a deal is imminent. USD/JPY has been flirting with the highest levels since August.

The Federal Reserve is watching developments closely, and the outcome will help shape the rate decision later this month. The meeting minutes from the Fed's September decision have shown concern about global headwinds and especially trade, while policymakers are content about domestic growth. Some hawks prefer communicating when the bank will stop cutting rates, while several doves noted that their economic models show growing chances of a recession.

Fed officials cited low inflation as one of the main reasons for cutting rates. Fresh inflation data for September has missed expectations on most measures, but the Core Consumer Price Index (Core CPI) remained at a healthy 2.4%.

The president has remained under fire for the Ukraine-gate scandal – which has dampened his approval ratings. Recent polls have shown that support for impeachment exceeds disapproval of it by five points. Trump told House Democrats that he would not cooperate with the investigation, but they continue collecting documents and evidence. The story is currently on the backburner.

US events: Further trade developments and retail sales

Markets are set to continue reacting to the high-level trade talks and respond to new developments. Any improvement in relations may lift USD/JPY, while a deterioration may send it down.

The fate of the impeachment depends on the opinions of Republican senators – who hold the key to securing a two-thirds majority needed to oust the president. In turn, these lawmakers are following opinion polls and assessing if Trump is an asset or a liability. While most Americans support an impeachment, only around 13% of Republican voters currently back the move.

If Democrats maintain their momentum and reach a critical mass supporting the inquiry, markets may react. Further developments are likely, but public opinion may move more slowly and perhaps in the other direction.

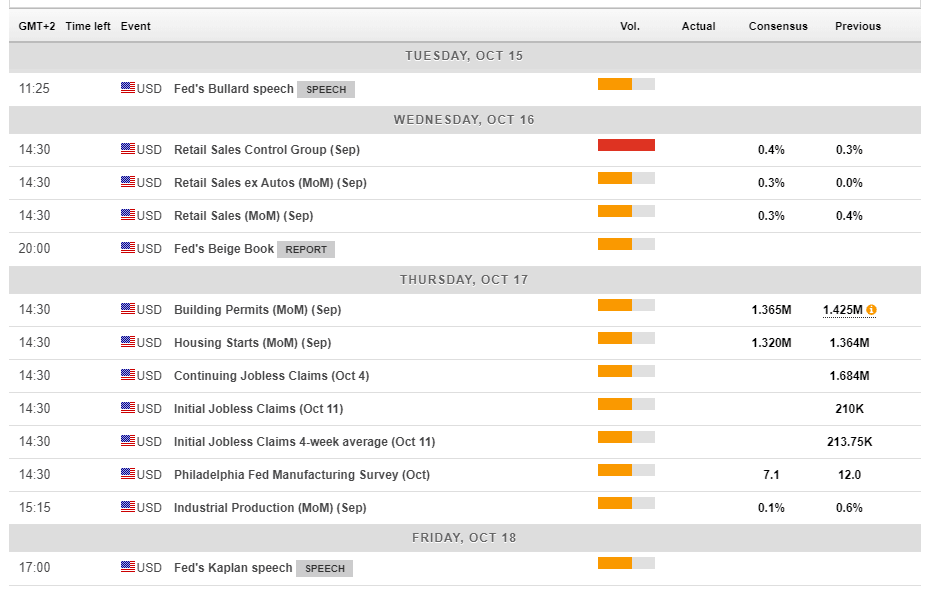

Several Fed officials are slated to speak in the upcoming week. James Bullard, President of the Saint Louis branch of the Federal Reserve, kicks off the week. He will likely repeat his dovish stance and advocate for more cuts. Robert Kaplan, his colleague from the Dallas Fed, has the last word of the week. In the middle, the bank's Beige Book will provide an update on economic activity.

The most significant economic indicator of the week is Retail Sales for September. Consumer sentiment has fallen off the highs but remains robust – and so have recent sales figures. Expenditure rose by 0.4% in August and the all-important Control Group – the "core of the core" – by 0.3%. Similar figures are expected now. Consumption consists of 70% of US economic activity, and any deviation is set to rock markets.

