USD/JPY Forecast: Market players keep selling the greenback

USD/JPY Current price: 103.11

- Optimism maintains the safe-haven dollar in sell-off mode.

- Australian and New Zealand upbeat figures exacerbated the greenback’s weakness.

- USD/JPY is poised to challenge the 103.00 figure and approach 102.20.

The USD/JPY pair flirts with the 103.00 level amid a dollar’s sell-off, following the US Federal Reserve monetary policy announcement. Hopes about a Brexit deal and a US stimulus package kept the safe-haven currency under pressure ever since the week started. The Federal Reserve maintained its monetary policy unchanged and pledged to keep supporting the economy. Policymakers reiterated their dovish stance but refrained from hinting at more easing.

Japan didn’t publish relevant macroeconomic data, but during the Asian session, New Zealand released its Q3 GDP and Australia its November employment figures, which resulted upbeat, further weighing on the greenback. The US calendar includes this Thursday housing-related figures, Initial Jobless Claims for the week ended December 11, and the December Philadelphia Fed Manufacturing Survey.

USD/JPY short-term technical outlook

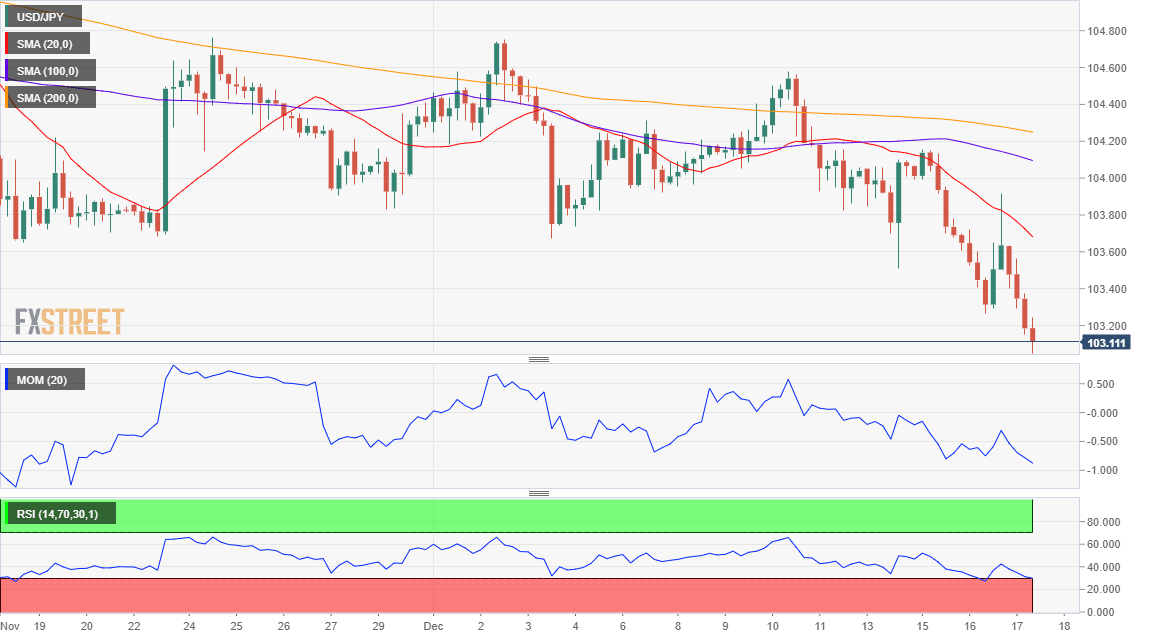

The USD/JPY pair maintains its bearish tone in the near-term. The 4-hour chart shows that technical indicators have reached oversold conditions, partially losing their bearish momentum but without signs of changing course. The 20 SMA accelerated south below the larger ones, reflecting selling interest strength.

Support levels: 102.70 102.20 101.80

Resistance levels: 103.15 103.50 103.90

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.