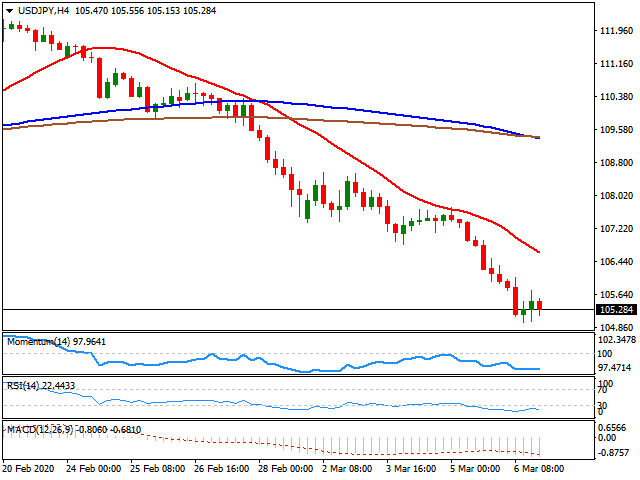

USD/JPY Forecast: Strong support at 105.00 under pressure

Current Price: 105.28

- Yen’s momentum intact as risk aversion and volatility reigns.

- US data irrelevant for USD/JPY that is looking at the 105.00 area.

Again on Friday, stocks tumbled, oil prices collapsed and government-bond yields hit new lows, ending a dramatic week for financial markets that included an emergency rate cut from the Federal Reserve. The growing spread of the coronavirus and global growth expectations tuned the panic button on. As long as it is on, yen’s strength will remain intact. US data on Friday included a better-than-expected employment report, but it did not offer relief for the US dollar versus the yen. Risk aversion and bond yields will continue to be the critical factor for the pair. Positive global news, related to COVID-19 or some kind of global coordinated fiscal stimulus, could favour a rebound in USD/JPY.

Short-term technical outlook

Since February 20, the pair has fallen more than 700 pips. Despite the aggressive decline, more losses seem likely if fear persists and despite the oversold readings across technical indicators. On Friday, USD/JPY traded below 105.00 for the first time since August, but it managed to stabilize above 105.00. The substantial support area around 105.00 is under pressure, and a break lower would clear the way to more losses. Potential support emerges at 104.75 (March 2018 low) followed by 104.40. If the pair remains above 105.00, some consolidation around 105.50 seems likely. Above the next resistance lies at 106.20 and then the strong zone around 106.60.

Support levels: 105.00 104.65 104.40

Resistance levels: 105.80 106.10 106.75

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.