USD/JPY Forecast: Pressure ease but bullish potential limited

USD/JPY Current Price: 107.20

- US April’s unemployment rate may be at around 19% according to a White House Advisor.

- USD/JPY recovered the 107.00 level but lacks follow-through.

The USD/JPY surged to 107.21 to settle around the 107.00 figure. The pair surged from its latest comfort zone around 106.60, at the same time the greenback fell against its European rivals, as part of month-end fixing. The yen fell despite sentiment deteriorating post-ECB, with equities turning red in the region and dragging Wall Street lower. This last was also affected by US employment data showed that over 3.8 million people filed for unemployment last week. White House Adviser Hassett later said that he expects April’s job report to show an unemployment rate of around 19%.

Japan released at the beginning of the day March Retail Trade figures, which were down by 4.5% in the month and by 4.6% when compared to a year earlier. Large Retailers’ Sales plunged by 10.1%, while Industrial Production was down by 3.7%. Meanwhile, April Consumer Confidence fell to 21.6 from 30.9 previously. The country will release this Friday, April Tokyo inflation, seen up by 0.4% YoY and the April Jibun Bank Manufacturing PMI, previously at 43.7.

USD/JPY short-term technical outlook

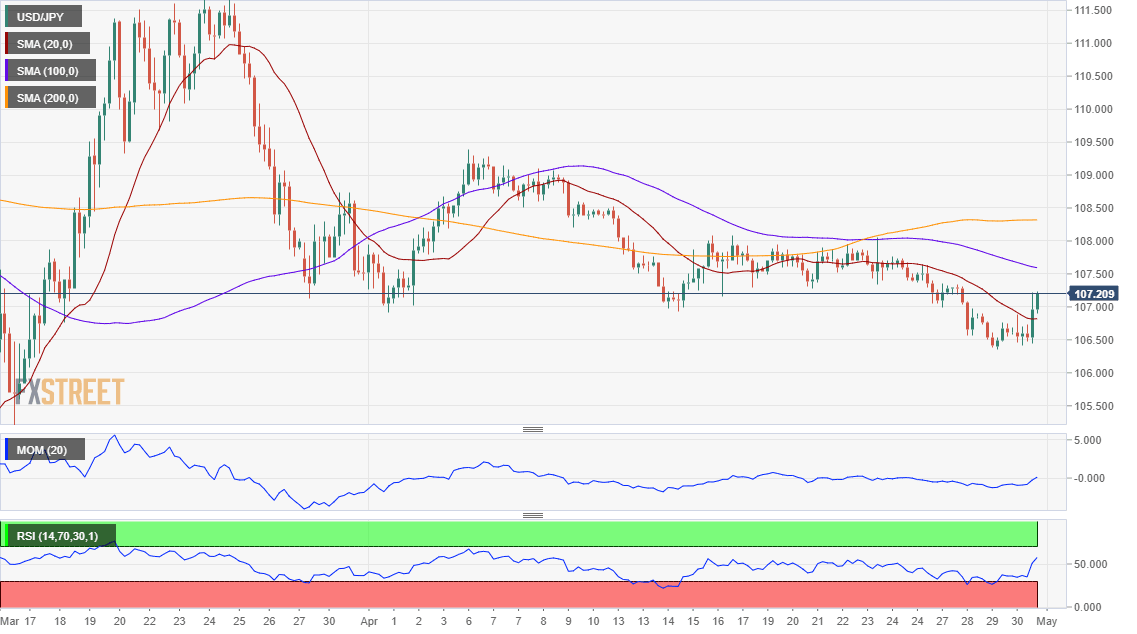

The USD/JPY pair is holding above the 107.00 level, but further gains are still unclear. The 4-hour chart shows that it’s developing above a mild-bearish 20 SMA, but still below the larger ones, with the 100 SMA heading south around 107.70 a former relevant resistance. Technical indicators entered positive territory, but lack follow-through beyond neutral levels, with the RSI partially losing their bullish strength.

Support levels: 106.95 106.50 106.10

Resistance levels: 107.30 107.70 108.05

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.