USD/JPY Forecast: President Trump’s speech put a halt to dollar’s rally

USD/JPY Current Price: 108.97

- The American dollar lost momentum by the end of the American session, following Trump’s speech.

- Us Federal Reserve’s chief Powell will testify before the Congress this Wednesday.

- USD/JPY at risk of losing some ground, bearish below 108.65.

The USD/JPY pair recovered ground during the first half of the day, rising to 109.28, although the greenback lost momentum by the end of the American session, and following US President Trump’s speech at the Economic Club of New York, which disappointed investors by not giving fresh clues related to trade developments with China. Wall Street managed to hold on to modest intraday gains, while US-Treasury yields edged marginally lower daily basis and the USD/JPY pair settling around the 109.00 figure.

Japan released October´s money supply, with the monetary aggregate M2 up by 2.5% year-on-year, following a 2.4% increase in the previous month. Machine Tool Orders, on the other hand, plummeted 37.4% after decreasing by 35.5% in the previous month. This Wednesday, the country will unveil its Q3 Gross Domestic Product, seen at 0.2% QoQ after printing 0.3% in the second quarter of the year.

USD/JPY short-term technical outlook

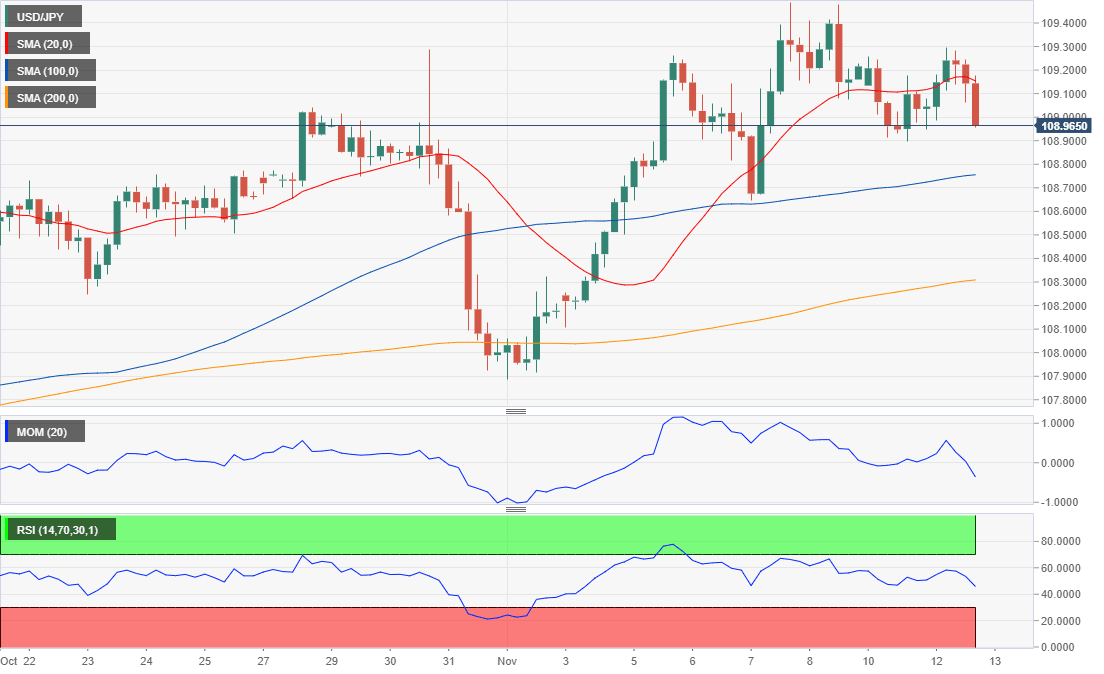

The USD/JPY is trading lower in range, with the risk skewed to the downside according to the 4-hour chart, as the price remains below a flat 20 SMA while technical indicators head south within negative levels. Nevertheless, the downside potential seems limited, with an immediate support at 108.90, and the next one at 108.65. It will be below this last that the pair would have chances of declining further.

Support levels: 108.90 108.65 108.40

Resistance levels: 109.30 109.60 110.00

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.