Both Building Permits and Housing Starts are projected to remain upbeat while Industrial Production carries expectations for modest growth. These figures, all scheduled for Thursday, will help shape Gross Domestic Product expectations for the third quarter.

Here are the top US events as they appear on the forex calendar:

Japan: Watch any escalation around Syria

The Japanese yen remains the ultimate safe-haven and moves first and foremost on trade news. It is also sensitive to geopolitical events. The Turkish incursion into Northern Syria and its clash with the Kurds has grabbed media attention and weighed on the Turkish Lira. However, it has been unable to move broader markets at the moment. If oil installations are hurt or the conflict broadens, the yen may benefit.

The Japanese economic calendar features Industrial Production for August, which is expected to show another substantial year on year fall. National inflation figures for August are also of interest, and they are expected to remain low. However, it is important to remember that the Tokyo region already released figures for that month, and the national data tend to be similar.

While North Korea is currently out of the headlines, it may reappear soon enough.

Here are the events lined up in Japan:

USD/JPY Technical Analysis

The technical picture for USD/JPY has improved in the past week, with USD/JPY not only confirming its move above the 50-day Simple Moving Average but also by conquering the 200-day SMA. However, momentum is flat and the currency pair remains below the double-top of 108.50.

Some resistance awaits at the recent high of 108.20, which defends the 108.50 level mentioned earlier. It is followed by 109.30, which was a swing high in late July. Next, we find the late May high of 109.95. The next levels to watch are 110.65 and 111.05.

Support awaits at 107.50, which provided support in July and also in September. It is followed by 107, a round number that provided support in late September. 106.50 was the low point in October, and it is followed by 105.75 and 105.05.

USD/JPY Sentiment

USD/JPY heavily depends on trade talks – set to rise on a deal and to fall on new tariffs. The recent optimism implies a greater chance to advance, but previous rounds of talks' failure mean all options are on the table.

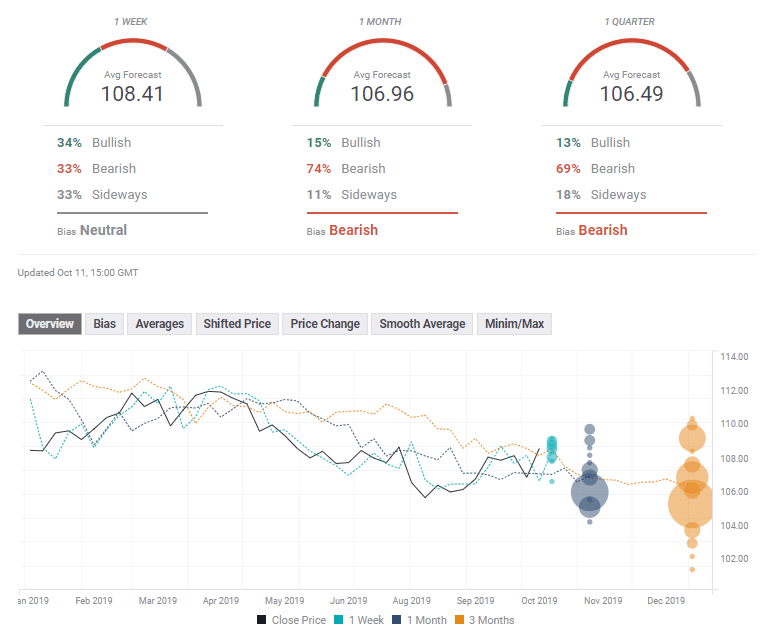

The FXStreet Poll is showing that experts have mixed opinions in the short term but see substantial falls down the line. Are forecasters skeptical about the deal? Only the short term forecast has seen an upgraded while longer-term ones have remained unchanged.

Related Forecasts

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.

-637063798696516544.png&w=1536&q=95)